How To Use an Inverted Hammer Candlestick Pattern in Technical Analysis

A single-candle pattern that typically signals a potential bullish reversal after a downtrend

The inverted hammer pattern signals a potential bullish reversal after a downtrend

Look for confirmation with a strong bullish candle

Combine with support zones, oversold indicators, and proper risk management to maximize success

The inverted hammer candlestick is a powerful signal that hints at a potential shift from selling pressure to buying momentum. Spotted after a downtrend, this upside-down candle warns traders that a market reversal could be near — but confirmation is key.

It looks like this:

- A small real body near the candle’s low

- A long upper shadow (at least twice the size of the body)

- Little to no lower shadow

Think of it visually as a hammer flipped upside down, swinging back to hit the market upward.

Inverted Hammer Meaning

The inverted hammer candlestick meaning reflects a battle between buyers and sellers:

- During the session, buyers tried to push prices much higher (long upper wick).

- Sellers fought back and dragged prices back toward the open.

- However, the buying pressure is a warning sign that sellers may be losing strength.

If confirmed by the next candles, this setup can hint that momentum is about to flip upward.

Inverted Hammer Bullish or Bearish?

In a downtrend → an inverted hammer is considered potentially bullish

It shows that although sellers dominated before, buyers are starting to challenge them.

The inverted hammer alone is not confirmation of a reversal.

You should always wait for the next candle to close higher (a strong bullish candle) before taking action.

So Where Does the Inverted Hammer Work Best?

- After prolonged downtrends

- Near support levels

- Following oversold signals (like RSI below 30)

It’s especially powerful when it appears at the end of exhaustion moves, where sellers are tired and buyers are ready to step in.

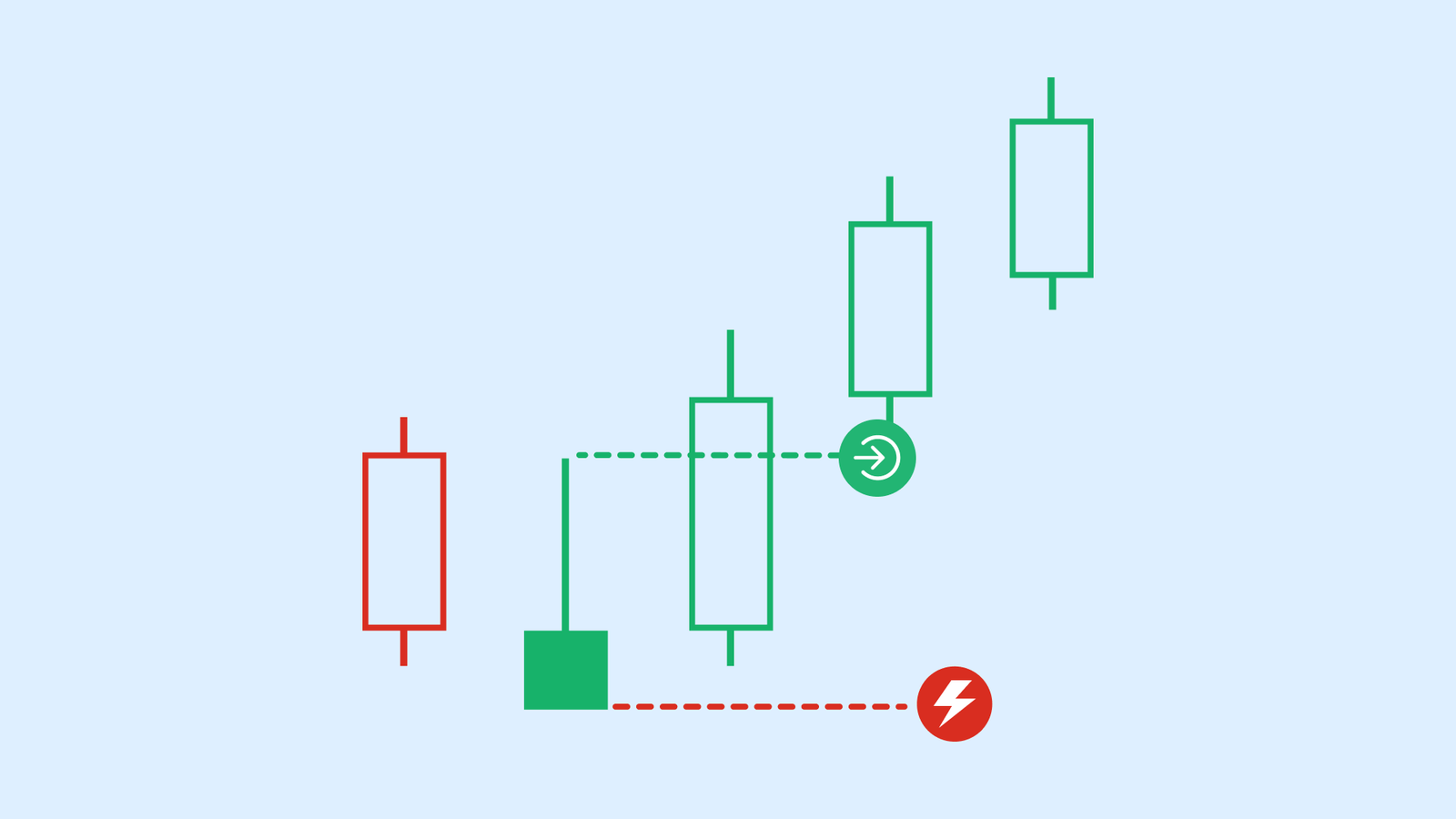

How to Trade an Inverted Hammer Candlestick Pattern

Step-by-Step:

1. Identify

- Find the inverted hammer after a clear downtrend.

2. Confirm

- Wait for the next candle to close above the inverted hammer’s high.

- This confirmation increases the probability of a bullish reversal.

3. Set Entry

- Enter the trade slightly above the confirmation candle.

4. Place Stop-Loss

- Below the low of the inverted hammer.

5. Target Setting

- First target: previous resistance or swing high.

- Or use a reward-to-risk ratio like 2:1.

Key Differences: Inverted Hammer vs Shooting Star

It’s easy to confuse an inverted hammer with a shooting star.

Both have the same shape — but context matters:

Inverted Hammer

- Appears after a downtrend

- Signals a potential bullish reversal

Shooting Star

- Appears after an uptrend

- Signals a potential bearish reversal

Always combine candlestick patterns with market structure and volume analysis for best results.