Yen falls ahead of UK budget review and RBNZ rate move

A quiet Asia session left the yen’s late-week bounce without follow-through, as BoJ delay bets, UK fiscal risk, an RBNZ cut, and a heavy US data backlog shaped the week’s opening tone.

Yen gives back gains with Japan on holiday; BoJ hike seen slipping into early 2026

UK Autumn Budget is a credibility test for gilts, equities, and sterling

RBNZ expected to cut 25 bps, with a slim risk of 50 bps given the long gap to February

Yen stalls as policy expectations lean against it

With Tokyo closed, Asia trading was subdued and the yen’s sharp rebound late last week lost steam. The pause reflects a familiar tug-of-war: some positioning argues for corrective strength, but the broader policy backdrop still leans against the currency. Markets increasingly price the risk that the Bank of Japan’s next hike slips into early 2026, a delay shaped as much by domestic politics as macro fundamentals.

Source: Tradingview

Early signals from the next Shuntō round show the main labor confederation pushing again for 5%-plus pay hikes in 2026—echoing this year’s outsized gains. Tight labor markets and a competitive yen support wage momentum, even as the government worries that premature tightening could undercut the recent ¥17.7 trillion stimulus package.

UK Autumn Budget: Credibility on the line

The UK’s budget looms as the key domestic test. Gilts, equities, and sterling will hinge on whether fiscal plans balance consolidation with growth support. A misstep risks a confidence shock in the bond market; a credible path could steady term premia and give sterling some breathing room.

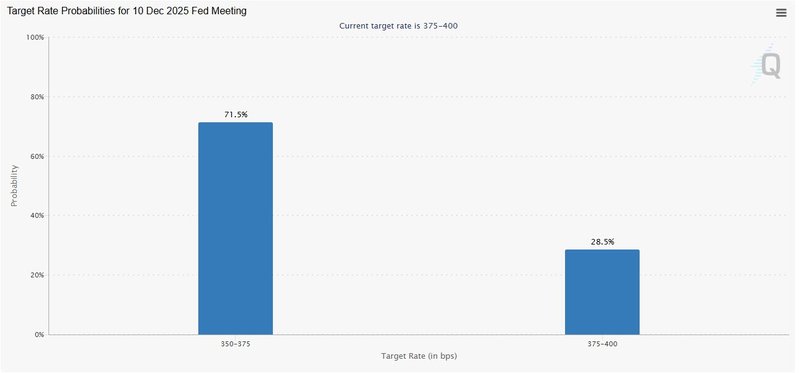

Fed watch: Caution into December

From the US, recent public remarks from a Federal Reserve regional president signaled “reasons to be hesitant” about another cut on December 9–10. The message: policy is now mildly restrictive, inflation is still above target, and labor data show softening—raising two-sided risks around the mandate. The Committee’s spectrum of views remains unusually wide, reinforcing data dependency into year-end.

Source: CME Group

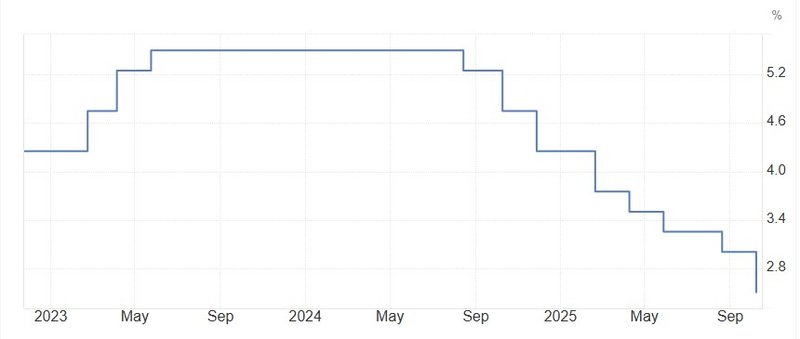

RBNZ: Baseline 25 bps cut, tail risk 50

The Reserve Bank of New Zealand is widely expected to lower the OCR by 25 bps to 2.25%, extending its easing cycle amid a deteriorating domestic backdrop. The complication is timing: the next meeting isn’t until February, creating a long gap that argues—at the margin—for front-loading. While the base case stays 25 bps, a 50 bps surprise can’t be dismissed. This is also the final meeting overseen by the acting governor before leadership formally changes on December 1, which may influence how finely the signal is calibrated.

Source: Tradingeconomics

Data catch-up: The heaviest US slate in weeks

With the US government reopened, a backlog of indicators returns. Markets will parse retail sales, PCE inflation, durable goods, and regional surveys to gauge momentum into Q4. In Europe and Asia, Germany’s Ifo and CPI flash, Switzerland and Canada GDP, Japan Tokyo CPI, and Australia’s monthly CPI round out a dense calendar. ECB meeting accounts should reinforce the message that policy and inflation are broadly “in the right place” for now, while the Fed’s Beige Book will be combed for tariff pass-throughs and labor-market tone.