Gold and US Treasury yields rise following robust employment data

Gold and US 10-year yields rose as markets continued to price in two 25bp rate cuts this year, despite resilient labor data. Oil climbed on unresolved US–Iran tensions, outweighing a sharp build in US crude inventories. Meanwhile, softer inflation in China renewed concerns about weak domestic demand.

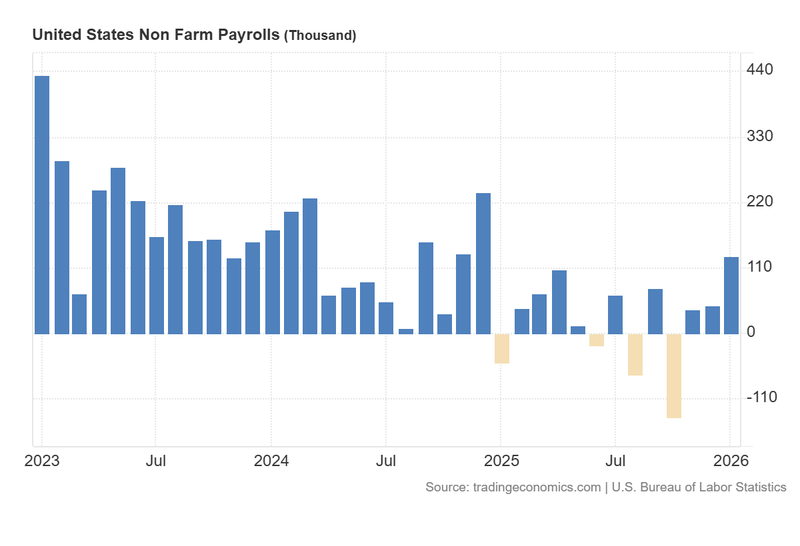

US non-farm payrolls exhibited a significant acceleration in January, adding 130,000 jobs, while the unemployment rate edged lower.

While the robust employment figures have not yet shifted the baseline expectation for two 25-basis-point cuts—as tracked by the CME FedWatch Tool—the probability of a more hawkish stance is gradually increasing.

Brent and WTI crude futures rose in tandem due to geopolitical uncertainty surrounding the US and Iran, with traders wary of potential supply chain disruptions.

China’s annual inflation rate cooled from 0.8% to 0.2%, suggesting a contraction in domestic demand despite mixed closes across Chinese equity indices.

US employment data exhibits strength: Gold and 10-Year yields advance

According to the US Bureau of Labour Statistics, non-farm payrolls surged from a revised 48,000 in December to 130,000 in January, significantly exceeding the consensus forecast of 70,000. This figure represents the strongest monthly gain since January 2025, marking a notable recovery over the past twelve months. Furthermore, the unemployment rate declined from 4.4% to 4.3%—a key development given that the Federal Reserve is projecting a 4.4% level for 2026. This stabilisation reduces the immediate pressure on the central bank to implement aggressive interest rate cuts in the near term.

Despite this labour market strength, market probabilities suggest that investors still anticipate two 25-basis-point cuts, likely in June and October, according to the CME FedWatch Tool. However, the margin between those expecting a cut and those expecting a "hold" is narrowing. For the June meeting, the probability of a 25-basis-point cut stands at 48%, compared to a 41% chance of no change. For October, the probability of a cut is 35% against a 29% chance of no action. Market participants are now pivoting towards forthcoming economic releases to gauge the Federal Reserve’s trajectory in a context that is becoming increasingly neutral.

In response to these developments, US equity indices finished the session mixed: the S&P 500 slipped by 0.01%, the Dow Jones Industrial Average fell 0.13%, and the Nasdaq Composite gained 0.29%. In the fixed-income market, the 10-year US Treasury yield rose by 3 basis points to 4.17%. Concurrently, the gold futures contract (GCJ26) appreciated by 1.45% to $5,104 per ounce, as bullion remains supported by broader expectations of an eventual pivot toward lower interest rates.

Figure 1. United States Non-Farm Payrolls (2023–2026). Source: Data from the US Bureau of Labour Statistics; Figure obtained from Trading Economics.

Oil prices rise on US–Iran impasse despite inventory build-up

The primary crude benchmarks, Brent and WTI, rose in parallel as tensions between Washington and Tehran remained elevated. This upward movement occurred despite a substantial increase in US crude stocks; data from the US Energy Information Administration (EIA) revealed an inventory build of 8.53 million barrels, dwarfing the forecast of 0.8 million and reversing the previous week’s contraction of 3.45 million. This represents the most significant weekly accumulation since February 2025.

Under typical market conditions, such a significant surplus would exert downward pressure on prices. However, geopolitical risks currently dominate the narrative. According to Reuters’ information, the US president Donald Trump indicated that he is considering the deployment of a second aircraft carrier to the Middle East should a deal with Iran fail to materialise, underscoring the risk of regional confrontation. While both nations have expressed a willingness to resume negotiations, the absence of a confirmed date for talks has left investors concerned about potential supply chain disruptions.

At the close of trade, the Brent futures contract (BRNJ26) rose by 0.87% to $69.40 per barrel, while the WTI contract (CLH26) appreciated by 1.05% to reach $64.63 per barrel.

Chinese inflation rate signals sharp deceleration

Data from the National Bureau of Statistics (NBS) of China revealed that the annual inflation rate fell from 0.8% in December to 0.2% in January, missing the market forecast of 0.4%. While positive and controlled inflation is generally a sign of healthy demand, this sharp deceleration highlights a persistent weakness in domestic consumption, as the rate remains significantly below the central bank’s 2% target. According to Trading Economics, the primary drivers of this slowdown were food prices (falling from +1.1% to –0.7%) and transport (declining from –2.6% to –3.4%), alongside notable drops in energy costs.

Equity market reactions in the region were varied; the FTSE China A50 index declined by 0.40% to 14,945 points, while the Hang Seng index in Hong Kong managed a modest gain of 0.22% to close at 27,224.