US inflation slows markedly, lifting stocks and gold

Gold prices and US equity indices advanced following a lower-than-expected US inflation report. The Consumer Price Index (CPI) decelerated from 2.7% to 2.4%, easing pressure on the Federal Reserve and bolstering market expectations for interest rate cuts in the latter half of 2026. Concurrently, oil prices settled slightly higher during a volatile session, as investors weighed the prospect of increased production against persistent geopolitical risks.

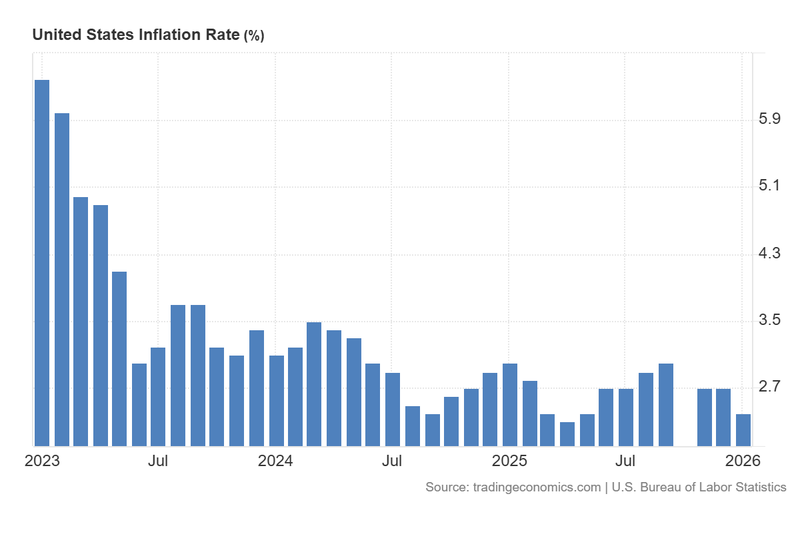

Data from the US Bureau of Labour Statistics (BLS) revealed that the annual inflation rate fell to 2.4% in January from 2.7% in December, driven largely by declines in gasoline prices and rental costs.

Gold futures on the COMEX exchange appreciated by 2.31%, as the precious metal typically benefits from the prospect of a lower interest-rate environment.

US stock markets recorded modest gains, reflecting positive investor sentiment toward the anticipated easing of monetary policy, which is expected to support corporate growth.

Brent and WTI crude benchmarks edged higher amidst conflicting signals regarding potential OPEC+ production increases and heightened geopolitical tensions between the US and Iran.

US inflation decelerates below forecasts: equity indices and gold advance

According to data released by the US Bureau of Labour Statistics, the annual inflation rate decelerated from 2.7% in December to 2.4% in January, falling below the consensus analyst forecast of 2.5%. This release marks the lowest inflationary level since May 2025 and solidifies a downward trend observed over the past three years. Additionally, core inflation—which excludes volatile food and energy prices—slowed from 2.6% to 2.5%, aligning with market expectations. While the CPI is not the Federal Reserve’s primary inflation metric, it provides critical insights into price dynamics within the US economy.

The CPI report highlighted that the primary drivers of this deceleration were lower gasoline prices and a cooling in rental expenses. Furthermore, a monthly deceleration in food prices—specifically for eggs, coffee, fruits, and vegetables—contributed to the broader annual easing. Conversely, electricity prices drew significant attention from analysts, accelerating by 6.3% year-on-year, a trend likely linked to the rising energy demand from data centres dedicated to artificial intelligence.

Following the release, the CME FedWatch Tool indicated a shift in market probabilities regarding the timing of interest rate cuts this year. The likelihood of an initial 25-basis-point cut in June has increased. Meanwhile, the projected timeline for a second cut has accelerated, moving from October to September. Finally, the probability of a third 25-basis-point reduction in December rose to 29.4%, compared to a 30.5% probability of no change at that meeting.

Market reaction was swift, with gold futures (GCJ26) appreciating by 2.31%. Bullion typically thrives when inflationary pressures subside, as it allows the Federal Reserve more latitude to support the economy—particularly in the context of a softening labour market and the rising fiscal risks associated with servicing historical debt levels. US equity indices also rose in tandem, with the S&P 500 gaining 0.05% to 6,836 points, the Dow Jones Industrial Average rising 0.10% to 49,500, and the Nasdaq 100 appreciating by 0.18% to 24,732 points.

Figure 1. United States Inflation Rate (2023-2026). Source: Data from the US Bureau of Labour Statistics; Figure obtained from Trading Economics.

Oil prices steady amidst mixed signals: OPEC production plans and geopolitical risk

As reported by Reuters, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) are reportedly considering a production increase beginning in April 2026 to accommodate anticipated peak summer demand—although this has yet to be confirmed via official OPEC channels. Additionally, is likely that members will maintain current production freezes through March 2026 to offset seasonally weaker first-quarter consumption. Historically, higher output levels exert downward pressure on crude prices by increasing global supply.

Conversely, market participants remain wary of potential supply chain disruptions should diplomatic tensions between the US and Iran escalate into a direct confrontation. While there are reports that diplomatic talks may convene next month to seek a resolution, uncertainty remains a dominant theme for oil traders. According to Reuters’ information, the Pentagon recently deployed a second aircraft carrier from the Caribbean to the Middle East—a move that contrasts with diplomatic efforts and has fueled intraday volatility.

By the close of the session, the Brent crude futures contract (BRNJ26) rose by 0.34% to $67.75 per barrel, while the WTI futures contract (CLH26) edged up by 0.08% to $62.89.