US inflation holds steady, gold rises, and oil volatility surges

US inflationary pressures remained stable, sustaining the probability of a neutral-to-dovish stance from the Federal Reserve. Concurrently, gold prices have extended their upward trajectory as investors seek safe-haven assets. Meanwhile, oil prices have appreciated sharply following heightening concerns regarding disruptions to Iranian crude exports amidst escalating social destabilisation.

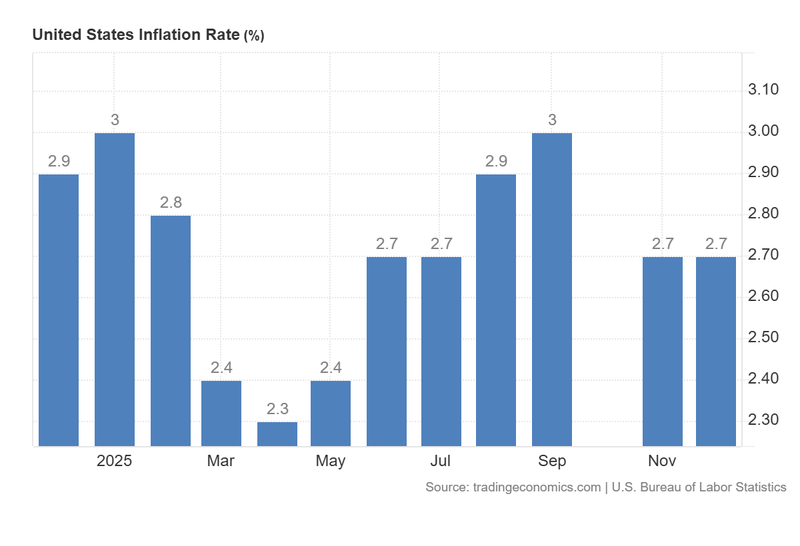

US inflation remained unchanged at 2.7%, with core inflation holding at 2.6%.

Gold is trading above $4,600, driven by central bank accumulation and safe-haven demand.

Oil prices closed over 2% higher as social destabilisation in Iran threatens Middle East supply chains.

US inflation rate remains unchanged as hopes for monetary easing gather momentum

According to the U.S. Bureau of Labour Statistics, the annual inflation rate remained stable at 2.7%, aligning with the consensus amongst analysts. Core inflation—which excludes the volatile food and energy sectors—similarly held steady at 2.6%. This figure was lower than the 2.7% anticipated by analysts, suggesting a moderation in underlying price pressures.

This data had a negligible impact on the probability of two 25-basis-point (bps) rate cuts in 2026, as projected by the CME Group’s FedWatch Tool. Current indicators suggest that interest rate reductions are expected in June and September. Although the anticipated spike in inflation has failed to materialise and the labour market's cooling remains gradual, domestic policy uncertainty in the United States remains elevated. Furthermore, ongoing tensions between Washington and counterparts in Latin America, Europe, and the Middle East continue to obscure economic projections, preventing high-confidence forecasts.

Despite inflation data being the primary focus for US markets, major equity indices exhibited minimal movement. The S&P 500 declined by 0.19% to 6,963, the Dow Jones Industrial Average fell 0.80% to 49,191, and the Nasdaq-100 closed 0.18% lower at 25,741.

Figure 1. United States Inflation Rate (year-over-year). Source: Data from the Bureau of Labour Statistics; Figure obtained from Trading Economics.

Gold prices ascend amidst monetary easing expectations and safe-haven demand

The Gold Futures contract (GCG26) continues to oscillate near record highs, trading in the vicinity of $4,610 during the session. Demand from central banks, Exchange-Traded Funds (ETFs), and futures participants remains robust, as these entities seek a hedge against persistent geopolitical, economic, and commercial risks.

Furthermore, the recent US inflation update did not provide the Federal Reserve with sufficient grounds to maintain an aggressively restrictive stance. Additionally, an unusual convergence of factors has intensified the geopolitical risk premium: the protracted Russia-Ukraine conflict, escalating tensions between the US and Latin America, and widespread protests in Iran. The potential for US intervention in the Middle East has further exacerbated global uncertainty.

Reflecting this trend, the silver futures contract (SIH26)—likewise regarded as a premier safe-haven asset—is currently trading above $88.

Oil prices rally on supply chain concerns in the Middle East

The primary benchmarks for Brent and WTI crude oil rose significantly, spurred by fears of potential interruptions to Iranian petroleum exports. The Brent futures contract (BRNH26) settled approximately 2.5% higher at $65.45 per barrel, while the WTI futures contract (CLG26) appreciated by 2.77% to $61.15 per barrel.

A surge in civil unrest within Iran has led to significant social destabilisation. These domestic political tensions have fuelled expectations that the nation may curtail its standard export volumes, potentially creating a bottleneck within regional supply chains.

The geopolitical risk premium has been further elevated by statements from President Donald Trump regarding potential US intervention, leading to heightened volatility in crude markets. Over the past week, oil prices have rallied by approximately 9%. Despite earlier projections of lower energy costs—premised on the assumption that Venezuelan crude reserves might be modernised by US firms—current prices continue to climb significantly due to these geopolitical catalysts.