Markets rise as optimism builds around resolving the shutdown

Major US equity indices rallied as markets welcomed the Senate’s approval of a funding bill that—if passed by the House and signed by President Donald Trump—would end the federal shutdown. The prospect of restored government operations reduced policy uncertainty and boosted risk appetite.

The US Senate approved a bill that would finance the government until 30 January 2026; it still requires House passage and presidential assent.

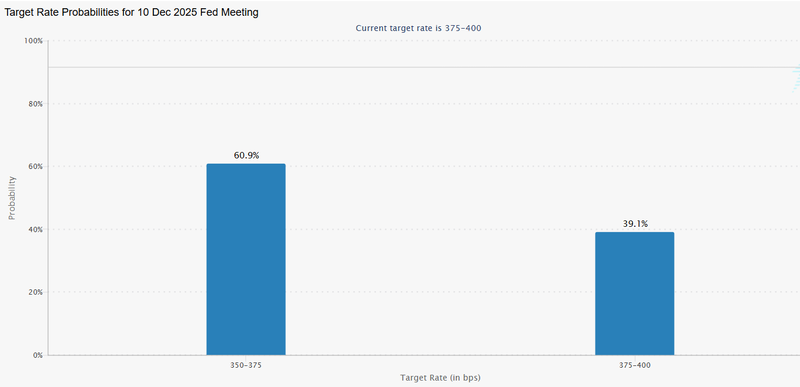

Fed officials are split on the timing and scale of further easing, pushing the market-implied probability of a December 25bp cut down to c. 61 per cent from earlier highs.

Risk assets gained on the prospect of the shutdown ending; the Nasdaq outperformed as investors rotated back into equities.

Markets react to Senate approval of funding bill

The United States Senate voted to approve a funding package that, if subsequently approved by the House of Representatives and signed by President Donald Trump, would lift the federal funding lapse and finance the government through 30 January 2026. The package reportedly consists of three appropriation bills to cover core government functions; it does not resolve outstanding disputes on health-care protections and the permanent extension of certain tax credits under the ACA.

Market participants treated the Senate vote as a de-risking event. Equity indices rose across the board as investors anticipated a normalisation of official data flows and reduced fiscal uncertainty. At the time of writing, the Dow Jones Industrial Average was up c. 0.88 per cent at about 47,398, the S&P 500 had climbed c. 1.58 per cent to c. 6,834 and the Nasdaq-100 had advanced c. 2.10 per cent to c. 25,587. The improvement in sentiment was tempered by the caveat that the bill must still clear the House and obtain presidential signature before the shutdown is definitively ended.

Fed remains divided; markets reassess December odds

Members of the Federal Open Market Committee continue to express divergent views on the appropriate path for policy. Some officials emphasise the need for caution given elevated price levels and rich financial valuations, while others point to rising unemployment and weakening activity as justification for easing.

The St. Louis Fed President, Alberto Musalem, signalled in a Bloomberg interview that the Federal Reserve should remain cautious on inflation. He noted that financial conditions — including equity valuations and house prices — remain elevated. In contrast, the San Francisco Fed President, Mary Daly, is more supportive of interest rate cuts, according to Reuters. She believes that the adoption of artificial intelligence could accelerate economic growth without fuelling inflation. Meanwhile, Fed Governor Stephen Miran has also indicated support for further rate cuts, citing easing inflation and a rising unemployment rate.

These public differences have helped drive a marked re-pricing in market expectations. According to the CME Group’s FedWatch Tool, the probability of a 25-basis-point cut at the December meeting is now about 61 per cent, down from roughly 90 per cent several weeks ago. Investors will treat this week’s US consumer-price index (CPI) and producer-price index (PPI) prints as pivotal inputs for FOMC deliberations—particularly if the shutdown ends and official data resumes a normal schedule.

Figure 1. Target-rate probabilities for the 10 December 2025 Fed meeting. Source: Figure obtained from the CME Group’s FedWatch Tool.

Gold rallies amid policy uncertainty and safe-haven demand

Gold prices rose more than 2.5 per cent on the day as market participants balanced improving risk sentiment with lingering uncertainty about the Federal Reserve’s policy reaction function. A combination of steady central-bank demand for bullion, unresolved questions about the timing of policy easing and the possibility that official data releases could change the outlook contributed to inflows into the metal. At one point gold approached US$4,118 per ounce, underscoring the metal’s continuing role as a hedge against policy and geopolitical uncertainty.

Key economic events this week

Monday

- Australia: Westpac Consumer Confidence Change

Tuesday

- Australia: NAB Business Confidence

- United Kingdom: Unemployment Rate

- Germany: ZEW Economic Sentiment Index

Wednesday

- Germany: Inflation Rate

Thursday

- United Kingdom: GDP Growth Rate

- US: Inflation Rate

Friday

- China: Industrial Production

- US: Producer Price Index

- US: Retail Sales