Markets focus on Fed signals, dollar weakness, and positioning into year-end

As 2025 draws to a close, markets are shifting attention away from headline growth numbers and toward monetary policy signals, currency moves, and investor positioning. The final weeks of the year are less about new data surprises and more about how traders prepare for 2026.

Markets are no longer reacting sharply to single data points.

Risk assets outside the US, and carry trades, reinforcing a broader shift in global capital flows.

Liquidity tends to be thinner and price movements can become more exaggerated.

How smoothly can policy normalize without causing stress.

Fed communication drives expectations more than data

The Federal Reserve remains the main anchor for global markets, even without major economic releases. Recent comments from Fed officials suggest confidence that policy is restrictive enough, but they continue to stress patience. This messaging has reinforced the idea that rate cuts are not imminent, yet still likely later in 2026 if inflation continues to cool. Markets are no longer reacting sharply to single data points. Instead, they are listening closely to tone and consistency. The Fed’s emphasis on being “data-dependent” has evolved into a broader message: policy will not react to noise. This has helped stabilize expectations and reduce volatility, even as investors’ price gradually easing next year.

Source: CME Group

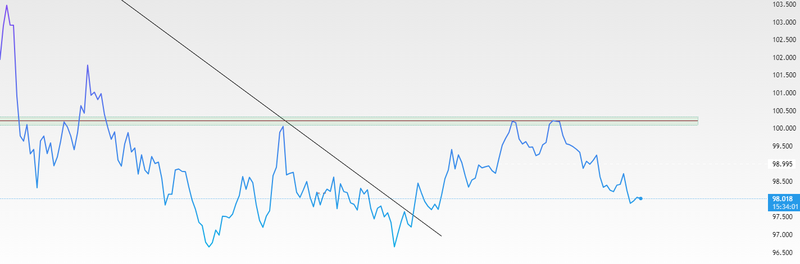

Dollar weakness reflects positioning, not panic

The US dollar remains under pressure, trading near its lowest levels since early autumn. This move is less about economic weakness and more about positioning. With much of the tightening cycle behind us, investors are reducing long-dollar exposure and reallocating toward commodities, emerging markets, and non-US assets. The dollar’s decline has been orderly, not disorderly. Treasury yields remain relatively stable, suggesting there is no loss of confidence in US assets. Instead, markets are adjusting to a world where interest rate differentials may slowly narrow in 2026, reducing the dollar’s advantage. This softer dollar environment has supported metals, risk assets outside the US, and carry trades, reinforcing a broader shift in global capital flows.

Source: Trading View

Year-end positioning favors caution and balance

As markets move toward the end of the year, liquidity tends to be thinner and price movements can become more exaggerated. Many investors are choosing to protect gains rather than chase late-stage rallies. Equity markets remain supported, but participation has narrowed, with fewer stocks driving gains while others move sideways or pull back. Defensive sectors such as utilities, healthcare, and consumer staples continue to attract interest, alongside commodities and real assets like gold and silver. These tend to hold value better if growth slows or volatility rises. Investors are not excited about risk entirely but are being more selective, reflecting cautious, late-cycle positioning.

How smoothly can policy normalize without causing stress

A smooth normalization means gradual, well-communicated moves by central banks. Investors want rate cuts or adjustments to happen step by step, with clear guidance, so markets can adjust expectations without sudden shocks. Abrupt or aggressive changes often trigger volatility in equities, bonds, and currencies. Smooth normalization also requires inflation to cool off without causing a sharp slowdown in spending or a rise in unemployment. Rate cuts that are optional, rather than forced by economic weakness, tend to be better received by markets. Another aspect is maintaining stability in financial markets during the transition. Central banks need to avoid sudden jumps in bond yields, disorderly currency moves, or funding stress. If these conditions hold, policymakers have room to adjust rates without triggering broader instability. Investors are reflecting on this reality by hedging rather than exiting positions. They stay invested in equities but avoid crowded trades, hold commodities as protection, and keep cash or short-term bonds for flexibility. This cautious positioning explains why markets appear calm on the surface but remain alert underneath. In the end, markets are no longer asking if policy will change they know it will. What matters is whether central banks can remove restrictions slowly enough to avoid breaking confidence or creating instability. Current signals suggest it is possible, though not guaranteed, which is why investors remain engaged but protective, balancing optimism with caution.