PCE meets forecasts as gold and oil edge higher

Personal consumption expenditures (PCE) inflation data arrived in line with analysts’ expectations, albeit with a slight acceleration in the headline measure. Although the release contained no major surprises, it suggests the tariff impact on prices is not yet visible in the data. In response, the dollar eased modestly, gold rose, and US equity indices appreciated into the close.

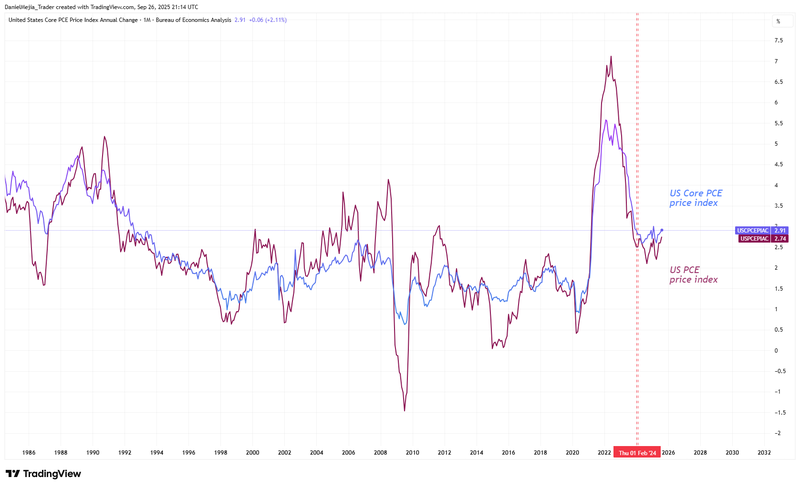

The PCE index showed a slight acceleration in its year-on-year change, while the core measure remained unchanged.

Gold futures closed near all-time highs, achieving a weekly gain of 1.82%. Demand for the safe-haven asset remains steady.

Energy prices continued to rise owing to an increased geopolitical risk premium and emerging scarcity issues.

The PCE index accelerates slightly, in line with estimates

The Personal Consumption Expenditures (PCE) Price Index, published by the Bureau of Economic Analysis (BEA), rose by 0.3% month on month, as expected by the analyst consensus. This implies a year-on-year increase of 2.7%, a mild acceleration from 2.6% previously. Meanwhile, the core PCE index, which excludes food and energy, rose by 2.9% year on year, with a 0.2% monthly increase. According to Reuters, the full tariff impact has yet to be felt because producers are still shipping from accumulated inventories and absorbing tax costs rather than passing them through to consumers. As such, the latest readings may not yet reflect a genuine uptick in underlying inflationary pressures.

Personal consumption increased by 0.6% month on month, above expectations. While 0.6% is not especially elevated versus historical norms, the indicator has been trending higher since June 2025. This is significant given that personal consumption expenditures account for more than two-thirds of US economic activity.

In sum, although the inflation metrics matched expectations, PCE readings appear range-bound around an average of roughly 2.8%. Moreover, the delayed pass-through of tariff effects adds uncertainty to the Federal Reserve’s next steps. The chart below illustrates the lateral pattern evident since 2024 in both headline PCE and core PCE, with potential inflection if either measure breaks sustainably above 3%.

Source: Own analysis via Trading View (September 26, 2025).

Gold higher despite dollar strengthening (weekly balance)

Gold futures rose by approximately 1.89% on the week, closing near US$3,800 per ounce and close to an all-time high. At today’s close, the Dollar Index (DXY) slipped by about 0.27% after in-line PCE data, aiding gold’s intraday gain of roughly 1%. That said, the relationship was not purely inverse over the week: gold gained 1.82% while the DXY advanced 0.54% (see chart below).

Structurally, gold remains underpinned by expectations of Fed easing, sustained central-bank demand, and hedging flows against persistent geopolitical risks. Debates at the UN General Assembly continue to focus on tensions in the Middle East, while the Russia–Ukraine conflict has escalated following remarks by US President Donald Trump suggesting Ukraine has a real chance of recovering territory with support from the EU and NATO. Against this backdrop, investors continue to favour gold as a principal safe-haven asset.

Source: Own analysis via Trading View (September 26, 2025).

Oil continues its momentum on geopolitical risk premium (weekly balance)

Brent and WTI futures ended the week notably higher, with Brent up 3.15% and WTI up 4.54% (see chart below). Contributing factors include Ukrainian drone attacks on Russian energy infrastructure, as well as an unexpected inventory draw reported by the International Energy Agency (IEA) in its weekly report. In addition, Russia’s Deputy Prime Minister Alexander Novak announced intentions to restrict diesel exports through year-end and to extend the current ban on gasoline exports.

Consequently, energy prices have remained on an upward trajectory amid shortages, refining constraints, and an elevated geopolitical risk premium—bolstered further by President Trump’s comments, which reduce the perceived likelihood of sanctions on Russia being lifted. Natural-gas prices also swung sharply: Henry Hub futures rose 10.40% today, bringing the weekly change to 9.21%.

Source: Own analysis via Trading View (September 26, 2025).