Gold hits record High as Fed policy and ETF demand drive rally

Gold reached record levels, surpassing $4,400 per ounce, a milestone that underscores growing investor interest and a mix of economic and geopolitical factors. This rally is being driven by several intertwined trends, with expectations around U.S. Federal Reserve policy and strong inflows into gold-backed ETFs playing central roles.

Fed has eased interest rates multiple times and markets expect further cuts in 2026.

Largest semi‑annual inflows since early 2020, with net inflows of about $38 billion.

Analysts expect new record at 4,400.

Structural demand from central banks and investors

One of the main reasons gold has soared is the market’s reading of Federal Reserve policy. In 2025, the Fed has eased interest rates multiple times and markets expect further cuts in 2026. Lower interest rates reduce the opportunity cost of holding gold, which does not pay dividends or interest. Investors see gold as an attractive alternative to bonds and cash when real yields are low or negative, meaning the return on holding cash after adjusting for inflation is minimal or even negative. The recent moderation in U.S. inflation, with consumer prices easing from earlier projections, has reinforced the view that the Fed can maintain a loose monetary stance for longer. This combination of softer rates and persistent inflation risk has made gold a preferred store of value for investors seeking protection against currency debasement and economic uncertainty. Geopolitical tensions also contribute to gold’s safe-haven appeal. Global trade and political risks have pushed investors toward assets that are less exposed to economic volatility. Gold, historically regarded as a secure store of wealth, benefits directly from these fears. Even when global stock markets fluctuate, gold provides an alternative that many traders and institutions rely on to preserve capital during uncertain times. Another important factor supporting the rally is structural demand from central banks and institutional investors. Many central banks around the world, including those in emerging markets, have increased their gold reserves as part of efforts to diversify away from fiat currencies and mitigate exchange-rate risks. This long-term, consistent buying has reduced the available supply of gold for other investors, helping maintain upward pressure on prices. Unlike short-term trading, these purchases reflect strategic thinking and are not easily reversed, providing stability and sustained demand for gold over time.

ETF Inflows a major catalyst for the rally

A major force behind gold’s record rally in 2025 has been the extraordinary demand pouring into gold‑backed exchange‑traded funds (ETFs), which allow investors to gain exposure to physical gold without holding the metal directly. This shift in investor behavior has added significant new liquidity to the gold market and has been one of the clearest indicators of sustained interest in precious metals this year. Data tracked by the World Gold Council, which monitors holdings and movements in gold ETFs globally, shows that inflows into these funds have increased substantially in 2025, bringing overall holdings near levels not seen since before the pandemic. By mid‑December 2025, global gold ETF total holdings had climbed to their highest point since late 2022, bringing total aggregated gold in ETF vaults back toward long‑term peaks. The pattern of flows tells a consistent story of strong investor confidence. Over the first half of the year, gold‑backed funds attracted some of the largest semi‑annual inflows since early 2020, with net inflows of about $38 billion globally, lifting total assets under management in these funds to around $383 billion and adding roughly 397 tonnes of gold to ETF holdings. Regional data highlights where much of this demand has come from. North American ETFs, such as the SPDR Gold Shares (GLD) and the iShares Gold Trust, were among the most active, drawing substantial contributions to overall flows. In North America alone, inflows totaled over $870 million for SPDR Gold Shares and more than $200 million for smaller funds like SPDR Gold Mini Shares Trust in recent reporting periods, adding tens of tonnes of gold to ETF reserves. These inflows have been consistent enough to push total physical gold held by ETFs higher month after month, even as price volatility rose. Increased ETF demand has helped lift combined ETF gold holdings closer to levels last seen when global economic uncertainty was at its peak in 2020. ETF inflows matter because every unit created typically corresponds to physical gold purchased and stored by the fund. This means that strong ETF flows reduce the available supply of gold in the open market and shift more metal into long‑term investment holdings. Unlike futures trading or speculative flows, these funds hold real gold in vaults, which supports the physical market and reinforces upward price pressure.

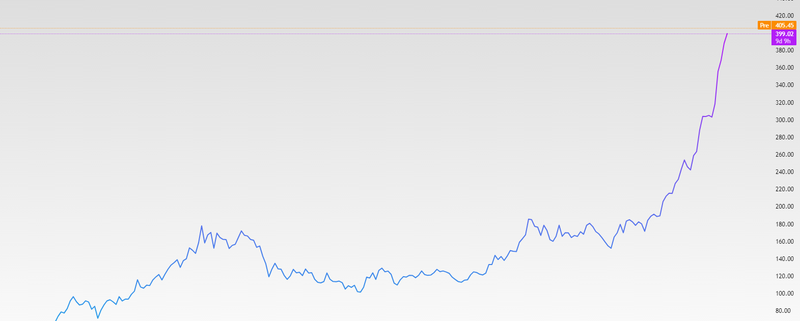

Source: Trading View

Analysts predicting a new record high near $4,650

The recent rally from $4,200 to $4,400 is viewed through Elliott Wave analysis as part of a Sub-wave 5 of (3). The Relative Strength Index (RSI) has moved into overbought territory. While overbought conditions can sometimes suggest a temporary pause in momentum, they can persist for extended periods during strong uptrends and do not necessarily indicate an immediate reversal. Based on Elliott Wave principles, there is a possibility of a consolidation or retracement phase corresponding to Wave 4. Analysts often observe the 0.382 Fibonacci retracement level or the area of the previous fourth wave of a smaller degree as potential reference points, which in this case falls around $4,150–$4,200. If the market progresses following this structure, a subsequent impulsive leg, identified as Wave (5), could extend further. Using a 1.618 projection of the prior move or extending Wave 1 from a hypothetical Wave 4 base suggests a theoretical range between $4,650 and $4,800.

Source: Trading View