Canadian dollar appreciates amid improved employment data

The Canadian Dollar (CAD) registered significant appreciation following better-than-expected results from the domestic labour market.

The unemployment rate recorded a notable decline in November, falling from 6.9 per cent to 6.5 per cent, thereby improving the country's employment landscape.

Net employment change recorded 53,600 new jobs, a figure considerably above market consensus.

The Canadian Dollar closed the session with an appreciation of approximately 0.90 per cent, supported by the strengthened employment data.

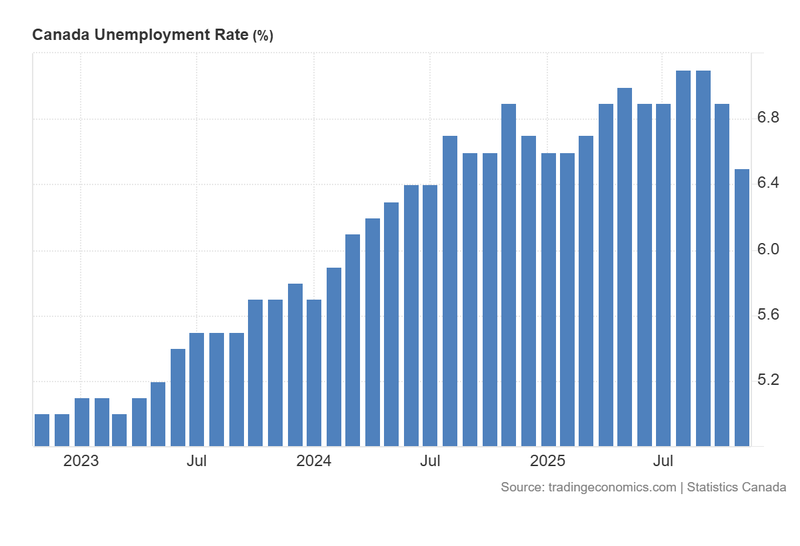

Canadian unemployment rate registers significant decline in November

According to data from Statistics Canada, the unemployment rate experienced a significant decrease from 6.9 per cent to 6.5 per cent, falling below the analyst estimate of 7 per cent. Furthermore, employment change recorded an increase of 53.6K (compared to the previous 66.6K), coming in considerably above analysts' expectations, which had forecasted a contraction of 5K.

According to the report, the primary improvement was driven by youth employment (+1.8 per cent). Sector-wise, the industries contributing most to job creation were natural resources (+3.4 per cent), healthcare and social assistance (+1.6 per cent), and accommodation and food services (+1.2 per cent). Conversely, job losses were recorded in the wholesale and retail trade sectors (-1.1 per cent).

The figure 1 illustrates that the unemployment rate in Canada has seen a substantial decline from the September peak of 7.1 per cent to the current value of 6.5 per cent in November. While the trend in the unemployment rate over the last three years has been distinctly upward, current performance suggests a potential structural shift. It will be crucial to monitor the Canadian labour sector in the coming months to determine whether these indicators signal sustained improvement or if weakness returns in subsequent periods.

Regarding the market reaction, the Canadian Dollar demonstrated a significant appreciation of approximately 0.90 per cent, attributed primarily to the strength of the employment data and concurrent weakness in the US Dollar.

Figure 1. Canada Unemployment Rate (2023-2025). Source: Data from Statistics Canada; chart obtained from Trading Economics.

Technical analysis of the USD/CAD pair

From a technical perspective, the USD/CAD pair is currently respecting an upward trendline acting as resistance, whilst simultaneously breaking below its long-term moving averages. Key observations include:

- Trend context. In the long term, the USD/CAD pair is respecting an ascending trendline that is now acting as dynamic resistance. The price is crossing below its long-term moving averages (50, 100, and 200 periods), marked by a bearish engulfing candlestick. Furthermore, the MACD and RSI indicators are signalling a strengthening bearish impulse.

- Resistance levels. Should the short-term resistance at 1.4122 be breached to the upside, the next significant ceiling corresponds to the level of 1.4388. A decisive break above these levels would suggest the potential for an extension into higher price zones.

- Support levels. If the short-term support at 1.3740 is broken to the downside, the next relevant floor is located at 1.3550 (a structural medium-term support). A loss of the 1.3550 zone would increase the probability of a deeper market correction.

- Momentum indicators. Both the MACD and RSI indicators are evidencing a strengthening bearish impulse. Additionally, the MACD is displaying a bearish divergence in the short term.

Figure 2. USD/CAD pair (2024-2025). Source: Own analysis conducted via TradingView.