DAX rises amid expansion in manufacturing PMI

The DAX index appreciated by 0.87% following the release of the HCOB Manufacturing PMI, which indicated an expansion for the first time since June 2022. This development suggests a potential recovery in German industrial activity.

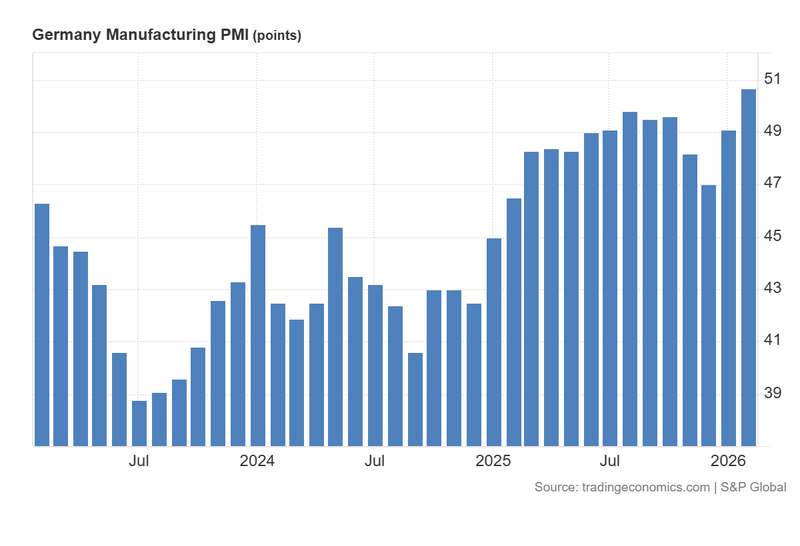

The HCOB Manufacturing PMI rose to 50.7, signaling expansionary conditions after a protracted period of contraction dating back to mid-2022.

The HCOB Services PMI was updated to 49.6, exceeding analyst expectations and indicating a marginal recovery within the sector.

The DAX 40 index maintains its long-term bullish trajectory, while short-term momentum indicators—specifically the MACD and RSI—demonstrate strengthening upward pressure from neutral zones.

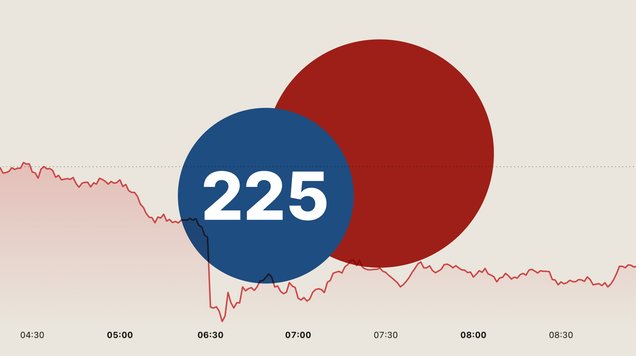

German manufacturing PMI signals expansion for the first time since June 2022

According to data from S&P Global, the HCOB Manufacturing PMI entered expansionary territory in February, reaching 50.7. This figure represents a significant increase from the previous reading of 49.1 and surpassed the consensus analyst forecast of 49.5. This marks the first time the index has risen above the 50.0 threshold since June 2022, providing a positive outlook for German industry, which has been hampered by various economic headwinds over the past few years. Furthermore, the HCOB Services PMI climbed from 48.4 to 49.6 over the same period. While a reading below 50 still indicates contraction, the result was notably higher than the analyst estimate of 49.2.

As a result, the DAX 40 index closed 0.87% higher at 25,260 points. This rally reflects improved market sentiment as investors respond to leading indicators suggesting a meaningful recovery in German industrial output.

Figure 1. Germany Manufacturing PMI (2023–2026). Source: Data from S&P Global; Figure obtained from Trading Economics.

Technical analysis of the DAX index

From a technical standpoint, the DAX continues to adhere to a long-term bullish trend. The following key observations detail the current market structure:

- Trend Context: The index remains in a long-term uptrend, characterised by a sequence of "higher highs" and "higher lows". It continues to trade above its 50, 100, and 200-day moving averages. In the short term, momentum indicators are trending upwards, suggesting that the current bullish impulse remains intact.

- Resistance Levels: Should the current record high of 25,420 be breached, the next significant technical target is identified at 26,150 (derived from a rectangle pattern projection). A sustained move above this level would signal an extension of the bull market into uncharted territory.

- Support Levels: In the event of a pullback, the 24,500 level (situated near the 100-day moving average) serves as immediate support. If this is invalidated, the next significant floor is located at 23,150. A decisive breach of the 23,150 area would heighten the probability of a deeper market correction.

- Momentum Indicators: Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are rising from neutral levels, suggesting that the upward momentum could have further room to develop.

Figure 2. DAX index (2024–2026). Source: Data from the Xetra Stock Exchange; Own analysis conducted via TradingView.