US consumer confidence dips as markets deliver mixed signals

Today’s report highlights several notable data releases. The Conference Board’s consumer-confidence gauge declined in its latest reading. China’s PMI prints came in below estimates. Japan’s industrial production fell for a second consecutive month. Meanwhile, the Reserve Bank of Australia (RBA) left interest rates unchanged.

US consumer confidence declined for a second consecutive month amid uncertainty linked to a softer labour market.

China’s PMI data missed expectations, although the manufacturing PMI showed a slight improvement.

Industrial production in Japan recorded monthly and year-on-year contractions of 1.2% and 1.3%, respectively.

The RBA kept its policy rate unchanged at 3.6%.

US consumer confidence lower than expected

The Conference Board reported a larger-than-expected fall in its Consumer Confidence Index: the consensus looked for 96, but the print came in at 94.2 versus 97.8 previously. According to the Conference Board’s note, “US Consumer Confidence Declines Again in September” (30 September 2025), a marked deterioration in consumers’ assessment of current conditions—driven mainly by softer hiring and weaker business conditions—pulled the index lower in the latest survey.

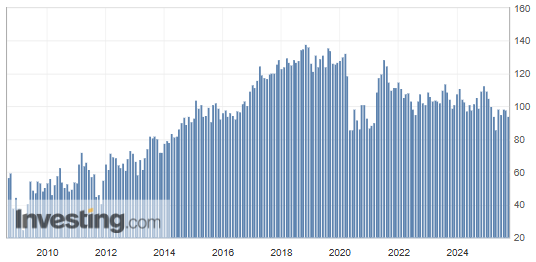

Figure 1 indicates that the post-2009 uptrend—which reflected a substantial improvement in confidence until 2018—has since reversed, with the index trending down from the first half of 2021. It is also worth noting that the 80-point threshold is consequential: periods with readings below that level have tended to coincide with recession or stagnation. The current level remains above 80.

Figure 1. Conference Board Consumer Confidence Index (2008–2025)

Source: The Conference Board. Image sourced from Investing (30 September 2025).

Why is the Conference Board’s confidence index relevant in the current economic situation?

The Conference Board’s index measures not only confidence but also expectations for income, business conditions, and labour-market prospects. It therefore offers insight into US households’ prospective consumption patterns over the short to medium term. A pronounced deterioration would signal a significant drag on aggregate demand and, in turn, on economic growth. At present, the level remains consistent with relative stability, but the multi-year trend is downward.

Despite the decline in confidence, US equities rose across the board as investors focused more intently on the potential federal-government shutdown facing a deadline today. In the event of a shutdown, the Department of Labor would not publish this week’s employment report, complicating the Federal Reserve’s data-dependent approach to policy.

China PMI data presented below estimates

China’s National Bureau of Statistics released the latest PMI readings. The NBS Manufacturing PMI printed 49.8—below expectations and indicating contraction (PMI < 50). The NBS Non-Manufacturing PMI came in at 50.0, also below estimates and down from 50.3 previously.

While the misses underscore lingering weakness, manufacturing did improve versus the prior 49.4 reading—an encouraging sign given the sector’s post-pandemic fragility. In market response, Hong Kong’s Hang Seng Index rose 0.8% to around 26,900, while the FTSE China A50 dipped 0.37% to roughly 15,110. Both China-linked indices retain the positive momentum built in recent months.

Industrial production in Japan showed contraction

Japan’s Ministry of Economy, Trade and Industry (METI) reported continued weakness in output. Industrial production fell 1.2% m/m, marking a second consecutive monthly contraction, and declined 1.3% y/y after a 0.4% y/y fall previously.

Regarding market reaction, the Nikkei 225 eased by about 0.25% to roughly 44,932. The yen weakened by close to 0.50% against the US dollar, ending near ¥147.80 per dollar.

Australia’s central bank decided to keep reference rates unchanged

The Reserve Bank of Australia ((RBA)) kept its policy rate unchanged at 3.6%, in line with analyst expectations. In market reaction, the Australian dollar appreciated by around 0.52% against the US dollar, to approximately US$0.6608.