Inflation data shifts Fed expectations as markets grapple with uncertainty

From softer U.S. inflation data to renewed political pressure from Donald Trump on Federal Reserve Chair Jerome Powell, equity markets showed signs of unease after the New York close.

Softer July inflation strengthened expectations of an interest-rate cut at the Fed’s next meeting.

With prices under forecasts, the dollar weakened while gold advanced in intraday trade.

Trump escalated his push for lower rates, now threatening legal action against Powell.

U.S. inflation stays soft, fueling rate-cut bets

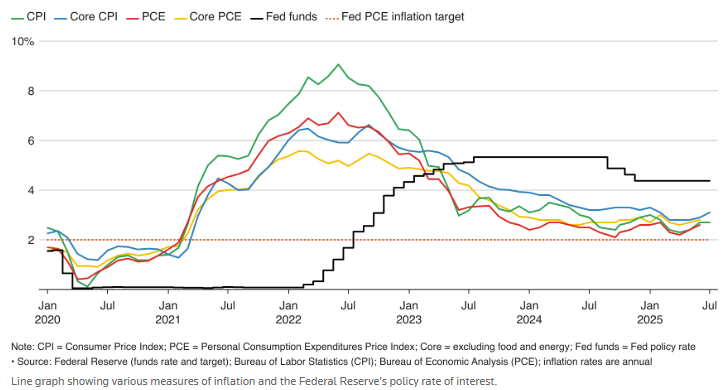

U.S. headline inflation held steady at 2.7% in July, below market expectations, while monthly CPI rose 0.2%, matching consensus forecasts. The weaker price data pushed the implied probability of a 25-basis-point rate cut at the Fed’s next policy meeting to 93.4%, according to CME’s FedWatch Tool.

While concerns remain over a potential inflation rebound as tariffs take effect, consumer prices have yet to show a sustained acceleration. That leaves fewer arguments for maintaining a restrictive stance. One caveat: core inflation — which strips out food and energy — rose to 3.1%, above both the previous 2.9% reading and the Fed’s 2% target.

So far, inflation indicators have not shown a decisive rebound despite new tariffs. Still, the risk of renewed price pressures remains, as inflation is yet to return to target despite tight monetary policy.

Source: Reuters (August 2025)

Dollar slips, gold gains

The U.S. Dollar Index fell roughly 0.43% after the release of softer inflation data, while gold rose about 0.55% as expectations of a Fed rate cut firmed. The dollar and gold typically move inversely: a weaker greenback makes the metal cheaper for overseas buyers, boosting demand, while a stronger dollar tends to weigh on gold prices.

Despite consensus pointing to easing inflation and cooling labor conditions — both supportive of policy loosening — uncertainty lingers. Questions over the Fed’s independence and the credibility of labor statistics could undermine market confidence if abrupt policy moves occur. That uncertainty has kept gold, the Dollar Index, and 10-year Treasury yields largely range-bound in recent months.

Source: TradingView

Trump turns up heat on Powell

White House Press Secretary Karoline Leavitt said President Trump is considering suing Powell over what he calls “deficient leadership” at the central bank, CNN reported. While the dispute spans several issues, the core tension lies in Trump’s demand for an aggressive rate-cut cycle — a move he argues would support the economy amid the administration’s hardline trade policy.

Rate cuts could also ease the growing burden of debt servicing. With market pricing showing near certainty of easing, the debate now shifts from whether cuts will happen to how deep and fast they might be. Investors are keenly awaiting the Fed’s updated economic projections in a climate of both domestic and geopolitical uncertainty.