Discount & premium zones in ICT trading

In ICT methodology, price doesn’t move randomly, it constantly rotates between areas where smart money is willing to buy (discount), and areas where they prefer to sell or even take profit (premium). Today I will explain how these zones are created and why price reacts to them, your chart becomes clearer, and your entries become more reliable.

Price is attractive for accumulation.

Shift to high-probability setups.

Trying to predict every candle.

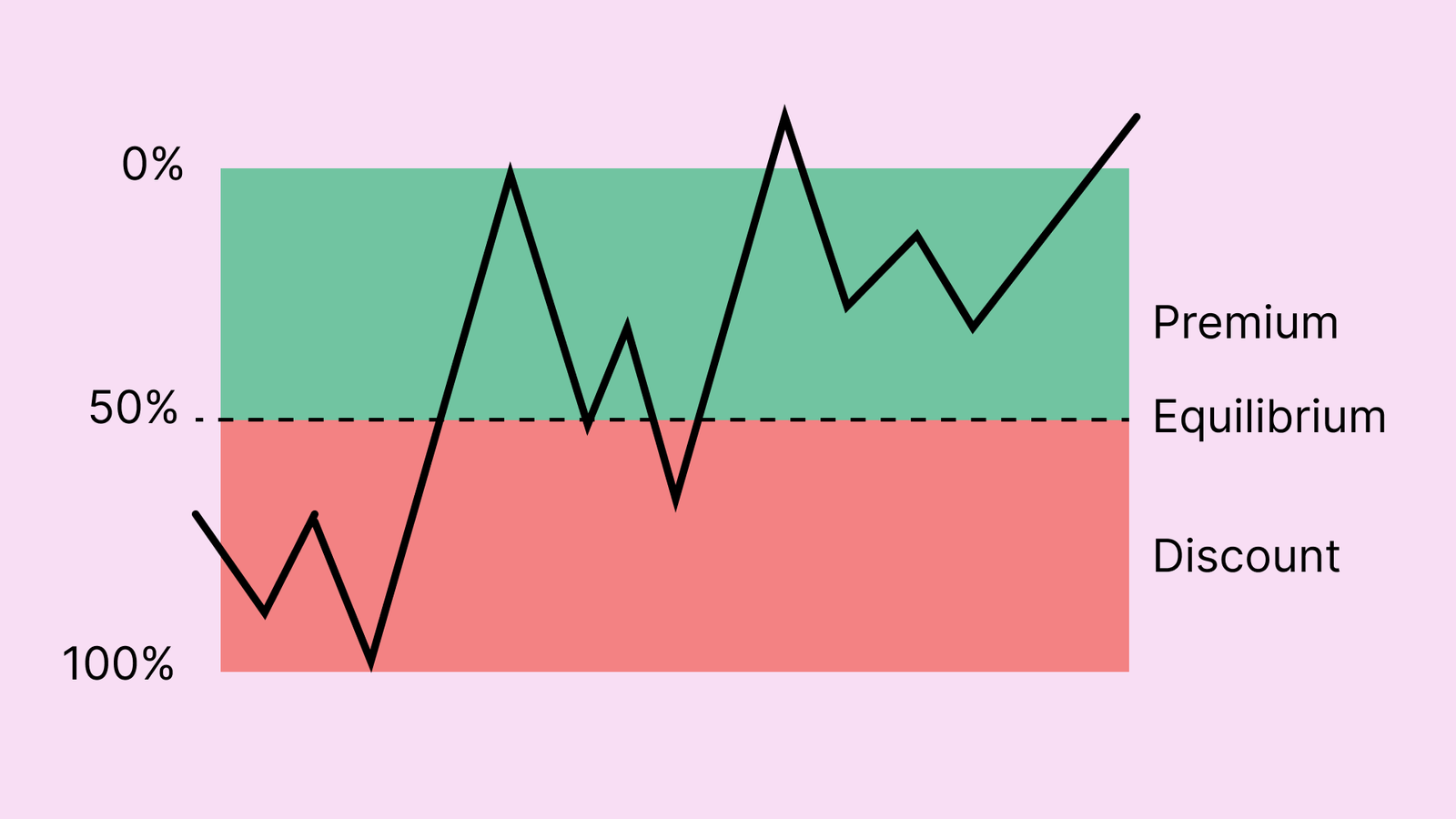

What Premium means

A premium is an area where price is considered expensive (overvalued) relative to the recent range. Smart money tends to sell into premium, set short positions or take profits on longs position. When price trades above the 50% of a major swing, you are in premium zone. This is the zone where the market is more likely to form distribution, then BOS to the downside and continue lower.

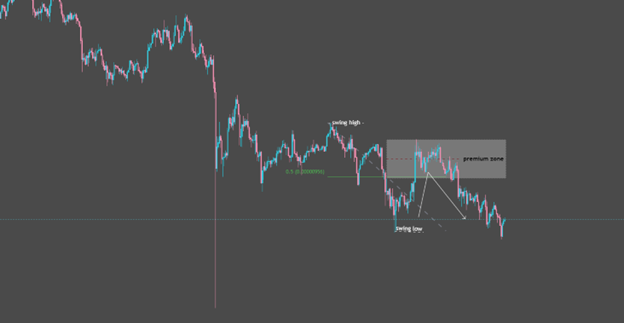

How to identify premium area

You can’t use premium until you define the swing range (high & low), you look at the most recent impulse leg (wave), you underline the daily or 4H swing high and swing low, select Fibonacci retracement draw from swing high to swing low ( bearish range) keep only the 0.5 level and hide the rest to have a clean picture.

The 0.50 level on the fib retracement is the midpoint (equilibrium).

Above 0.50 is premium

Below 0.50 is discount

If you are math fan you can identify the 0.50 area from the midpoint formula (swing high price + swing low price) / 2

Any price above 0.50 is a premium area where traders start searching for short positions and they intend to put the stop loss above the swing high.

This concept should be gathered with another trading concepts that you use to take trading, for example when the price reaches the premium area you wait for an engulfing candle to close below the previous candle low.

When you short from premium your targets are the previous swing low, discount zone of the same range you took, or using classic technical analysis.

Source: Trading View

What discount means

A discount is an area where price is considered Cheap (undervalued) relative to the recent range, the price becomes attractive for accumulation and the smart money tends to look for long setups, entering again existing long positions, and absorb liquidity from the panic sellers.

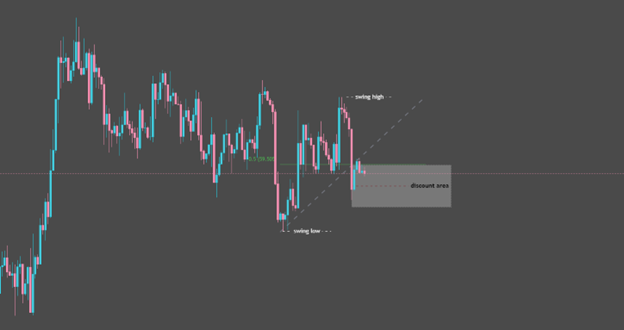

How to identify discount area

You can’t use discount until you define the swing range ( the high & low), you look at the most recent impulse leg (wave), you underline the daily or 4H swing high and swing low, select Fibonacci retracement draw from swing low to swing high ( bullish range) keep only the 0.5 level and hide the rest to have a clean picture.

The 0.50 level on the fib retracement is the midpoint (equilibrium).

Any price below 0.50 is a discount area where traders start searching for long positions and they intend to put the stop loss below the swing low.

This concept should be gathered with another trading concepts that you use to take trading, for example when the price reaches the discount area you wait for an engulfing candle to close above the previous candle high.

When you long from discount your targets are the previous swing highs, premium zone of the same range you took, or using classic technical analysis.

Source: Trading View

FAQs

What are Premium and Discount zones in forex trading?

Premium zones are price areas above the equilibrium level (the midpoint of a price range), where an asset is considered expensive and ideal for selling. Discount zones are price areas below the equilibrium level, where the asset is considered cheap and ideal for buying.

How do institutions use Premium and Discount zones?

Institutions typically sell in Premium zones during downtrends and buy in Discount zones during uptrends. These zones are used to execute large orders with minimal market impact while efficiently taking advantage of liquidity.

Why is higher time frame analysis important in ICT trading?

Higher time frame analysis provides a broader view of market structure and overall trend direction, helping traders align their strategies with the dominant market bias and identify the strongest and most reliable Premium and Discount zones.