Pound sterling slips amid growing unemployment concerns

The British pound has depreciated following the release of weak labour market data, characterised by a rising unemployment rate and a deceleration in employment growth. Market participants are increasingly weighing the possibility of interest rate cuts by the Bank of England (BoE) to support the UK economy in the coming months. Simultaneously, Canadian inflation slowed more than anticipated, coming in below analysts' expectations.

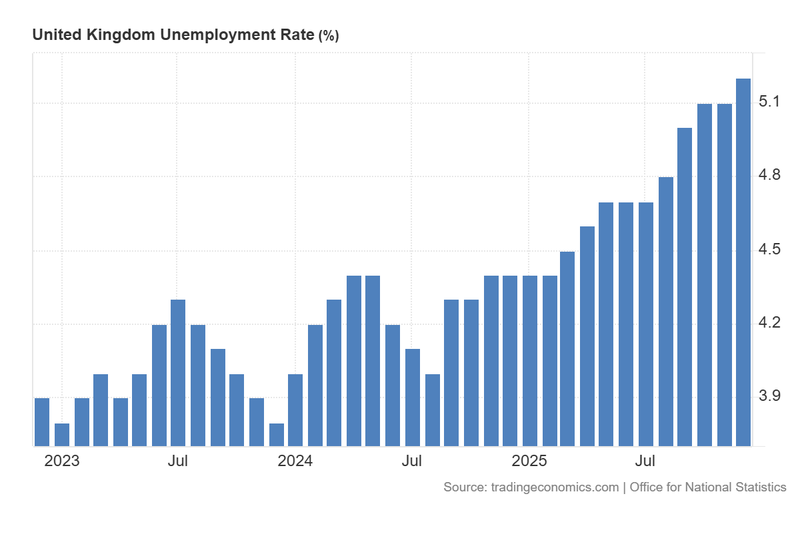

The UK unemployment rate climbed from 5.1% in November to 5.2% in December, as employment change figures signalled a slowdown in job creation.

GBP fell against the US dollar as investors raised their expectations for BoE monetary easing in response to signs of economic fragility.

Canada’s inflation rate eased from 2.4% to 2.3% in its latest reading, providing the Bank of Canada (BoC) with further justification for a more accommodative monetary stance.

Despite mixed signals from Federal Open Market Committee (FOMC) members regarding future policy, market expectations for two 25-basis-point rate cuts in 2026 remain steady, according to the CME FedWatch Tool.

UK unemployment rises above analysts’ expectations: British pound falls

According to data released by the UK Office for National Statistics (ONS), the unemployment rate rose from 5.1% in November to 5.2% in December, exceeding analysts' forecasts which had predicted the rate to remain unchanged. This figure represents the highest unemployment level since March 2021. Furthermore, employment change—a measure of the net shift in the number of people in work—decelerated from 82,000 to 52,000 over the same period. Both indicators highlight the mounting economic pressures affecting the UK's labour sector and overall productivity.

The growing weakness in the labour market is likely to increase pressure on the Bank of England (BoE) to consider lowering interest rates in its upcoming meetings. However, investors have now shifted their focus to the crucial inflation data scheduled for publication on Wednesday, 18 February. In response to the labour data, the British pound depreciated by 0.50%, trading at 1.3561 against the US dollar, as markets began to discount a higher probability of near-term rate cuts.

Figure 1. United Kingdom Unemployment Rate (2023–2025). Source: Data from the Office for National Statistics; Figure obtained from Trading Economics.

Canadian inflation decelerates below forecast: Canadian dollar softens

Data from Statistics Canada reveals that the headline inflation rate eased from 2.4% in December to 2.3% in January, falling short of the consensus forecast for an unchanged reading. Additionally, core inflation—which strips out volatile food and energy costs—decelerated from 2.8% to 2.6% during the same period. While this disinflationary trend is a positive development for price stability as the Bank of Canada (BoC) nears its 2% target, the broader economic context is pressuring the central bank to support an economy impacted by rising trade tensions between the US and Canadian governments.

According to Trading Economics, the primary driver of the slowdown was the transportation sector, where prices fell significantly, influenced by a 16.7% drop in gasoline prices. Conversely, food price inflation accelerated from 6.3% to 7.3%. Following the release, the Canadian dollar depreciated slightly by 0.03%, trading at 1.3636 against the US dollar, as market participants adjusted for a less hawkish outlook from the BoC.

FOMC members express mixed expectations regarding Fed decisions

Uncertainty regarding the Federal Reserve's future interest rate path persists amidst conflicting signals from policymakers. As reported by Reuters, Federal Reserve Governor Michael Barr suggested that interest rate cuts could be on the horizon if inflationary risks remain stable. However, Governor Barr noted that potential tariff pressures could impact prices, requiring the FOMC to remain data-dependent. He further observed that while the employment sector shows signs of stabilisation, the deceleration in new hires remains a primary risk.

In contrast, Chicago Fed President Austan Goolsbee, speaking to CNBC, adopted a more dovish tone, suggesting the Federal Reserve could approve several rate cuts this year if inflation continues its descent toward the target. Goolsbee’s outlook was supported by recent data showing higher-than-expected non-farm payrolls alongside a lower-than-expected unemployment rate, which, while reducing the urgency for immediate cuts, still points to underlying shifts in the labour market.

Despite these differing viewpoints, there is a consensus that the Federal Reserve must remain responsive to incoming economic data. According to the CME FedWatch Tool, the probability of two 25-basis-point rate cuts remains intact, with markets currently pricing in the first cut for the June meeting, followed by a second in September. Reflecting this pervasive uncertainty, major stock indices closed with mixed results.