Euro-Dollar’s $1.20 test is still on the table — but the euro needs proof

A move in euro-dollar toward $1.20 and beyond remains a plausible 2026 scenario, but the market is not paying up for it yet. The pair’s sticky trade around $1.18 is signaling fading dollar-bear conviction and an absence of a clean euro catalyst. To unlock the next leg higher, traders likely need economic validation — a clearer euro-area growth turn, a supportive relative-rate story, or a structural tailwind tied to fiscal integration.

Euro-dollar is stuck near $1.18, reflecting weaker USD-bear momentum and limited euro drivers.

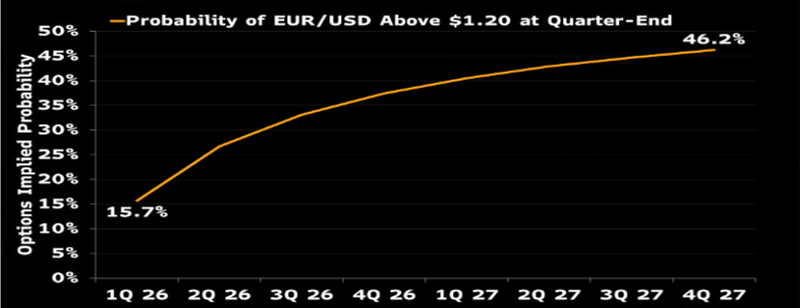

Options markets still assign meaningful odds of $1.20 later in 2026, with probabilities rising into 2027.

Relative rates remain the most coherent euro support case: Fed cuts vs. an ECB that may be near done.

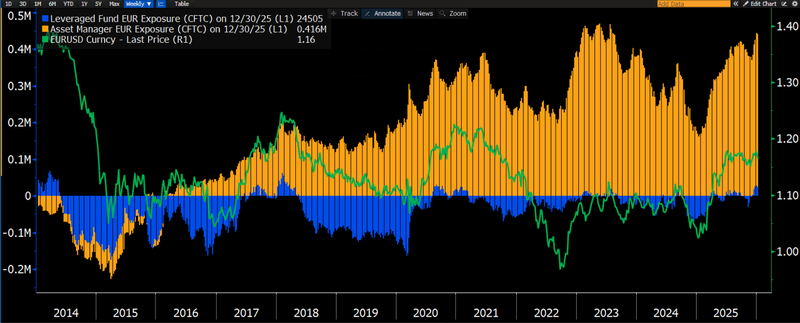

Positioning is increasingly stretched on the long-euro side, raising the risk of pullbacks without a fresh trigger.

Why $1.20 is feasible — and why it’s not “free money”

The macro argument for a higher euro in 2026 is straightforward: if cyclical momentum and yield differentials reassert themselves as the dominant G10 drivers, a dovish Fed path can keep the dollar on the defensive. That said, price action has been uncooperative. The euro has struggled to break decisively beyond the $1.18 area, and that “stickiness” reads like a market that wants more than theory — it wants evidence.

Technically, the near-term chart isn’t a tailwind either. With support cited around $1.15, the euro is not far from a zone where a weaker run of data could quickly turn a slow grind into a deeper retracement.

Source: TradningView

Options markets: the $1.20 trade is alive, not dominant

FX options are still keeping the $1.20 narrative on life support — and not in a small way. As of Jan. 8, implied probabilities for euro-dollar trading above $1.20 rise through 2026: 15.7% by end-1Q, 26.7% by end-2Q, 33.1% by end-3Q, and 37.4% by end-4Q. Those odds climb further into 2027, reaching the mid-40% range by year-end.

Source: Bloomberg

Markets don’t see $1.20 as a base case, but they do see it as a material tail risk — the kind that stays in play as long as the Fed easing story doesn’t die.

The growth narrative: the euro needs a macro reason, not a slogan

Dollar direction in 2026 still runs through US growth and inflation, especially after recent data disruptions. Consensus expectations cited put US growth at about 2% in 2026, after 2% in 2025, with risks potentially tilted higher given easing financial conditions, fiscal support, and wealth effects.

But euro-dollar is a relative game, not an American monologue. The euro-area’s ~1.2% 2026 growth consensus becomes crucial: any upward revisions — or even a cleaner run of data that improves confidence — would validate a less-dovish ECB stance and give euro bulls something sturdier than wishful thinking.

Yields: the cleanest euro support case — and it may be partly priced

For now, the most compelling “real” driver for euro bulls is the relative policy path. The framing is simple: the ECB looks closer to done, while the Fed has room to cut toward a more neutral zone. That should, in theory, narrow euro-US front-end yield differentials and lean supportive for EUR/USD over time.

Pricing referenced shows the market looking for about 69 bps of Fed easing by year-end, while ECB rates are seen near 2% through 2026. The euro-US two-year yield differential near -137 bps versus a 4Q low around -162 bps suggests the relative-rate story has already moved in the euro’s favor — and that’s the catch. If the yield narrative is increasingly “known,” EUR/USD may need the growth narrative or a structural catalyst to do the heavy lifting from here.

Geopolitics: headline noise, unless Europe changes the fiscal structure

Early-2026 geopolitical risk hasn’t left much of a footprint on euro-dollar — consistent with the idea that these shocks are often treated as local and episodic rather than regime-changing for medium-term G10 direction.

Still, geopolitics can matter indirectly through fiscal channels. Defense spending is rising as a priority across both the US and Europe, and that reframes medium-term debt dynamics. A potential euro-positive inflection point would be joint EU debt issuance to finance defense — a structural change that could alter the euro’s long-term scarcity and credibility premium. That’s not the base case, but it’s the kind of catalyst that would make $1.20 feel less like a stretch target and more like a destination.

Positioning: longs are crowded, upside needs a new spark

Positioning adds another constraint. Leveraged funds are running small euro overweights, and asset managers’ longs are described as stretched to highs not seen since mid-2023. The figures cited show, as of Dec. 30, 2025: leveraged funds +24,505 contracts versus -55,231 a year earlier, while asset managers were +416,483 versus +161,474.

Crowded longs don’t kill a trend — but they do make it fragile. Without a fresh driver, positioning can turn a routine dip into a sharper unwind, and it makes “grinding higher” harder when marginal buyers are already in.

Source: Bloomberg