US markets recover amid sharp inflation deceleration

US equity markets were supported by a pronounced deceleration in US inflation, which has increased the likelihood of additional Federal Reserve easing in 2026. The Bank of England (BoE) cut its policy rate by 25 basis points, citing continued uncertainty in the outlook, while the European Central Bank (ECB) held rates steady and reiterated a data-dependent approach.

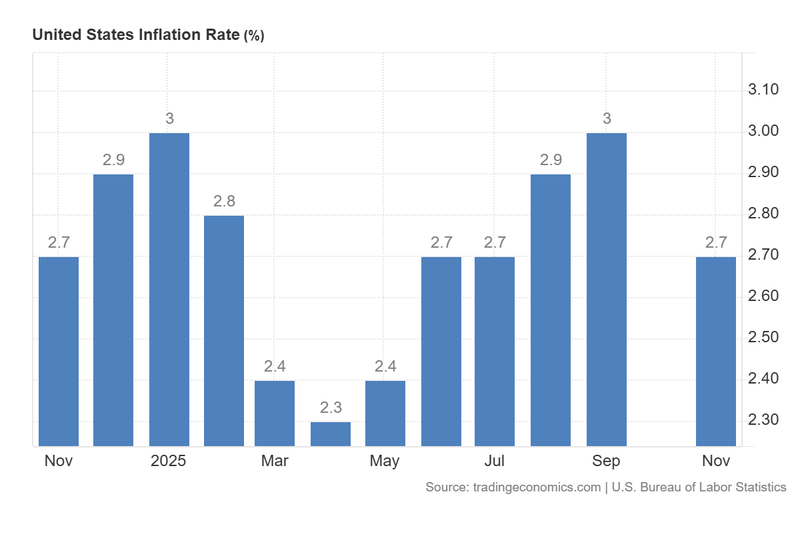

US headline inflation fell to 2.7 per cent year-on-year and core PCE-aligned measures eased to 2.6 per cent, the weakest core read since April 2021.

The Bank of England reduced Bank Rate to 3.75 per cent, but signalled that further easing will depend on incoming data.

The ECB left its policy rate unchanged at 2.15 per cent, emphasising resilience in the euro-area economy and a meeting-by-meeting approach.

US equities rallied: the S&P 500 and Nasdaq-100 led gains as 10-year yields eased and the dollar gave up some strength.

US markets rise amid a material deceleration in inflation rates

Data from the Bureau of Labor Statistics showed a notable slowdown in US inflation. The headline rate eased from 3.0 per cent (September) to 2.7 per cent (November), below consensus forecasts of c. 3.1 per cent. Core inflation — excluding food and energy — fell to 2.6 per cent, the lowest core reading since April 2021. (The October CPI release remained omitted owing to data collection issues associated with the government shutdown.)

Markets interpreted the softer prints as strengthening the case for lower policy rates next year. The CME Group’s FedWatch Tool continues to reflect significant odds of policy easing in 2026; market pricing currently implies the possibility of two 25-basis-point cuts, even as the Federal Open Market Committee’s own projections indicated a more modest easing path.

Whilst the most recent inflation data represents a favourable development for the United States and the Federal Reserve, the forthcoming readings for December and January remain pivotal for the central bank’s policy deliberations. Given that the government shutdown could have distorted previous data sets due to irregularities in collection and methodology, a rigorous assessment of the current months is essential to mitigate any statistical anomalies.

Following the releases, US equities advanced: the S&P 500 rose 0.79 per cent to 6,774, the Dow Jones gained 0.14 per cent to 47,951, and the Nasdaq-100 appreciated 1.51 per cent to 25,019. Concurrently, 10-year Treasury yields fell three basis points to 4.124 per cent, and the Dollar Index (DXY) was largely unchanged at 98.41.

Figure 1. United States inflation rate (year-on-year). Source: Bureau of Labor Statistics; Figure obtained via Trading Economics.

BoE cuts rates but stresses data dependence and uncertainty

The Bank of England decided to reduce its benchmark interest rate by 25 basis points, lowering it from 4 per cent to 3.75 per cent in accordance with market consensus. This decision was framed by a shifting macroeconomic backdrop: the labour market continues to show signs of softening, with the unemployment rate maintaining an upward trajectory to reach 5.1 per cent in October. Conversely, headline inflation exhibited a notable deceleration in November, retreating from 3.6 per cent to 3.2 per cent—the most temperate reading since April 2025. This combination of cooling price pressures and a deteriorating employment outlook provided the necessary impetus for the Monetary Policy Committee (MPC) to apply this cut.

However, the central bank signalled that the pace of future monetary easing may become more measured. The internal divide within the MPC remains pronounced, as evidenced by a narrow 5–4 vote split. Dissenting members expressed concern that domestic inflation remains uncomfortably elevated—the highest among developed economies—warranting a more cautious approach. Furthermore, the BoE is navigating a complex global landscape; both the European Central Bank and the Federal Reserve have indicated a potential pause in their respective easing cycles, with the latter anticipating only a single rate reduction throughout 2026.

In terms of market response, the British Pound saw a marginal appreciation of 0.03 per cent against the US Dollar, trading at 1.3383. Meanwhile, the FTSE 100 index rose by 0.65 per cent to 9,837. This equity rally reflects a positive sentiment towards lower borrowing costs, which are expected to alleviate financial pressures on the private sector and bolster the viability of new capital projects.

ECB holds rates and reiterates meeting-by-meeting approach

The European Central Bank maintained its deposit rate at 2.15 per cent, in line with market expectations. President Christine Lagarde characterised the euro-area economy as resilient to external shocks and reiterated that policy decisions will remain data-dependent.

The ECB acknowledged both upside and downside risks in inflation rates — from global trade frictions to potential fiscal-driven price pressures — and signalled that it will evaluate incoming indicators before altering its stance.

The euro exhibited a very small appreciation following the decision, trading near $1.3381 as markets digested the divergence between a neutral ECB and more overt easing in the UK and (potentially) in the US next year.