Profit-taking and risk rotation push metals down

The initial pressure in the market originated in the Nasdaq, where selling emerged after a prolonged period of concentration-driven gains in large-cap technology stocks, gold and silver became sources of funding rather than destinations of fear. The market’s reaction to Kevin Warsh’s positioning was subtle but revealing. Rather than being interpreted as a dovish signal.

Nasdaq slid roughly 4%, with U.S. equities acting as the catalyst rather than the cause.

Spot silver has plunged nearly 10%, marking its steepest drop in more than a decade.

Warsh’s presence was read as an indication that Federal Reserve independence remains intact.

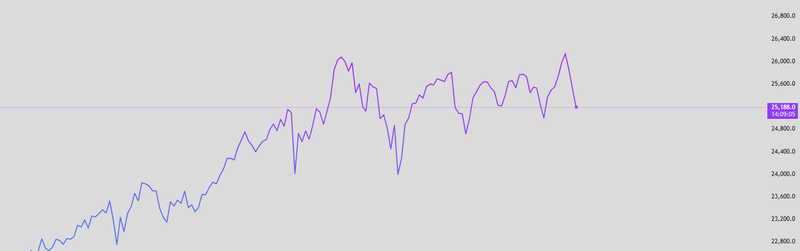

Nasdaq and U.S. equities

The initial pressure in the market originated in the Nasdaq, where selling emerged after a prolonged period of concentration-driven gains in large-cap technology stocks. This was not a reaction to a single data point, but a broader valuation reset. Earnings, while still solid in absolute terms, failed to justify marginally higher multiples in an environment where liquidity is no longer expanding.

Futures opening lower reinforced the signal: risk asymmetry had changed. Once the Nasdaq rolled over, broader U.S. equities followed not through panic selling, but via systematic de-risking. Portfolio managers trimmed exposure to assets with the largest embedded gains, choosing patience over chasing momentum while waiting for confirmation that the correction has fully absorbed near-term risks.

U.S equities

That reset accelerated as Nasdaq slid roughly 4%, with U.S. equities acting as the catalyst rather than the cause. Concerns around tighter profit margins, driven by rising AI and cloud infrastructure costs, forced investors to reassess how much future growth is already priced into mega-cap tech. The issue was not revenue stability, but margin durability, a subtle shift that matters when positioning is crowded.

This phase reflects rotation, not capitulation. Capital is being reallocated, not withdrawn. However, until volatility stabilizes and market breadth improves beyond a narrow set of defensive or value names, upside attempts remain structurally fragile. Leadership is no longer guaranteed, and in this environment, valuation discipline not growth narratives is setting the tone.

Source: Trading View

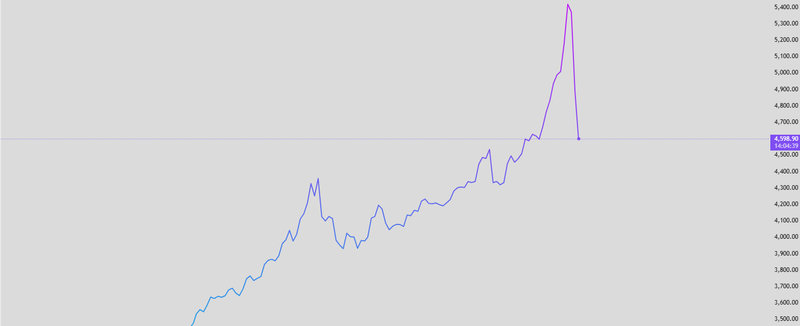

Gold and silver

Spot gold has fallen roughly 5%, the recent sharp decline in gold does not invalidate that structural case. What the market is experiencing instead is a violent bout of profit realization, amplified by renewed dollar strength and the need for liquidity as equities corrected.

As risk assets sold off and volatility spiked, gold and silver shifted from being defensive allocations to sources of funding. Investors sold what they could, not necessarily what they wanted to. This is typical behavior in transitional market phases: assets that performed best and remain liquid are often liquidated first to meet margin calls, rebalance portfolios, or raise cash.

Source: Trading View

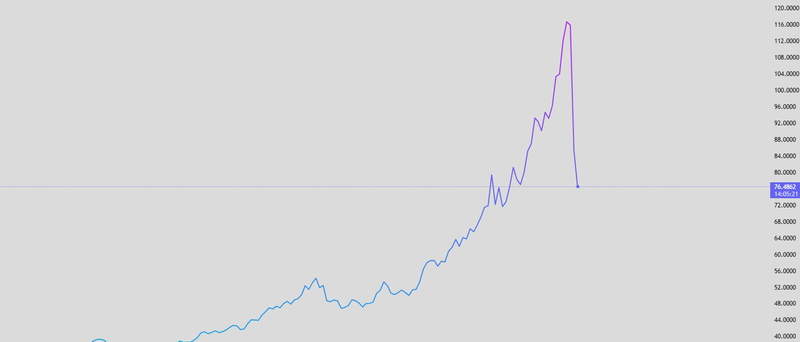

Silver fall 10%

Spot silver has plunged nearly 10%, marking its steepest drop in more than a decade, while extending what is already a record sell-off. These are extreme moves, but they reflect positioning dynamics rather than a sudden loss of faith in precious metals as long-term hedges.

The result is a sharp, emotionally driven correction rather than a fundamental breakdown. Structurally, the metals market is undergoing a reset in positioning, flushing out crowded trades and excess leverage. The underlying narrative hedging against macro instability and long-term fiscal risk remains intact, even if near-term price action is forcing a reassessment of timing rather than conviction.

Source: Trading View

Kevin Warsh and market interpretation

The market’s reaction to Kevin Warsh’s positioning was subtle but revealing. Rather than being interpreted as a dovish signal, his profile reminded markets of his historically hawkish stance and firm views on monetary discipline. This stood in contrast to expectations that a more accommodative figure might be appointed, particularly amid assumptions of political pressure for easier policy. Instead, Warsh’s presence was read as an indication that Federal Reserve independence remains intact, and that policy decisions will continue to prioritize credibility and inflation control over short-term market relief.

Market interpretation

In an environment where inflation risks have not been fully extinguished, this interpretation tempered risk appetite rather than supporting it. Markets do not react to personalities alone; they react to policy continuity, timing, and what has already been priced in. The implicit realization was not that rate cuts were imminent, but that any easing would likely be cautious, conditional, and delayed. As a result, the response was not bullish. The market adjusted to the idea that flexibility would not come easily, and until clearer guidance emerges possibly through formal communication this perception acts as a constraint on risk-taking rather than a catalyst for renewed upside.