The Depth of Market (DOM)

Your Key to understanding market liquidity and price movement

What Is the Depth of Market (DOM)?

How does the Depth of Market tool work?

The relationship between Market Depth and liquidity

The Depth of Market (DOM) Tool and How It’s used in trading

The Depth of Market (DOM) is a tool used in global trading platforms. It displays pending buy and sell orders over a specific period, helping traders understand and identify areas of supply and demand and anticipate future price movements.

In other words, DOM reflects the number and size of buy and sell orders for a particular asset at different price levels, allowing traders to gauge supply and demand zones.

How can it be used in trading?

Depth of Market is often used as an indicator of market liquidity. It’s also known as the order book, as it functions as a digital record of an asset’s open orders.

For example, traders can use DOM to identify potential demand and supply levels for an asset such as gold. These levels often indicate areas where price reversals might occur, helping traders find good entry points for buy or sell positions.

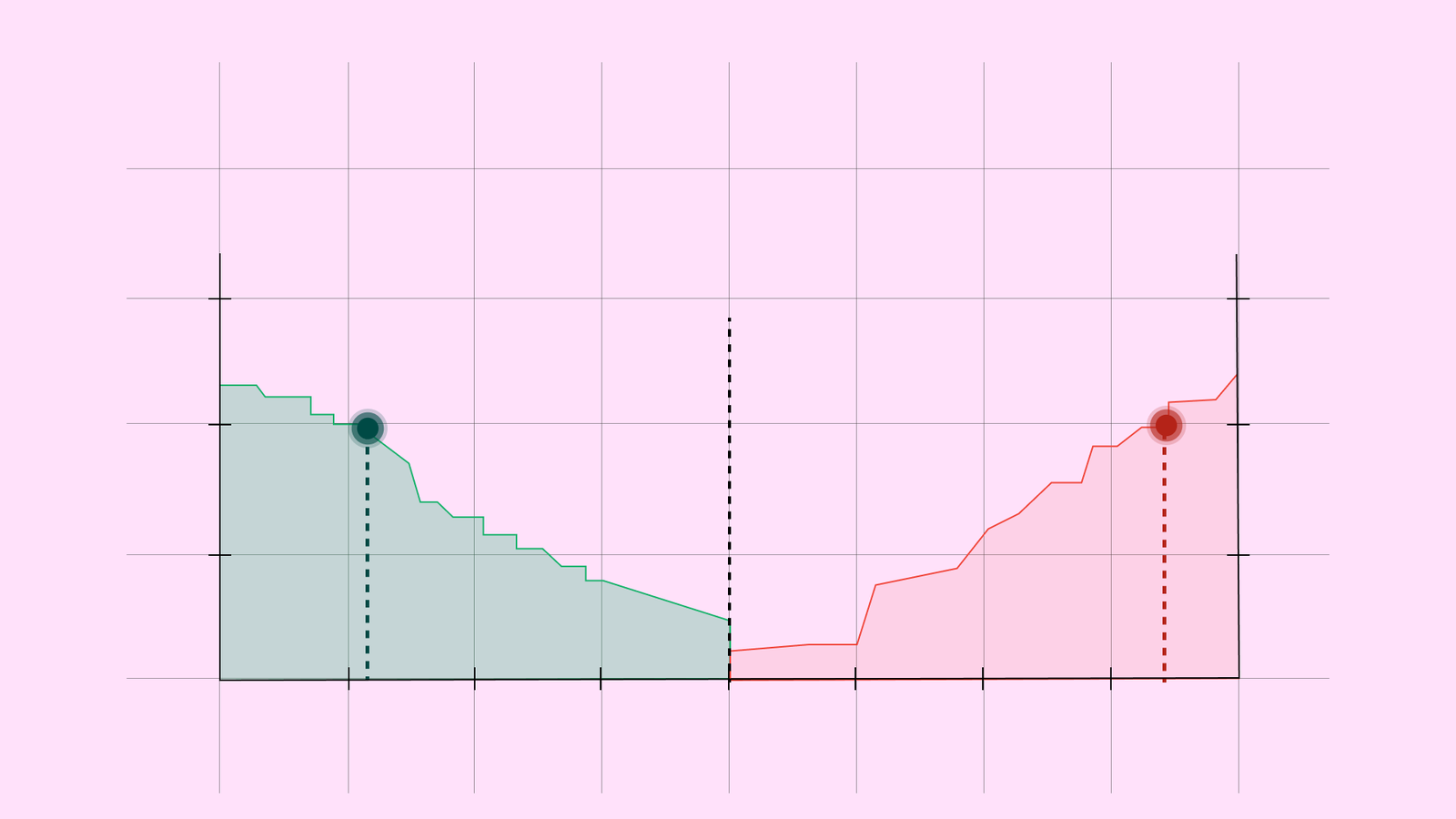

The greater the number of buy and sell orders, the higher the liquidity. Market depth is determined by the number of Buy Limit and Sell Limit orders.

Traders also rely on DOM data during major market events that impact a stock or currency — for instance, when a company releases its quarterly earnings report. In such cases, DOM can be a powerful tool for analyzing trader behavior and market sentiment.

Understanding the depth of market tool

When buyers are placing orders at higher price levels, it often signals expectations of rising prices. On the other hand, a strong interest in selling at lower price levels may indicate an upcoming price decline.

Market depth plays a significant role in predicting price movement. For example, if a descending triangle pattern is forming and the DOM shows increased sell orders, this combination strengthens the expectation of a downward move — helping traders make more confident decisions.

Factors affecting market depth

Margin requirements:

Higher margin requirements reduce a trader’s ability to control larger positions, as a greater portion of their capital is tied up as collateral. Lowering margin requirements allows for more leveraged trades but increases overall risk.

Lot Size:

This is the minimum price movement of an asset, which varies from one instrument to another. Traders can increase their trade volume to aim for higher profits, depending on their risk tolerance and strategy.