Markets dip after Trump tariff order, July non-farm payrolls in spotlight

Markets reverse modestly after President Trump imposes steep new tariffs; traders now turn focus to today’s U.S. non-farm payrolls for direction.

arkets reverse modestly after President Trump imposes steep new tariffs; traders now turn focus to today’s U.S. non-farm payrolls for direction.

Markets reverse modestly after President Trump imposes steep new tariffs; traders now turn focus to today’s U.S. non-farm payrolls for direction.

The U.S. dollar index climbed toward 100, near two-month highs, amid rising risk from trade tensions.

Upcoming non-farm payroll (NFP) report is the next major catalyst—strong data could boost the dollar further and undermine safe-haven metals like gold and silver.

Trade escalation ripples through global equities

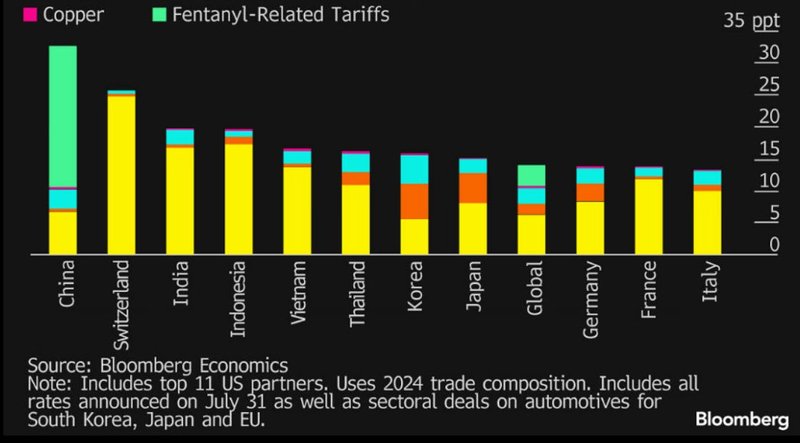

U.S. President Donald Trump’s long-anticipated executive order on global trade hit markets late Thursday, confirming a 10% minimum tariff on imports from countries without finalized trade deals, while enforcing steep reciprocal tariffs on others. India was hit with a 25% duty, Canada with 35%, and Switzerland with 39%. China remains exempt—for now—with a separate deadline looming on August 12.

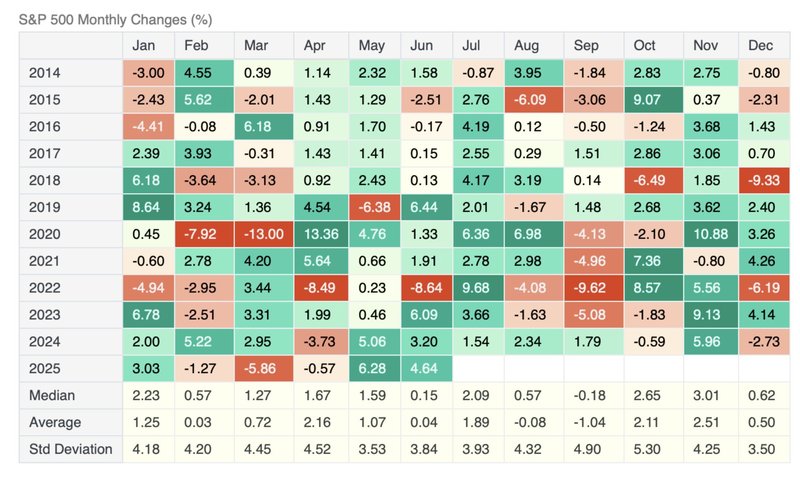

While equity markets reacted with broad risk aversion, the declines were contained. Asian indices slipped slightly, as several key exporters like Thailand, Malaysia, and Taiwan were spared the worst tariffs. U.S. futures were largely flat overnight, with the S&P 500 and Dow posting minor pullbacks. Despite global trade volatility, the S&P 500 closed out July in positive territory for the 11th straight year — the longest such streak since 2014.

The subdued reaction suggests the latest tariff escalation may have been partly priced in. However, geopolitical risk premiums remain elevated, and investor focus is rapidly shifting to the next key data catalyst: today’s U.S. non-farm payrolls.

Dollar strength weighs heavily on metals

The U.S. dollar index remains firm near the 100 mark, holding at a two-month high and pressuring commodities across the board. The greenback’s recent rally is fueled by resilient U.S. macro data and diminishing expectations for near-term rate cuts, especially after a stronger-than-expected Q2 GDP print and Powell’s guarded tone at the Fed press conference.

Gold and silver continue to struggle, extending losses as copper collapses to fresh multi-week lows. The core theme across metals is the Fed’s hawkish shift, which limits the appeal of non-yielding assets. Should the upcoming NFP report show labor market resilience, the dollar could gain further momentum, adding to headwinds for the precious metals complex.

July NFP in focus: Can job gains derail Fed cut bets?

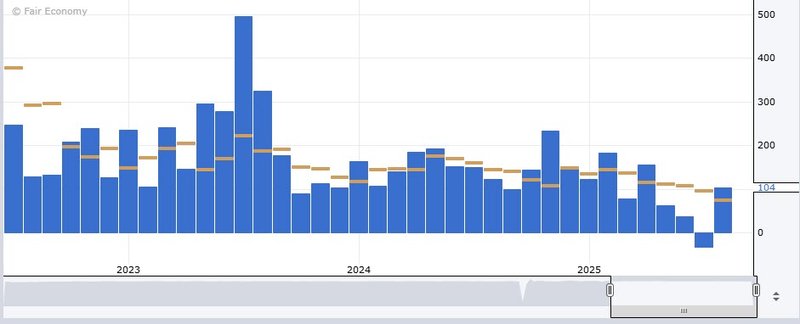

Economists expect the July non-farm payroll report to show 102,000 new jobs, with the unemployment rate inching up to 4.2%. Average hourly earnings are forecast to rise by 0.3% month-on-month. While two of the usual four pre-NFP indicators are missing this month, the available data hint at a possible upside surprise.

ADP private payrolls rose by 104,000—rebounding from last month’s disappointment—while initial jobless claims have trended lower, with the 4-week moving average now at 221K. These signals point to underlying labor market strength, which could undermine bets on aggressive Fed easing.

Fed funds futures currently assign only a 0.2% chance of a September rate cut, with the probability of two cuts this year falling to just 40.1%. A strong payrolls report would likely reinforce the dollar’s bullish narrative and keep downward pressure on gold, silver, and other commodities.

Expect high volatility around key data prints, especially as the U.S. dollar’s path now increasingly hinges on the interplay between domestic labor strength and global geopolitical stress.