US shutdown persists while gold prices surge higher

A failure to reach a bipartisan agreement in the US Senate has left the government shutdown in place, exacerbating uncertainty and prompting investors to seek safe havens. Gold futures rose to a new record, while major US equity indices declined amid concerns.

Bipartisan talks in the US Senate failed, leaving the government shutdown ongoing and prolonging uncertainty over the release of official economic data.

Gold futures (GCZ5) exceeded $4,300 per ounce, supported by trade tensions, the unresolved shutdown and expectations of Federal Reserve rate cuts.

US crude inventories rose for a third consecutive week above analysts’ forecasts; Brent (BRNZ5) and WTI (CLX5) traded at four-month lows.

Australia’s unemployment rate increased by 20 basis points to 4.5 per cent, exceeding expectations and marking its highest reading since November 2021.

The US shutdown remains in effect with no immediate prospect of resolution

CNBC reported that the US Senate was unable to agree a resolution to end the government shutdown after a Republican bill was rejected on a party-line vote. Although the impasse is a domestic political matter, markets are sensitive because a prolonged shutdown delays the publication of official economic indicators that are material to the Federal Reserve’s policy deliberations.

Market pricing currently assigns a high probability—around 96 per cent—of a 25-basis-point cut at the October meeting, according to the CME Group’s FedWatch Tool. In this environment, investors are increasingly turning to private-sector data to infer labour-market conditions; several such indicators (for example, ADP employment change) have signalled weakness, but official releases are widely regarded as essential for policy decisions.

During the week, Fed Chair Jerome Powell declared that FOMC members have not seen material changes in incoming data and noted that quantitative tightening could end in the near term, reinforcing expectations of an eventual shift towards looser policy. Nevertheless, relying on partial or private data in the absence of official statistics introduces additional risk to policy formulation. Commercial tensions between the US and China—heightened in advance of a planned presidential meeting at the end of October—further add to uncertainty.

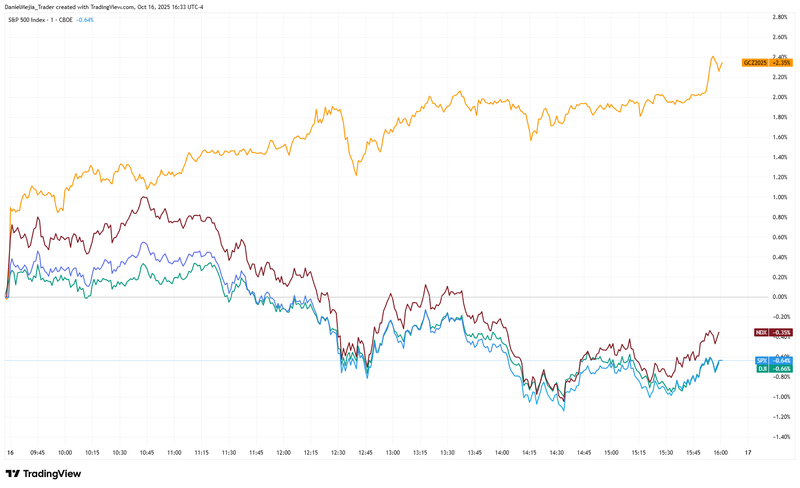

At the market close, major US indices weakened: S&P 500 decreased 0.63 per cent to 6,629 points, Nasdaq-100 fell 0.36 per cent to 26,657, and the Dow Jones declined 0.65 per cent to 45,952. By contrast, the COMEX gold contract rose approximately 3.03 per cent, surpassing $4,300 per ounce as investors sought refuge.

Figure 1. Market close of S&500, Nasdaq100, Dow Jones, and Gold future contract. Source: data from NYSE Exchange, Nasdaq Exchange, and COMEX Exchange. Own analysis conducted via TradingView.

Why the end of the shutdown matters

The Federal Reserve has repeatedly emphasised that its decisions are data-dependent and grounded in official statistics. A government shutdown that impedes the timely release of employment, inflation and other macroeconomic data complicates the Fed’s ability to form a clear view of the economy. If policymakers were forced to rely predominantly on private-sector indicators, their assessments might be less robust, with potential implications for credibility and the perceived independence of the central bank.

Private data are valuable as a complement to official releases but are generally not a substitute for them when making monetary-policy decisions. Perceived compromises to central-bank independence or to the quality of the information informing policy could amplify market volatility.

Gold attains a new record amid political and trade uncertainty

The COMEX gold future contract (GCZ5) reached a new high, rising roughly 3.03 per cent to around $4,329 per ounce and recording an approximate year-to-date gain of 61 per cent. Elevated geopolitical and commercial tensions—including recent US criticisms of China’s expanded rare-earth export controls, which the White House described as a threat to global supply chains—together with the unresolved US shutdown and market expectations of Fed rate cuts, supported demand for gold as a safe asset.

Market participants currently price a high probability of a 25-basis-point cut at the next Fed meeting, with consensus expecting two further 25-basis-point reductions by December and January.

US crude inventories record a third consecutive weekly build

The US Energy Information Administration reported crude inventories rising by 3.524 million barrels, above analysts’ expectations of a 0.12 million-barrel build. This was the third consecutive weekly inventory increase exceeding forecasts.

A Reuters analysis cited the International Energy Agency’s warning of a potential global supply surplus in 2025–26, while OPEC+ has signalled plans to increase production from November 2025, compounding oversupply concerns. Brent (BRNZ5) and WTI (CLX5) futures fell in parallel—down approximately 1.34 per cent and 1.30 per cent respectively—settling near four-month lows. Brent closed at about $61.12 per barrel and WTI at roughly $57.52 per barrel.

Australia’s unemployment rate rises above expectations

The Australian Bureau of Statistics reported that the unemployment rate rose by 20 basis points to 4.5 per cent, above consensus expectations of 4.3 per cent and the highest reading since November 2021. In response, the Australian dollar depreciated by approximately 0.38 per cent against the US dollar to 0.6484.

If you're interested in trading commodities or currencies, you can explore the contracts offered by Equiti Group.