Canadian dollar recovery signs

The Canadian dollar has shown resilience this week, even as the U.S. dollar remains sensitive to incoming U.S. data. USD/CAD traders are watching oil moves that directly affect the Canadian dollar’s terms of trade, Canada domestic data, Bank of Canada positioning, and U.S. macro surprises, including the delayed PCE inflation print. The net result has been choppy price action in USD/CAD, with the pair trading in a tight but decisive range for now.

Productivity data show a 0.9% QoQ increase.

Yield differential between U.S. and Canadian debt: U.S. Treasuries remain more attractive to investors.

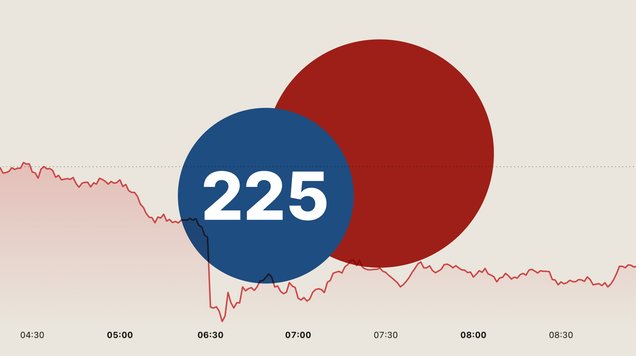

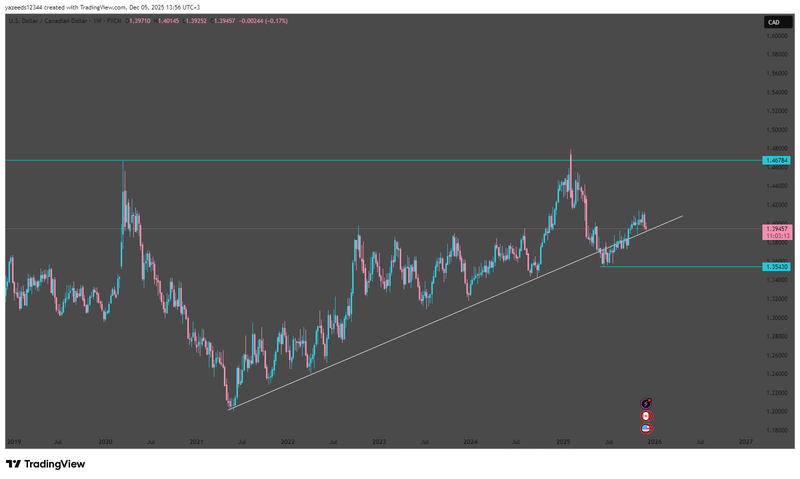

USD/CAD technical outlook.

USD is pressuring CAD

The Canadian dollar has recently gained attention as it strengthened against the U.S. dollar, reflecting a combination of domestic economic strength and favorable global commodity trends. Productivity data showed a 0.9% quarter-on-quarter increase, reversing a previous contraction. This positive signal, coupled with rising oil prices, has provided strong support for CAD. CAD started to gain momentum against USD after reaching a five-week high, trading around 1.3925. These moves reflect the belief that CAD remains undervalued and that medium-term fundamentals could support a recovery.

What’s holding CAD back

One key challenge is the yield differential between U.S. and Canadian debt. U.S. Treasuries remain relatively more attractive to investors, which tends to draw capital toward the USD and exert pressure on the CAD. Additionally, the Bank of Canada’s recent rate cut to 2.25%, the lowest in three years, has reduced the currency yield appeal compared to the U.S. dollar. That initially caused USD/CAD to rally toward 1.47884, but when talks began about the U.S. starting QE and a rush in rate cuts, the pair started a downward movement. Also, the USD has lost some momentum. From a technical viewpoint, USD/CAD is near a critical level 1.35430; if the price breaks it, we could see bearish momentum become stronger, and confidence in CAD will regain.

Source: Trading View

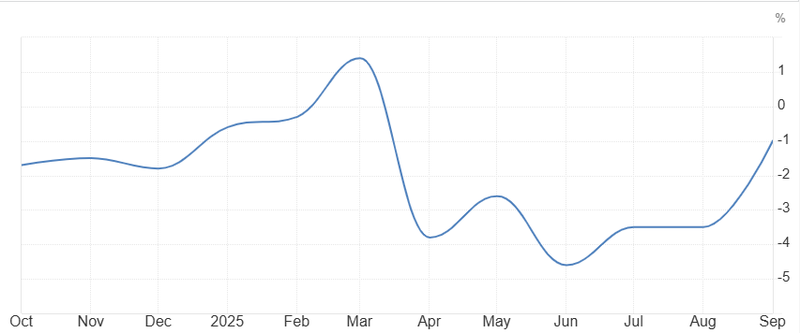

Recovery Signs in Manufacturing

Even though Canadian manufacturing production is still contracting, the slowdown from -4.5% to -1% is a positive signal for the economy and the CAD. A smaller contraction indicates that the sector is stabilizing and may be approaching a recovery, which can boost investor confidence. A slowing contraction may influence the Bank of Canada to maintain or tighten monetary policy sooner, making the currency more attractive. Overall, a deceleration in decline is viewed as a signal of recovery, supporting the CAD even before growth turns positive.

Source: Statistics Canada