Asia markets turn risk-on as confidence in a December Fed cut grows

Dovish Fed pricing kept risk assets bid in Asia, powering NZD and AUD while the yen stayed soft despite chatter of a near-term BoJ move. Focus now swings to the UK Autumn Budget.

Kiwi jumps after a hawkishly framed RBNZ cut

Aussie firms as inflation tops forecasts, pushing RBA easing into 2026

Yen underperforms despite talk of a December–January BoJ hike window

UK Budget risk looms; gilts are the confidence barometer

Asia session: Risk appetite extends, dollar soft at the margins

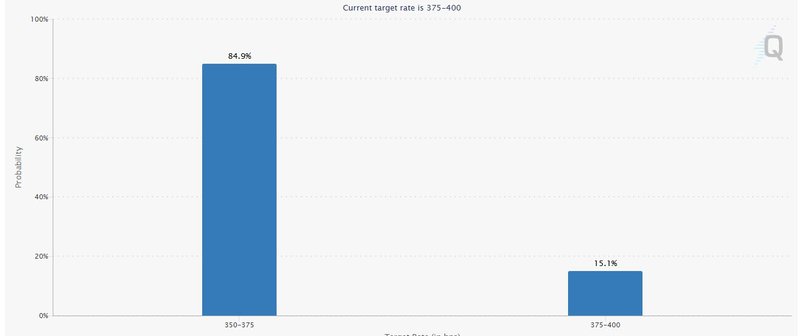

A constructive tone from intensifying bets on a December Fed cut pushed U.S. equities higher overnight and briefly knocked the 10-year Treasury yield below 4%. In Asia, NZD and AUD outperformed; JPY stayed heavy. Index moves were broadly positive (Nikkei, Hang Seng, and Shanghai all higher), with U.S. futures steady after a solid close. Markets are pricing roughly an 85% chance of a December Fed rate cut, implying a move from the 3.75%–4.00% range down to 3.50%–3.75%.

Source: CME Group

New Zealand: RBNZ trims 25 bps but shuts the door on a deeper easing cycle

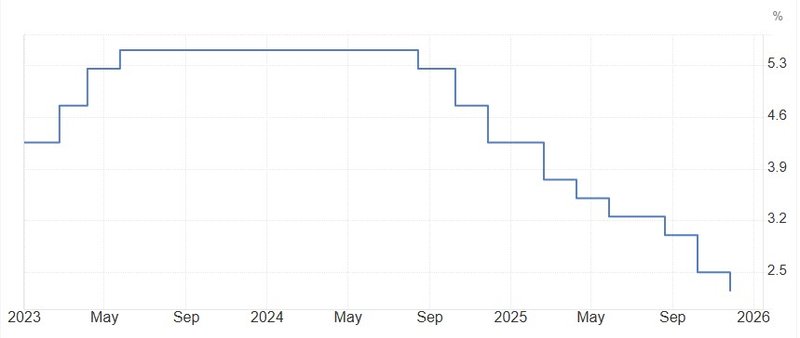

The RBNZ lowered the OCR by 25 bps to 2.25% but paired it with firm guidance. The decision (5–1, one hold dissent) signaled limited appetite for further cuts: projections show the OCR troughing near 2.2% through 2026 and edging to ~2.7% by end-2027. The statement noted activity is stabilizing, weaker NZD is supporting exporters, and inflation risks look more balanced—language that effectively frames yesterday’s move as the cycle’s endpoint absent a negative shock. NZD rallied on the “cut-and-done” message.

Source: TradingEconomics

Australia: Inflation re-accelerates, extending RBA patience

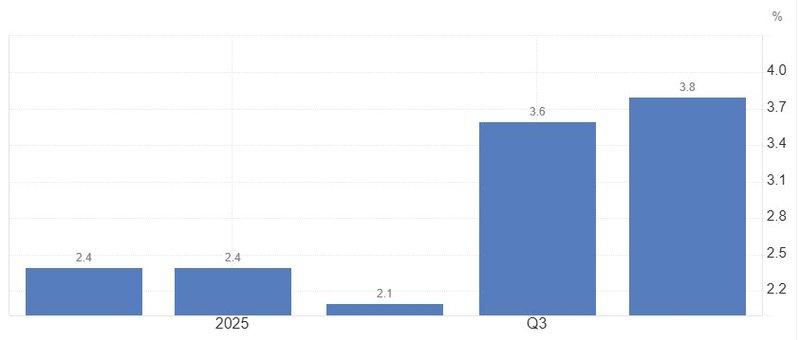

Australia’s monthly CPI quickened to 3.8% y/y in October (trimmed mean 3.3%), with both goods and services prices firming. Housing led gains (5.9%), followed by food/non-alcoholic beverages and recreation/culture. The upside surprise nudges markets to push any RBA rate cut further into 2026 and offered AUD a tailwind.

Source: TradingEconomics

Japan: Yen stays soggy despite BoJ chatter

Reports that officials are preparing markets for a possible December move—after high-level political consultations—left traders unconvinced. A close call between a December hike and a January delay keeps timing uncertain; sensitivity to the Fed’s decision one week earlier adds another layer. For now, JPY softness reflects skepticism that near-term policy traction will materialize.

Source: TradingView

UK Autumn Budget: Credibility test ahead

Conflicting pre-briefing on tax settings leaves an unusually wide distribution of outcomes. Gilts will be the cleanest read on confidence in the fiscal stance; sterling is likely to move inversely with gilt yields—this is a trust test, not yield-seeking.