U.S. markets at record highs as oil continues to decline

U.S. equity markets surged to fresh all-time highs on expectations of monetary easing from the Federal Reserve, while oil prices extended their decline amid a steady build in U.S. inventories.

The S&P 500 and Nasdaq closed at record levels as investors bet on imminent Fed easing.

Brent and WTI fell around 0.7% after U.S. crude inventories rose by 3 million barrels, against expectations for a draw.

European leaders pressed the U.S. to secure guarantees for Ukraine in any deal with Russia.

Global equity funds logged their biggest inflows in over four years, led by European markets.

S&P 500 and Nasdaq surge on Fed cut bets

Investor sentiment toward U.S. equities turned optimistic on the possibility of monetary easing by the FED. Treasury Secretary Scott Bessent amplified that optimism by stating that the Federal Reserve should consider a more aggressive reduction in policy rates of roughly 1.5%, beginning with a 50-basis-point cut at the September meeting.

This backdrop is steering investors not only toward technology and defense, but also toward sectors such as Healthcare and Financials. However, the mounting momentum also entails considerable market risk, as U.S. company valuations are at historically elevated levels—particularly within technology, which currently has a significant weight in the main benchmark index (S&P 500).

Oil loses ground on inventory build

Benchmark crude prices—Brent and WTI—fell about 0.7% intraday after U.S. crude stocks rose by 3 million barrels, according to the Energy Information Administration (EIA). Analysts had expected a draw of 275,000 barrels. The EIA also revised its outlook, raising its year-end 2025 supply growth forecast while trimming demand expectations, reinforcing a bearish tone in the market.

Attention is now on Friday’s meeting between President Donald Trump and Russian President Vladimir Putin. Trump has warned of potential economic sanctions if no peace deal is reached. Any blockade of Russian energy exports could disrupt supply chains in Asia and Europe, injecting fresh volatility into prices given Russia’s critical role in global oil flows. Still, a negotiated settlement remains possible.

Europe seeks guarantees from Trump for Ukraine and European countries

German Chancellor Friedrich Merz said European leaders are pressing the U.S. to ensure that any agreement with Russia protects European interests as well as Ukraine’s sovereignty. The message was delivered during a call with President Trump. Europe’s demands include binding security guarantees and a firm rejection of Russian territorial claims or NATO membership restrictions on Ukraine.

Financial markets sensitive to geopolitical risk—including gold and oil—remain in consolidation ranges, awaiting clarity on the outcome of the talks and their implications for global supply chains.

Global equity funds see historic inflows

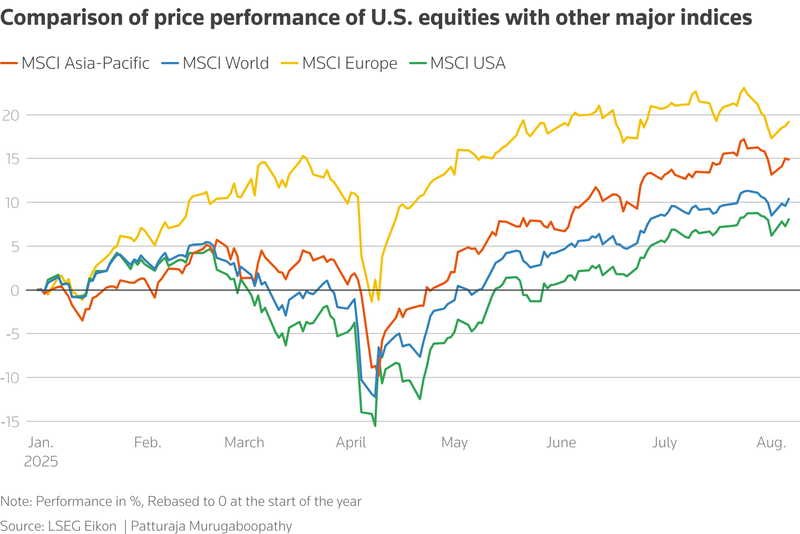

Global equity funds have accumulated record investment inflows, reflecting a growing shift of capital from the United States to other economies with more attractive valuations. According to LSEG Lipper, global funds (ex-U.S.) recorded inflows of USD 13.6 billion in July, the highest figure since December 2021. By contrast, U.S. equity funds posted outflows of USD 6.3 billion in the same period (Reuters, August 2025).

This trend aligns with investors’ pursuit of greater diversification and an allocation toward assets with more compelling market valuations. The following chart illustrates how, in recent months, the strongest capital gains have been in global funds (ex-U.S.), led primarily by European funds, which have outperformed since April 2025.