Japanese yen softens despite BoJ’s restrictive policy shift

The Bank of Japan (BoJ) has adopted a restrictive monetary policy stance by raising interest rates to their highest level in three decades. Despite this hawkish pivot and the central bank’s reaffirmed commitment to its primary mandate of price stability, the Japanese Yen experienced notable volatility following the announcement.

The Bank of Japan increased its short-term interest rate from 0.5 per cent to 0.75 per cent in response to persistent inflationary pressures.

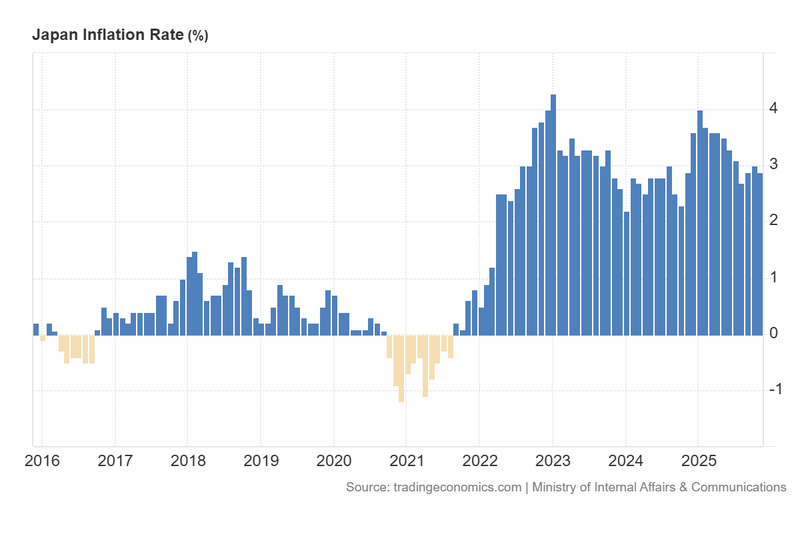

Japan's headline inflation currently stands at 2.9 per cent, with core inflation—excluding fresh food—tracking slightly higher at 3.0 per cent.

Following the market close, the USD/JPY pair rose by 1.45 per cent, marking a prominent depreciation of the Yen despite the BoJ’s restrictive measures.

BoJ raises interest rates citing inflationary pressures via unanimous vote

The Bank of Japan has elected to increase its benchmark interest rate from 0.5 per cent to 0.75 per cent, a move largely in alignment with market analysts' forecasts. This current level represents the highest interest rate environment in thirty years—a significant milestone in Japanese monetary history. The BoJ is endeavouring to anchor inflation expectations; the November release showed a headline rate of 2.9 per cent, notably above the central bank’s symmetric target of 2 per cent. It is particularly relevant to note that this policy shift was secured through a unanimous vote by the Board.

The central bank is navigating a complex economic landscape characterised by competing pressures. On one hand, persistent inflation necessitates tighter credit conditions; on the other, the Japanese government has announced an extensive fiscal stimulus package intended to bolster domestic growth. Nevertheless, the BoJ has emphasised that its primary focus remains the stabilisation of prices. Consequently, forthcoming updates to the economic outlook will be critical for decision-making within its established data-dependent framework.

Figure 1. Japan Inflation Rate (2016-2025). Source: Data from the Ministry of Internal Affairs & Communications of Japan; Figure obtained from Trading Economics.

Monetary outlook and market reaction

While the Japanese central bank has adopted a restrictive stance, it has refrained from providing explicit forward guidance regarding the timing of future movements. According to comments from BoJ Governor Kazuo Ueda, the wage momentum anticipated for the coming year could serve as the primary catalyst for further rate hikes. However, the data-dependent approach remains sensitive to elevated economic and geopolitical uncertainties worldwide.

Market participants have interpreted the BoJ’s latest decision as a definitive shift towards a more restrictive regime amidst stubborn inflation. This sentiment was reflected in the Japanese Government Bond (JGB) market, particularly in the 10-year maturity, which reached a 20-year high—increasing by 5.7 basis points to yield 2.018 per cent. Since the Bank of Japan reduced its direct intervention in the yield curve, market forces have assumed a more prominent role in shaping economic and financial expectations.

Regarding the Japanese Yen’s reaction, the currency depreciated by 1.45 per cent against the US Dollar, reaching ¥157.73. Although an increase in interest rates typically bolsters a local currency, both the USD and JPY are experiencing unique volatility as investors weigh high uncertainty in the global economic outlook.

Technical analysis of the USD/JPY pair

From a technical perspective, the USD/JPY pair is currently undergoing a period of consolidation. Nevertheless, price action remains positioned above its long-term moving averages, suggesting that the broader bullish momentum remains intact. Key observations include:

- Trend Context: In the long term, USD/JPY is exhibiting a broad consolidation pattern, reflecting market indecision. In the shorter term, however, the trend remains bullish—characterised by a structural sequence of higher highs and higher lows—whilst the price continues to respect the 50, 100, and 200-period moving averages.

- Resistance Levels: Should short-term resistance at ¥157.80 be breached to the upside, the next significant ceiling is identified at ¥161.50 (a historically relevant peak). A decisive break above these levels would suggest potential for further extension into higher price territories.

- Support Levels: If short-term support at ¥154.50 is invalidated, the next relevant floor is located at ¥151 (a structural pivot point that coincides with the 100-day moving average). A loss of the ¥151 zone would significantly increase the probability of a deeper market correction.

- Momentum Indicators: Both the MACD and RSI indicators are beginning to recover their bullish strength. Furthermore, the absence of bearish divergences indicates that the prevailing upward momentum remains in force.

Figure 2. USD/JPY Pair (2024-2025). Source: Data from the Intercontinental Exchange (ICE); Own analysis conducted via TradingView.