Gold breaks the $5,000 psychological barrier amid safe-haven demand

The Gold futures contract (GCG26) has surpassed the prominent $5,000 psychological level for the first time. The precious metal is rallying due to a confluence of factors, most notably safe-haven demand from investors, mounting concerns regarding the Federal Reserve's independence, and a weakening US dollar.

Gold futures rose by 2% to breach the $5,000 barrier, bringing the precious metal’s accumulated return over the past twelve months to an impressive 82%.

Persistent safe-haven inflows, anxiety surrounding the Fed’s autonomy, and the depreciation of the US dollar are collectively exerting positive pressure on gold prices.

The primary trend remains bullish; however, momentum indicators suggest the asset is currently trading in overbought territory.

Gold futures contract surpasses $5,000, a prominent psychological barrier

Gold futures have rallied significantly, driven by safe-haven demand amidst heightened geopolitical uncertainty. A combination of factors is positively impacting prices, including global instability, growing scepticism regarding the US dollar, and expectations of monetary easing for the current year. Consequently, gold has accumulated a return of approximately 82% over the past twelve months.

Regarding the latest geopolitical developments, US President Donald Trump declared over the weekend that he would impose a 100% tariff on Canada should it continue to pursue a trade deal with China. Gold prices typically rise during periods of escalating geopolitical, commercial, or economic tension as investors seek to hedge against volatility.

Concurrently, the Federal Reserve is set to determine its monetary policy this week. According to the CME FedWatch Tool, probabilities indicate the central bank will maintain interest rates at the current level of 3.75%. However, market participants are closely monitoring how pressure from the White House on Federal Open Market Committee (FOMC) members might influence their future policy stance, increasing market uncertainty.

In the currency markets, the US Dollar Index (DXY) fell by 0.42% to 97.05 points, its lowest level since September 2025. The dollar is facing increasing downward pressure due to several factors. Two of the most significant are rising global distrust in the currency—stemming from dissatisfaction with current US foreign policy implementation—and speculation regarding a potential intervention in the Japanese yen, which has appreciated by 2.6% over the last three days. A weaker dollar generally stimulates demand for gold, as the metal becomes more affordable for holders of other currencies.

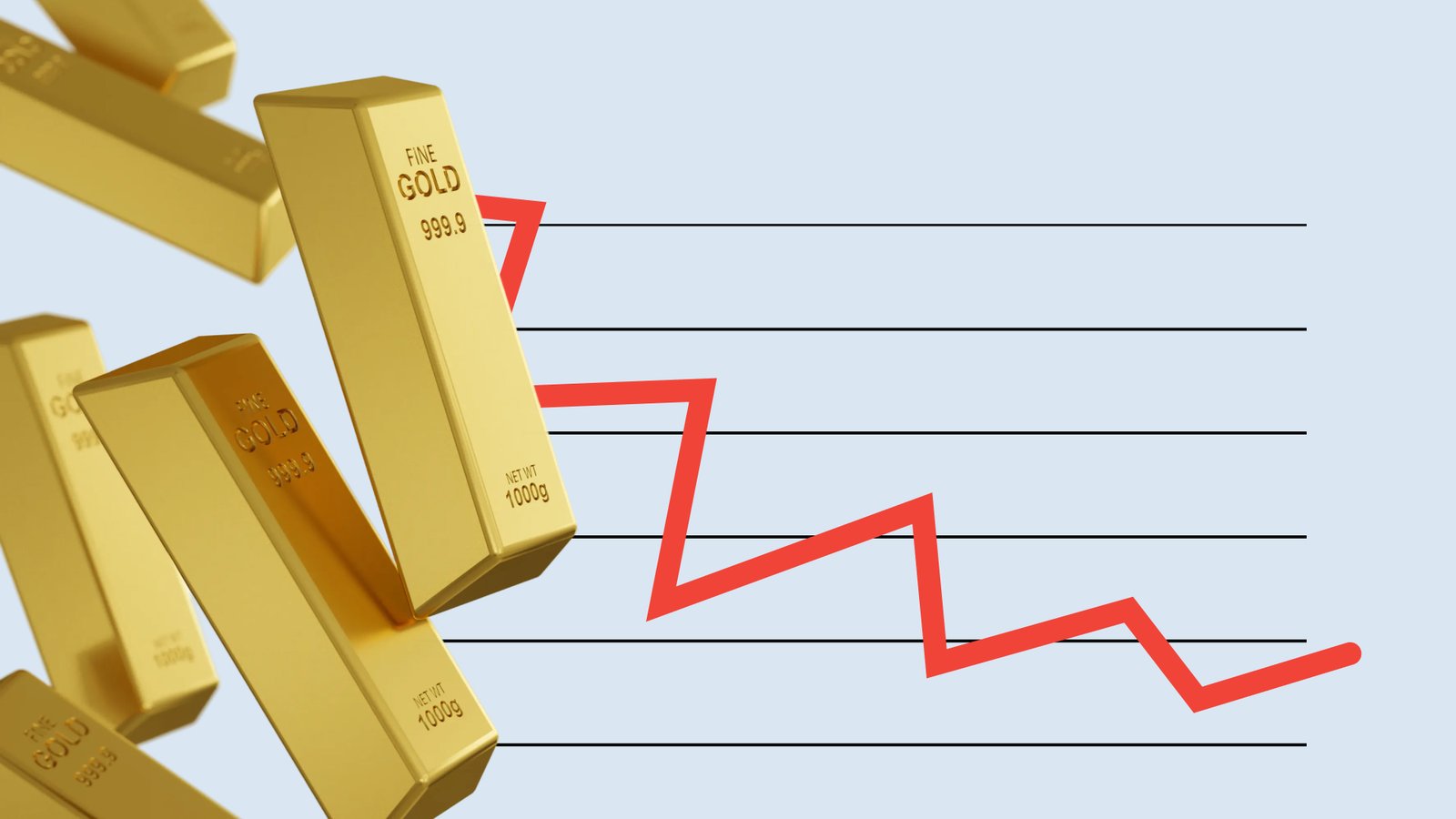

Technical analysis of gold

From a technical perspective, gold futures maintain a robust long-term bullish trajectory. A detailed analysis of the current market structure reveals several key observations:

- Trend Context: On daily timeframes, gold exhibits a clear market structure defined by a series of "higher highs" and "higher lows". Prices remain significantly above the primary 50, 100, and 200-period moving averages, confirming the underlying strength of the current trend.

- Resistance Levels: Should the $5,100 psychological barrier be breached, the next significant technical ceiling is identified at $5,200 (the next psychological level). A sustained move above these levels would signal a potential extension into uncharted price territory.

- Support Levels: In the event of a pullback, immediate short-term support sits at $4,560. If this level is invalidated, the next structural floor is located at $4,375 (a medium-term support). A breach of the $4,375 zone would heighten the probability of a major market correction.

- Momentum and Volume: Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) exhibit increasing upward pressure; however, both are currently trading in overbought territory. Meanwhile, the Volume Profile and contract volumes indicate that demand remains consistent, suggesting that fundamental hedging requirements are supporting the price action.

Figure 1. Gold Future Contract GCG26 (2024–2026). Source: Data from the COMEX Exchange; own analysis conducted via TradingView.