Oil, gold futures climb amid US–Venezuela tensions

Futures for both oil and gold rose sharply after an escalation in tensions between the United States and Venezuela. The Brent and WTI contracts rallied more than 2.5 per cent, while gold breached US$4,450 per ounce for the first time as investors sought safe havens. Beijing criticised recent US detentions of Venezuelan vessels, adding a diplomatic dimension to the market reaction.

Brent and WTI futures gained 2.65 per cent and 2.83 per cent respectively on concerns that US action could disrupt Venezuelan crude exports.

Gold futures climbed 1.87 per cent, briefly exceeding US$4,450/oz, as geopolitical risk and expectations of Fed easing supported demand.

China’s Foreign Ministry condemned the detentions, calling them a serious violation of international law, which heightened diplomatic tensions.

Oil rises after escalation in tensions between the US and Venezuela

Markets reacted to a series of maritime enforcement actions after the US administration ordered a blockade of sanctioned oil tankers to and from Venezuela. In recent days the US Navy has detained vessels reportedly linked to Venezuelan exports; details remain incomplete and subject to official clarification.

The prospect that US measures could curtail Venezuelan flows — even if only intermittently — pushed crude prices higher on the view that global supply would tighten. China’s Foreign Ministry publicly condemned the detentions, calling them a “serious violation of international law”, a statement that added diplomatic friction between Beijing and Washington – China is one of Venezuela’s largest buyers of crude.

At the close, Brent futures (BRNG6) were up 2.65 per cent at US$62.07 per barrel, while WTI futures (CLG6) rose 2.83 per cent to US$58.00 per barrel. Traders cited both the potential for a gradual erosion of Venezuelan exports and an already fragile supply backdrop as reasons for the move.

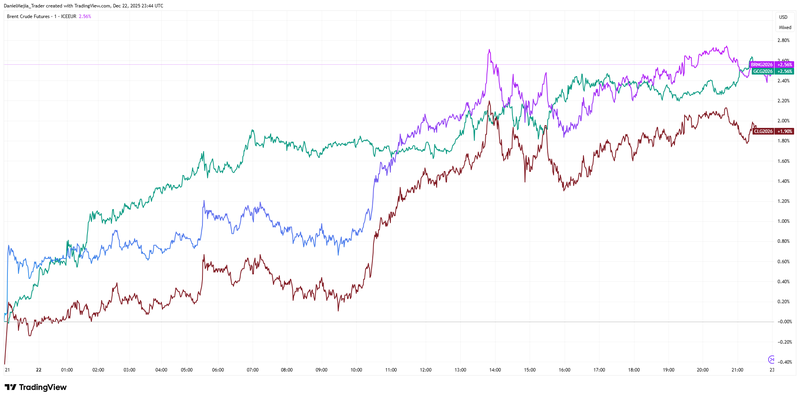

Figure 1. Brent, WTI and Gold futures (daily performance). Source: COMEX and ICE-EUR; chart derived from TradingView.

Gold exceeds US$4,450 for the first time

The gold futures contract (GCG26) advanced 1.87 per cent, closing around US$4,469/oz — a fresh nominal high — as investors sought refuge from heightened geopolitical risk. Demand for non-yielding safe havens was bolstered by two concurrent forces: the escalation of tensions between the US and Venezuela; and ongoing market expectations of monetary easing from the Federal Reserve, which reduce the opportunity cost of holding gold.

Market participants noted that the CME Group’s FedWatch Tool continues to price a meaningful probability of policy easing in 2026, a factor that has supported precious metals in recent weeks. Central-bank demand and ETF flows also remain constructive, adding to the upside momentum.

Key economic events this week

Monday

- Australia: RBA Meeting Minutes

- United Kingdom: GDP Growth Rate

Tuesday

- US: Durable Goods Orders

- US: GDP Growth rate

- US: Conference Board Consumer Confidence

Wednesday

- US: AIE Crude Oil Inventories Change

Thursday

- Japan: Industrial Production

- Japan: Retail Sales