Pound weakens following soft UK employment data

The United Kingdom’s labour market showed signs of deterioration this month: the unemployment rate rose and payrolls contracted, prompting renewed uncertainty over the Bank of England’s policy path and weighing on sterling.

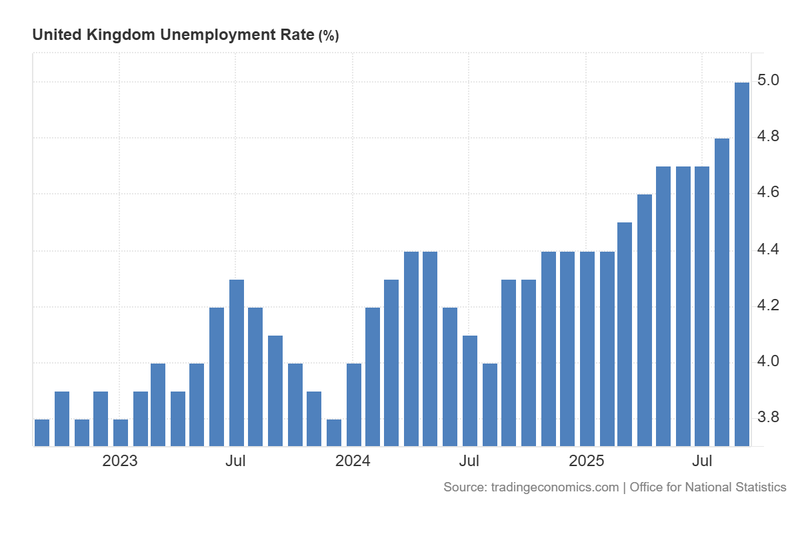

UK unemployment rose to 5.0 per cent and employment fell by 22,000, the first jobs decline since April 2024.

The Labour Market softening complicates the BoE’s policy calculus: the Monetary Policy Committee remains narrowly split on the timing of cuts.

Euro-area sentiment outperformed expectations marginally (ZEW index), supporting the euro against both sterling and the dollar.

Brent and WTI climbed as markets weighed potential disruptions from sanctions on Russian firms and attacks on refinery infrastructure, despite OPEC+ supply signals.

Employment data in the United Kingdom shows weakness

The Office for National Statistics reported that the UK unemployment rate increased from 4.8 per cent to 5.0 per cent, slightly above the consensus expectation of 4.9 per cent. The 0.2-per-cent uptick represents the largest twelve-month increase in the series and marks the highest unemployment rate in roughly three years (Figure 1).

Accompanying the rise in unemployment, headline employment fell by 22,000 jobs, driven by a reduction in full-time positions. This is the first monthly decline since April 2024 and suggests a growing soft patch in labour-market conditions. The combination of higher inflation and rising unemployment presents a challenging outlook for the BoE: price pressures remain elevated while demand in the labour market is weakening.

GDP growth has slowed over the last three quarters, with year-on-year growth standing at 1.4 per cent, reinforcing concerns about the near-term outlook for activity. The Monetary Policy Committee’s recent vote—split five to four between those favouring a pause and those preferring a cut—illustrates the internal uncertainty about the appropriate policy stance. In response to the employment data, sterling dipped modestly, trading around USD 1.3162 (a decline of approximately 0.08 per cent).

Figure 1. United Kingdom unemployment rate (2022–2025). Source: Office for National Statistics; figure obtained via Trading Economics.

German economic sentiment below expectations but showing relative resilience

The ZEW Centre for European Economic Research’s economic-sentiment index in Germany fell slightly to 38.5 from 39.3, missing consensus of 40.0. Despite the disappointment, the indicator remains above its long-run average and signals that analysts retain a cautiously positive view of the six-month outlook.

Germany’s macro backdrop remains mixed. Third-quarter GDP growth was effectively flat (quarterly 0.0 per cent; year-on-year 0.3 per cent), consistent with stagnation in industrial activity. Nevertheless, the ZEW reading suggests that sentiment may be stabilising, an interpretation that supported a modest appreciation of the euro: EUR/USD traded around 1.1585 (up c. 0.25 per cent), and EUR/GBP strengthened by about 0.36 per cent to c. 0.8801.

Oil prices rise amid supply-risk concerns

Brent and WTI futures advanced on the day as markets weighed potential supply disruptions arising from Western sanctions on Russian energy firms and reported Ukrainian strikes on Russian refinery infrastructure. Brent (BRNF6) rose approximately 1.72 per cent to US$65.16 per barrel, while WTI (CLZ5) gained about 1.38 per cent to US$60.95 per barrel.

Sanctions targeting major Russian producers, including Lukoil and Rosneft, and the US deadline for halting specified business interactions (set for 21 November) have introduced near-term uncertainty over flows. Concurrently, Ukrainian military action against refinery targets may curtail processing capacity, with implications for refined-product availability. Offsetting these upside risks, the prospect of additional OPEC+ production increases continues to exert downward pressure on price expectations.

Finally, markets are also parsing the potential macro impact of a resolution to the US government shutdown: if the pause in federal operations ends, a normalisation of demand data and economic activity could support energy consumption, whereas a prolonged impasse would weigh on near-term oil demand.