ECB expected to pause as fed looks to us inflation data

The European Central Bank (ECB) is widely expected to keep rates unchanged this week, while the Federal Reserve faces growing pressure ahead of key U.S. inflation releases. Global markets remain sensitive to signs of monetary policy shifts, with investors watching Europe, the U.S., and Asia for clues on growth and price dynamics.

ECB to hold rates at 2% with soft-landing outlook

Fed CPI, PPI data to shape September cut odds

Japan stocks rally; oil, gold extend gains

ECB poised for extended pause

The ECB is set to leave its deposit rate at 2.00%, marking a second straight hold after delivering 200 basis points of cuts between June 2024 and June 2025. With inflation back at the 2% target and unemployment at record lows, policymakers see little urgency to ease further.

The backdrop has been described as a “soft landing”: price stability near target alongside a resilient labor market. In this environment, the ECB can afford to step back and monitor the impact of earlier cuts.

Survey data supports this outlook. Nearly 60% of economists in a Reuters poll expect no further changes through 2025, and a narrow majority predict rates will remain at or above 2% into 2026. Expectations of a long pause have helped keep the euro broadly supported in recent weeks.

Fed walks a tighter line ahead of CPI

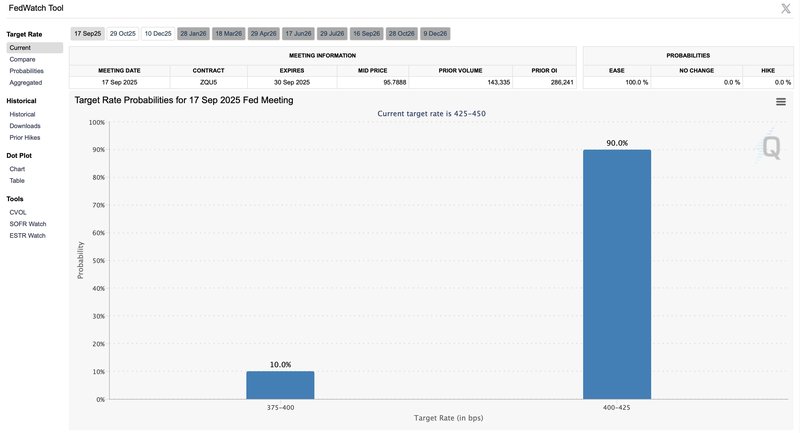

Across the Atlantic, the Fed’s path looks less settled. Two consecutive weak nonfarm payroll reports have boosted bets on easing, with markets pricing in a 25-basis-point cut in September and rising risk of a 50-point move.

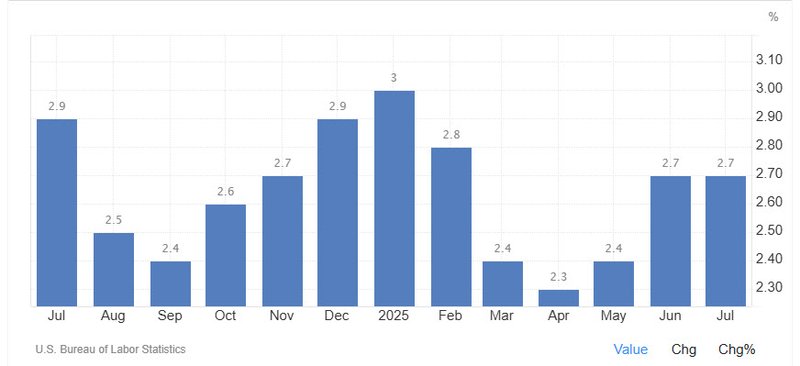

The key test will come with August CPI and PPI, due Thursday. Headline CPI is expected to rise to 2.9% year-on-year from 2.7%, while core CPI is forecast to hold steady at 3.1%. Any upside surprise would complicate the Fed’s decision, highlighting the challenge of managing sticky inflation against weakening job growth.

Dollar moves are likely to mirror each CPI headline as traders recalibrate the odds of one or two cuts before year-end.

Japan’s political shift lifts equities

In Asia, Japanese stocks rallied toward record highs after Prime Minister Shigeru Ishiba announced his resignation. The yen weakened on the news, as investors bet on continued policy stability despite setbacks in securing a trade deal with the U.S.

Oil steadies after OPEC+ decision

WTI futures rose over 1% toward $63 a barrel, snapping a three-day decline. OPEC+ confirmed a modest production hike of 137,000 barrels per day from October, smaller than previous increases. The move reflects Saudi Arabia’s push to reclaim market share while acknowledging risks of oversupply later in the year.

China’s exports cool, gold shines

China’s exports grew 4.4% in August, the slowest pace in six months, as shipments to the U.S. fell 33%. Imports rose 1.3%, leaving a trade surplus of $102 billion.

Meanwhile, gold climbed to a record high as the U.S. dollar struggled to recover from dismal jobs data. The August NFP report showed just 22,000 new jobs, while unemployment ticked up to 4.3%. The weak print reinforced expectations of Fed easing and lifted safe-haven demand for bullion.

The week ahead

Investors face a packed calendar:

- Wednesday: China CPI, PPI; U.S. PPI

- Thursday: ECB rate decision; U.S. CPI, jobless claims

- Friday: Germany final CPI; UK GDP and trade balance; U.S. Michigan sentiment and inflation expectations