MSS vs BOS: essential guidance for mastering market structure

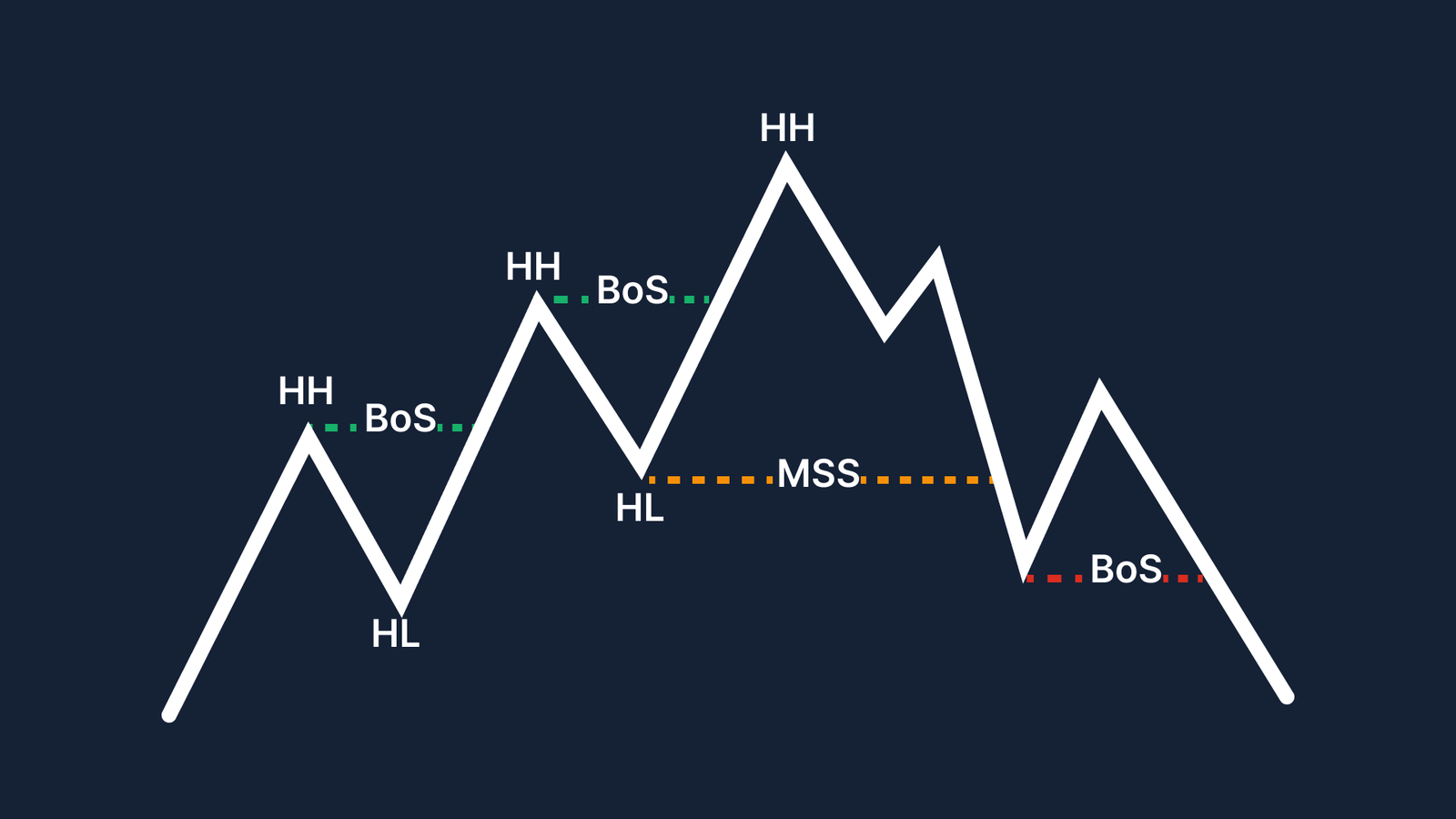

Market Structure Shift (MSS) and Break of Structure (BOS) are two of the most important concepts in ICT trading. MSS signals a potential reversal in the market directions, however the BOS confirms continuation of the existing trend and the trend that we had the signal from the MSS. These structural tools provide ICT traders with precise entry points, clear bias and a deeper understanding of price delivery. This article will explain how they appear in the Bullish and Bearish conditions.

BOS continues the Trend: MSS challenges it.

MSS does not confirm a full trend reversal.

While MSS introduces doubts, BOS reinforces confidence.

ICT methodology revolves around liquidity, displacement and structure.

BOS vs MSS in ICT Market Structure

Market Structure tells the story of trend, momentum, and intentions, ICT methodology the two structure events dominate price interpretation: Market Structure Shift (MSS) and Break of Structure (BOS). Although traders often confuse them, they represent two different behaviors in the market. “BOS continues the Trend: MSS challenges it”.

Market Structure Shift (MSS)

A Market Structure Shift (MSS) is a sudden break against the prevailing trend, signaling the first potential step toward a reversal. It shows that the market may be transitioning from distribution into accumulation, or the opposite.

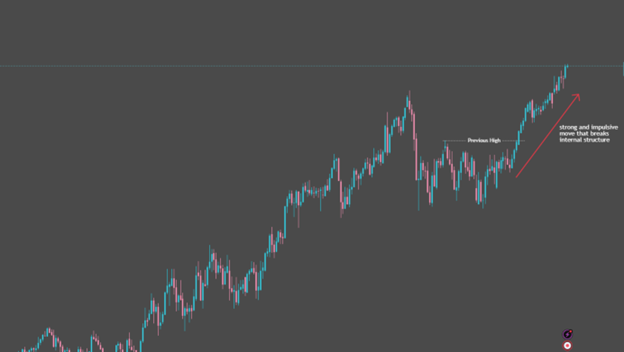

MSS is often driven by displacement, strong and impulsive move that breaks internal structure (Main Previous Low) in the opposite direction of the existing trend.

Source: Trading View

Rules of MSS

- An internal swing high or low (Previous High or Low) against the trend must break.

- The break should be impulsive, wide-range, and show displacement.

- After the break, the market left behind a Fair Value Gap (FVG).

- MSS does not confirm a full trend reversal – it signals the start of one.

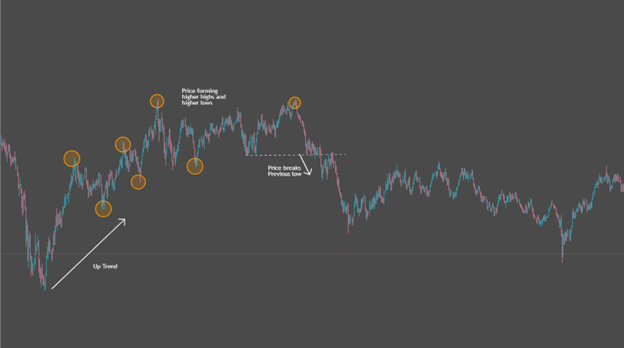

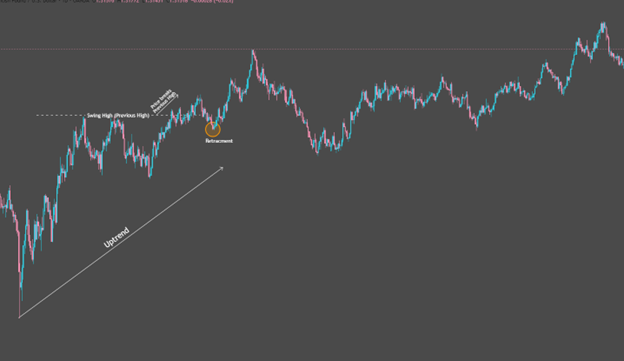

How MSS happens in a bullish scenario

- The market has been trending upward.

- Price forms higher highs and higher lows.

- Suddenly price breaks the previous higher low with strong momentum.

- Form a lower low, that break of a low show a shift from bullish flow into potential bearish order flow.

- Traders begin watching for bearish setup on the pullback (wait correction).

Source: Trading View

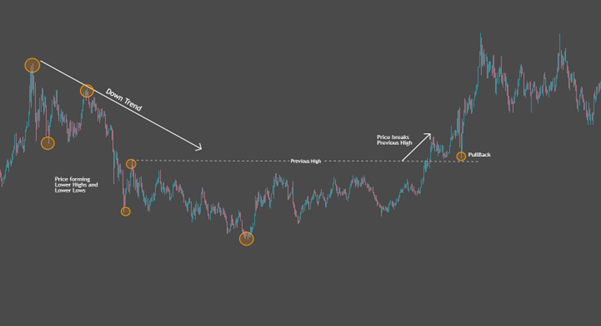

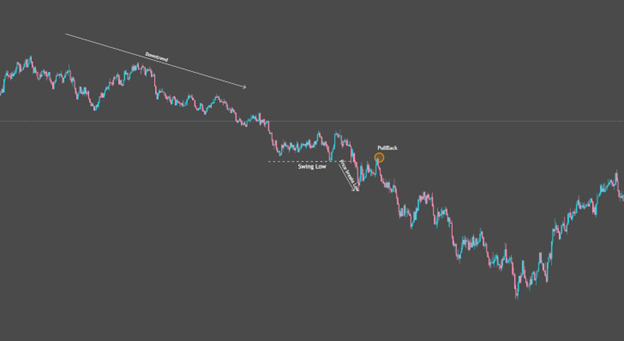

How MSS happens in a bearish scenario

- The market has been trending Downward.

- Price forming Lower highs and Lower lows.

- Suddenly price breaks the previous Lower High with strong momentum.

- Form a Higher High, that break of a previous High shows a shift from bearish flow into potential bullish order flow.

- Traders begin watching for bullish setup on the pullback (wait correction).

Source: Trading View

Break of Structure (BOS)

A Break of Structure is a continuation signal; it occurs when price breaks a high or low in the same direction as the existing trend. Confirms that the trend remains intact.

“While MSS introduces doubts, BOS reinforces confidence.”

Source: Trading View

Rules of BOS

- Trend direction must be clear (Not Sideways).

- Price must break an external Swing High (in an Uptrend).

- Price must break an external Swing Low (in a Downtrend).

- BOS should ideally occur with displacement (Strong Momentum).

- After BOS, Price often returns to the Fair Value Gap to continue the trend.

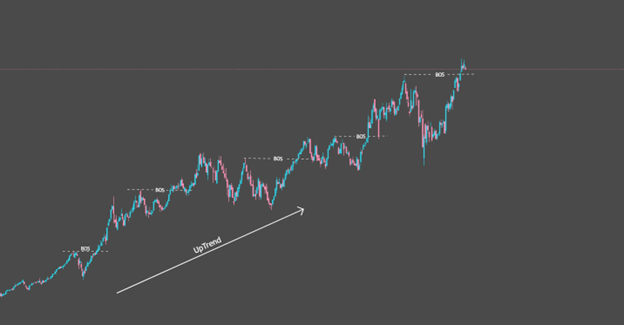

How BOS Happen in a Bullish Scenario

- Having a clear Uptrend.

- Price is making Higher Highs and Higher Lows.

- Price breaks a previous swing high (Previous High).

- The break confirms the continuation of the bullish movement.

- Traders wait for retracement into the Fair Value Gap (FVG) or Support Zone.

Source: Trading View

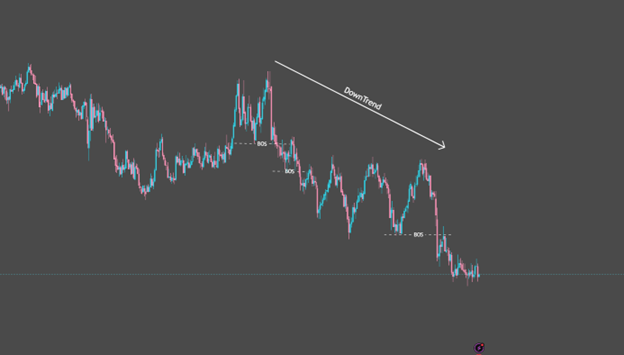

How BOS Happen in a Bearish Scenario

- Price is making Lower Lows and Lower Highs.

- Price breaks a previous swing low (Previous Low).

- This confirms that sellers remain in control.

- Traders wait for pullback to Fair Value Gap (FVG), or Resistance Zone for entries.

Source: Trading View

How to tell the difference between MSS and BOS

BOS = continuation

MSS = potential reversal

- BOS breaks structure with the trend.

- MSS breaks the structure against the current trend.

- BOS confirms that the current trend is healthy and continued.

- MSS warns that the trend may be losing strength and start reversal.

- BOS seeks continuation entries.

- MSS prepares trades for a new directional bias.

Why MSS and BOS matter for ICT traders

ICT methodology revolves around liquidity, displacement and structure. MSS and BOS are essential because they give traders:

- Directional Bias – MSS warns of reversal potential on the current trend, BOS confirms trend continuation.

- Entry Models – Both form the foundation of the FVG and the SnR zone entry patterns.

- Liquidity Logic – MSS often occurs after liquidity grabs, BOS often occurs as price searching for liquidity.

- Clearer Timing – BOS and MSS help traders avoid guessing and instead follow price delivery.

- Higher Precision – ICT traders rely on structure to identify high-probability setups with correct timing

FQAs

What is the main difference between MSS and BOS in ICT trading?

MSS (Market Structure Shift) signals a potential reversal, while BOS (Break of Structure) confirms trend continuation. MSS breaks structure against the trend, whereas BOS breaks structure with the trend.

Does an MSS always mean a full trend reversal?

No. MSS only signals the beginning of a possible shift in order flow. It does not confirm a complete reversal unless followed by further structural breaks such as BOS in the opposite direction.

Why is displacement important in MSS and BOS?

Displacement shows strong institutional activity. In MSS, it confirms that the opposing side (buyers or sellers) is gaining control. In BOS, it confirms continuation and healthy momentum in the prevailing trend.