The RBA hiking into a headwind

The Reserve Bank of Australia has officially detached itself from the global dovish consensus. By hiking the cash rate to 3.85% last week and effectively signaling a terminal rate of 4.2% by December.

The Reserve Bank of Australia has signaled a terminal rate of 4.2% by December.

AU–US front-end yield, gap is a magnet for capital.

1-week 10-delta skew is moving toward puts.

Inflation ticked back up to 3.8%, hitting its highest mark since June 2024.

AUD/USD reached 0.7100 for the first time since 2023.

The RBA tightrope

The Reserve Bank of Australia has signaled a terminal rate of 4.2% by December Governor Bullock is attempting a high-risk maneuver: crushing a resurgence in inflation without capsizing an economy that is already taking on water.

The data presents a classic, albeit dangerous, bifurcation. On one side, we have an inflation impulse that refuses to die, driven by capacity constraints and a tight labor market. On the other, the growth outlook has deteriorated significantly. The RBA’s own forecast of 1.6% GDP growth for the 2026-27 financial year is not just "soft” it is recessionary in per-capita terms, particularly given high immigration levels.

Hiking rates into a supply-side constrained slowdown rarely ends with a "soft landing." It typically ends with a sharp demand shock. The market is pricing in the hikes because it has to, but the sustainability of a 4.2% cash rate in an economy growing at 1.6% is highly questionable.

Source: Reserve Bank of Australia

The bond market aiming for higher for longer

The move in Australian 3-year yields to cycle highs isn’t just noise; it’s a repricing of the RBA’s pain threshold. The market has accepted that Governor Bullock isn't bluffing about that 4.2% terminal rate.

More importantly, look at the AU–US front-end yield differential. It remains elevated. In a world of compressing spreads, that gap is a magnet for capital. It’s the primary engine driving the AUD/USD spot price higher. The "carry" is back, and as long as those spread holds, the path of least resistance for the currency should be up.

Options market tells a different story

While spot traders are chasing the yield, the options market is flashing a warning light.

Short-dated risk reversals have turned lower. Specifically, the 1-week 10-delta skew is moving toward puts. Traders are paying a significant premium to protect themselves against a sudden drop in the Aussie dollar. This isn't necessarily a bearish bet on the direction; it’s a "tail risk" hedge.

Source: LSEG

Labour market and inflation

The Australian job market just threw a massive curveball. The unemployment rate dropped to 4.1% in December, the lowest level we’ve seen since May 2025, the economy added over 65,000 jobs.

A labor market this tight usually means one thing, wage growth isn't slowing down. When businesses have to fight for workers, they pay more, and those costs eventually show up in the price of your morning coffee. This data effectively killed the "soft landing" dream for early 2026 and forced the RBA to keep the pressure on interest rates.

Source: Australian Bureau of Statistics

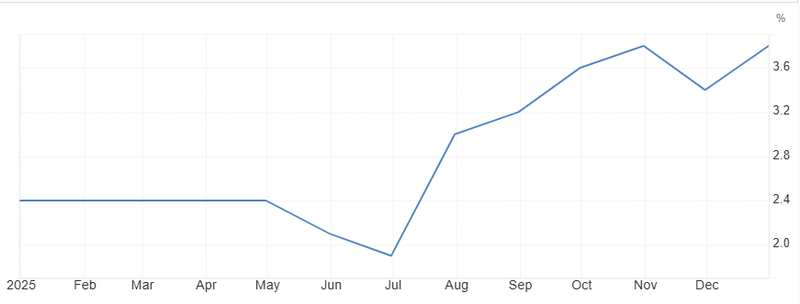

Inflation spike

Most of 2025, inflation was cooling, but inflation ticked back up to 3.8%, hitting its highest mark since June 2024. The RBA's mandate is to keep inflation between 2% and 3%, with the "sweet spot" at 2.5%. The Problem at 3.8%, inflation is moving away from that target, and even if energy was excluded it’s still near 3.3% this tells the RBA that the heat isn't just from a one-off spike in electricity or fuel it’s "sticky" and embedded in everything from rents to insurance.

Source: Australian Bureau of Statistics

Technical outlook

AUD/USD reached 0.7100 for the first time since 2023. Price is currently trading near this level, while RSI is testing values not seen in five years and is approaching overbought territory (above 70). A potential pullback toward the 0.7050–0.7000 area would represent a technical retracement, allowing the market to assess whether former resistance may act as support before any further directional development.

Source: Trading View