How Engulfing pattern works

An engulfing pattern is a two-candle reversal formation in technical analysis that signals a potential shift in market direction. It occurs when the second candlestick fully “engulfs” the body of the first candle, indicating a strong change in momentum between buyers and sellers.

Engulfing pattern is primarily considered a reversal pattern.

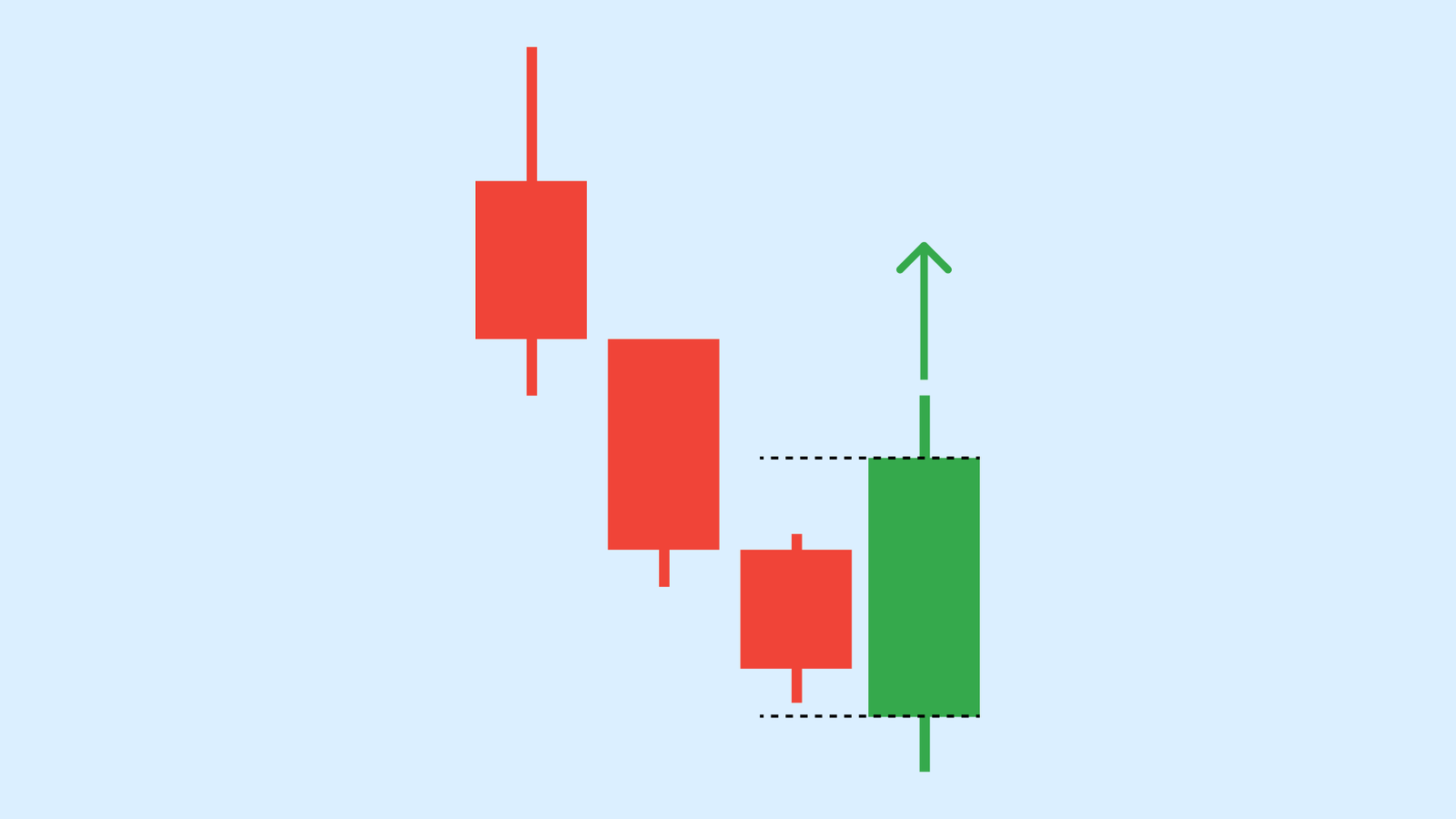

Bullish engulfing pattern appears after a downtrend.

Bearish engulfing pattern appears after an uptrend.

Engulfing patterns are most useful following a clean downward price move.

Engulfing candle pattern

An engulfing pattern is primarily considered a reversal pattern, not a continuation pattern. Its core purpose in technical analysis is to signal a potential shift in market control from buyers to sellers or vice versa.

The structure itself reflects a sudden and decisive change in momentum. In a bullish engulfing pattern, sellers dominate the first candle, but buyers completely overwhelm them in the second candle. In a bearish engulfing pattern, the opposite happens — buyers lose control as sellers take over aggressively.

This shift in dominance is what makes the pattern inherently reversal oriented. It typically appears, at the end of a downtrend (bullish engulfing), at the end of an uptrend (bearish engulfing)

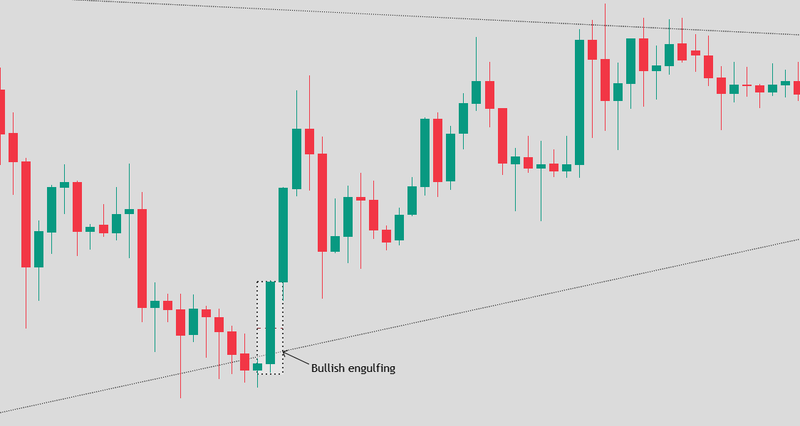

Bullish and bearish engulfing pattern

A bullish engulfing pattern appears after a downtrend and signals a potential upward reversal. It consists of two candles. The first candle is bearish (closes lower than it opens).

The second candle opens lower or near the previous close, then rallies strongly and closes above the first candle’s open fully engulfing the prior candle’s body, this shift shows that sellers were initially in control, but buyers stepped in aggressively and overpowered them. The stronger and larger the second candle, the stronger the shift in momentum may be.

The pattern is more meaningful when it forms near a support level, after a prolonged decline, or with increasing volume.

Source: Trading View

Bearish engulfing

A bearish engulfing pattern appears after an uptrend and signals a potential downward reversal. The first candle is bullish (closes higher than it opens).

The second candle opens higher or near the previous close but then sells off sharply, closing below the first candle’s open fully engulfing the prior candle’s body.

This indicates that buyers were initially dominant, but sellers stepped in decisively and seized control. It often reflects exhaustion in an uptrend.

The signal becomes stronger if it forms near resistance, after extended gains, or alongside elevated trading volume.

Source: Trading View

How engulfing pattern works

The pattern reflects a sudden shift in control. In a bullish engulfing pattern, the first candle is bearish (price closes lower), and the second candle opens lower but then closes higher, completely covering the body of the previous candle. This suggests that buyers have overwhelmed sellers, potentially signaling the end of a downtrend, wait for the engulfing candle close above the previous high and the stoploss is the previous low.

Source: Trading View

Bearish engulfing pattern

In a bearish engulfing pattern, the first candle is bullish, and the second candle opens higher but closes lower, engulfing the prior candle’s body. This indicates that sellers have taken control and may signal a potential top, wait for the candle to close below the previous candle low and the stoploss is the previous high.

Source: Trading View

Risk of engulfing patterns

A bullish engulfing pattern can be a powerful signal, especially when combined with the current trend; however, they are not bulletproof. Engulfing patterns are most useful following a clean downward price move as the pattern clearly shows the shift in momentum to the upside. If the price action is choppy, even if the price is rising overall, the significance of the engulfing pattern is diminished since it is a fairly common signal.

The engulfing or second candle may also be huge. This can leave a trader with a very large stoploss if they want to trade the pattern. The potential reward from the trade may not justify the risk.

FQAs

What is an engulfing pattern in trading?

An engulfing pattern is a two-candle reversal formation in technical analysis where the second candle completely covers or “engulfs” the body of the first. It signals a potential shift in market momentum from buyers to sellers or vice versa.

What is the difference between bullish and bearish engulfing patterns?

A bullish engulfing pattern occurs after a downtrend, where buyers take control and push prices higher. A bearish engulfing pattern occurs after an uptrend, with sellers overwhelming buyers, suggesting a potential downward reversal.

Is an engulfing pattern a reversal or continuation signal?

Primarily, it is a reversal pattern, signaling a change in trend. In rare cases, it can act as a continuation signal in strong trending markets, but this is secondary.

How do I confirm an engulfing pattern?

Confirmation can come from the next candle closing in the same direction, breaking key support or resistance, or aligning with momentum indicators like RSI or MACD.

Does volume matter in engulfing patterns?

Yes. Higher-than-average trading volume during the engulfing candle strengthens the signal, showing stronger conviction behind the move.