Japanese yen rises on BoJ stance and intervention speculation

The Japanese yen closed with a significant appreciation as the Bank of Japan (BoJ) maintained its neutral-to-hawkish policy outlook. This movement was further bolstered by intense market speculation regarding a potential currency market intervention by the Ministry of Finance (MoF) to support the yen.

The Japanese yen surged 1.71% against the US dollar, reaching ¥155.66, driven by expectations of official intervention.

Despite Japanese inflation decelerating to 2.1% in December, the Bank of Japan elected to hold interest rates steady at 0.75%, while signalling a readiness to tighten further if necessary.

While the USD/JPY pair remains within a long-term consolidation range, short-term momentum indicators suggest increasing downward pressure.

Japanese yen closes with prominent appreciation amid BoJ stance and intervention rumours

The Japanese yen recorded a notable appreciation of 1.71% against the US dollar, settling at ¥155.66 by the market close. This atypical volatility appears to be driven by two primary factors: a shifting economic outlook that supports a restrictive stance from the Bank of Japan, and heightened speculation that the Ministry of Finance may be preparing to intervene in the foreign exchange market.

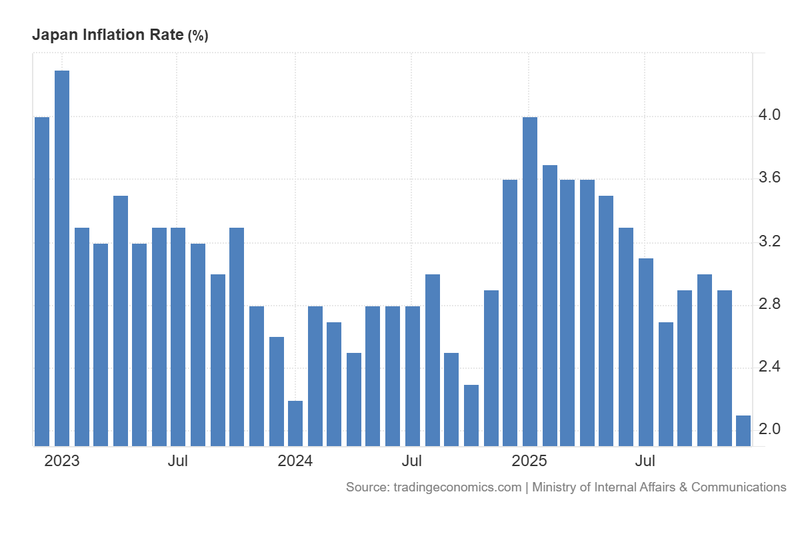

Data from Japan’s Ministry of Internal Affairs and Communications indicates that the year-on-year (YoY) inflation rate slowed significantly, falling from 2.9% in November to 2.1% in December—the lowest level recorded since April 2022. Furthermore, core inflation—which excludes volatile fresh food and energy costs—decelerated from 3.0% to 2.4%. Consequently, the BoJ found sufficient grounds to maintain its neutral-to-hawkish stance, leaving the benchmark interest rate unchanged at 0.75%. However, the central bank left the door open for further restrictive measures and higher interest rates should price stability remain elusive.

Simultaneously, market participants exerted strong supply-side pressure on the USD/JPY pair amid rumours of a central bank intervention to bolster the domestic currency. It should be noted, however, that the Ministry of Finance has not officially confirmed any such action.

Figure 1. Japan Inflation Rate (2023-2025). Source: Data from the Ministry of Internal Affairs & Communications of Japan; Figure obtained from Trading Economics.

Technical analysis of the USD/JPY pair

From a technical perspective, the USD/JPY pair is currently navigating a period of consolidation. Key observations include:

- Trend Context: In the long term, the pair is exhibiting a broad consolidation pattern, reflecting significant market indecision. While the medium-term trend remains technically bullish—defined by a sequence of higher highs and higher lows—short-term momentum indicators now signal growing strength in a downward (bearish) impulse.

- Resistance Levels: Should short-term resistance at ¥159 be breached to the upside, the next significant ceiling is identified at the historical peak of ¥161.50. A decisive break above this level would suggest the potential for further extension into higher price territories.

- Support Levels: If the short-term support at ¥154.50 is invalidated, the next critical floor is located at ¥151. This represents a structural pivot point situated close to the 200-day moving average. A breach of the ¥151 zone would significantly increase the probability of a deeper market correction.

- Momentum Indicators: The Moving Average Convergence Divergence (MACD) indicator exhibits a bearish divergence spanning several months. Additionally, the Relative Strength Index (RSI) is trending downwards, confirming the strengthening of short-term bearish momentum.

Figure 2. USD/JPY Pair (2024-2026). Source: Data from the Intercontinental Exchange (ICE); Own analysis conducted via TradingView.