Fed minutes highlight splits while cut expectations drop

Minutes of the Federal Open Market Committee revealed a clear division among policymakers, prompting markets to scale back expectations of near-term easing and driving a notable appreciation of the dollar. At the same time, consumer-price inflation in the United Kingdom and euro-area slowed modestly, and oil prices fell despite a larger-than-expected weekly drop in US crude inventories.

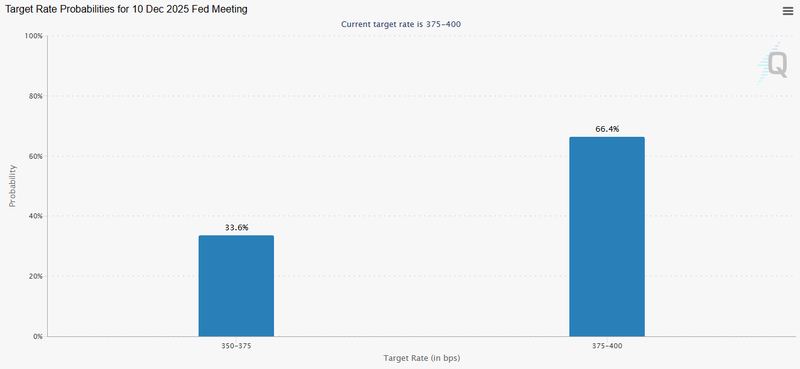

The market-implied probability of a 25-basis-point Fed cut in December fell materially — from about 50 per cent to c. 33 per cent — after the minutes disclosed intra-committee disagreement.

The dollar strengthened as investors repriced policy risk, while Treasuries attracted renewed interest amid a less dovish outlook.

Headline inflation eased to 3.6 per cent in the UK and to 2.1 per cent in the EU.

Brent and WTI declined despite a sizeable reported draw in US inventories, as traders balanced geopolitical supply concerns against prospective OPEC+ output increases.

Fed minutes show division about future interest-rate movements

Following publication of the FOMC minutes, the CME Group’s FedWatch Tool recorded a sharp fall in the probability of a 25-basis-point cut at the December meeting — to approximately 33.6 per cent from roughly 50 per cent only days earlier. The minutes revealed that several committee members cautioned that an early cut could risk a setback in progress towards the 2 per cent inflation objective and might undermine confidence in the central bank’s commitment to price stability.

The document emphasised the diversity of views within the committee: some members favoured patience given sticky inflation readings, while others remained open to easing should incoming data justify it. Political commentary compounded market reaction — President Donald Trump reiterated criticism of the Fed chair — but the principal market impact derived from the Fed’s internal divergence. As investors reduced expectations of imminent easing, the US Dollar Index (DXY) rose, closing higher by c. 0.52 per cent at 100.11.

Figure 1. Target rate probabilities for the 10 December 2025 Fed meeting. Source: CME Group.

UK and EU inflation rates show modest deceleration

In the United Kingdom, the Office for National Statistics reported that headline consumer-price inflation slowed to 3.6 per cent year-on-year from 3.8 per cent, in line with consensus. Core inflation eased marginally to 3.4 per cent. The reading provides some relief to the Bank of England, which faces the twin challenge of containing inflation while responding to a weakening labour market and subdued growth. Sterling weakened on the day, trading around USD 1.3057 (down c. 0.65 per cent).

Eurostat’s data for the European Union showed headline inflation easing to 2.1 per cent year-on-year from 2.2 per cent, consistent with forecasts; core inflation held steady at 2.4 per cent. While the euro-area figures are broadly close to the ECB’s objective and thus alleviate immediate policy pressure, the modest slowdown also reflects fragile demand in parts of the bloc — notably Germany — and therefore carries growth implications. The euro traded near USD 1.1538, down around 0.37 per cent on the session.

Oil prices decline despite a significant fall in US inventories

Weekly data from the US Energy Information Administration showed a larger-than-expected draw in crude inventories, with stocks falling by 3.426 million barrels versus an anticipated decline of c. 0.6 million. Ordinarily, such an aggregate draw would be supportive for crude prices; however, Brent and WTI futures fell by c. 2.13 per cent and 2.04 per cent respectively.

Market participants consider two offsetting forces. On the upside, geopolitical tensions and supply interruptions related to the Russia–Ukraine conflict continue to pose upside risks to flows. On the downside, reports that OPEC+ members are considering modest production increases for late 2025 and early 2026 have tempered the bullish impulse. As a result, WTI has traded in a tight band of roughly US$59.00–US$61.50 in recent weeks, while Brent has oscillated between c. US$63.00 and US$65.50.