The role of triangles and extended waves in Elliott Wave theory

Triangles indicate market balance and a pause in trend direction. An extension occurs when one motive wave within an impulse becomes extended.

A triangle represents a corrective pattern consisting of five overlapping waves.

Extensions occur when one of the sub-waves, usually wave 1, 3 or 5, becomes disproportionately long.

When wave 1 or 5 is extended, wave 3 or another impulse adjusts to uphold Elliott Wave rules.

Triangles in Elliott wave

A triangle is a corrective pattern made up of five overlapping waves labeled A-B-C-D-E. Each wave typically subdivides into a 3-wave structure, giving an overall 3-3-3-3-3 pattern. The pattern commonly appears as a sideways consolidation before the next major move. Triangles reflect a balance of forces between buyers and sellers and often signal a pause before the trend continues.

Where triangles occur

Triangles only occur in specific positions within larger wave structures:

Fourth wave of impulse (most common), B wave of a corrective zigzag. They do not appear as standalone moves or in every wave position—knowing where they can occur is crucial for correct wave counting.

Source: Trading View

Types of triangle patterns

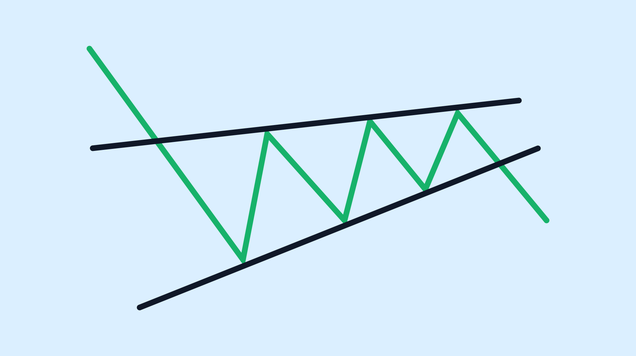

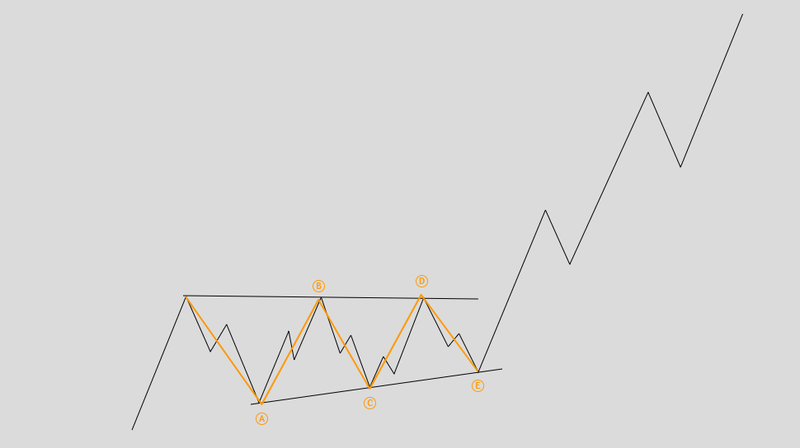

Ascending triangles

Flat top, rising bottom, ascending triangle is labeled with letters (A-B-C-D-E) rather than numbers. An ascending triangle is defined by 5 sub-waves (3-3-3-3-3), meaning each leg of the triangle is itself a corrective three-wave move, and the upper boundary (resistance) is a flat horizontal line, while the lower boundary (support) consists of rising higher lows. It is almost always a "penultimate" move in wave 4 or wave B, right before the final move larger trend (before Wave 5 or Wave C).

Source: Trading View

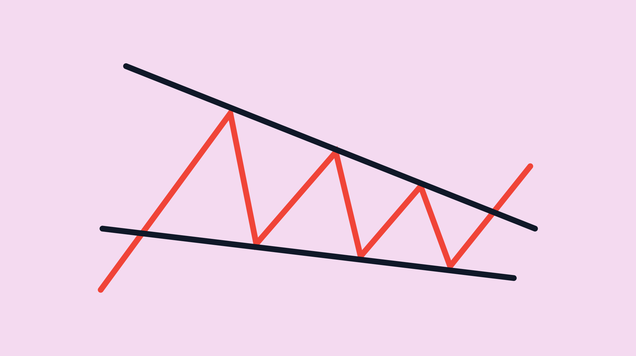

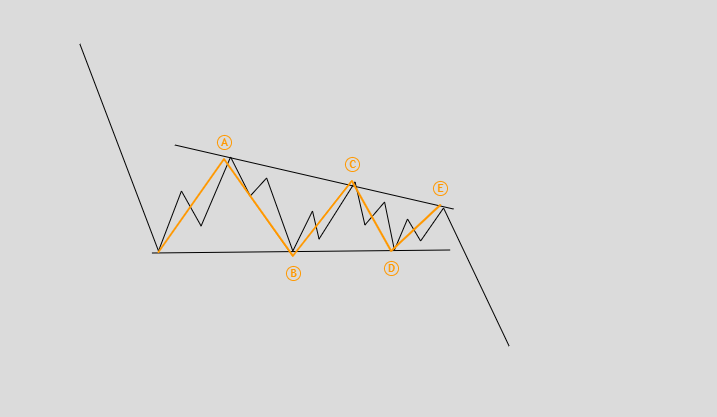

Descending triangles

Flat bottom, falling top, descending triangle is labeled with letters (A-B-C-D-E) rather than numbers. A descending triangle is defined by 5 sub-waves (3-3-3-3-3), meaning each leg of the triangle is itself a corrective three-wave move, and the lower boundary (support) is a flat horizontal line, while the upper boundary (resistance) consists of falling lower highs. It is almost always a "penultimate" move in Wave 4 or Wave B, right before the final move of a larger trend (before Wave 5 or Wave C).

Source: Trading View

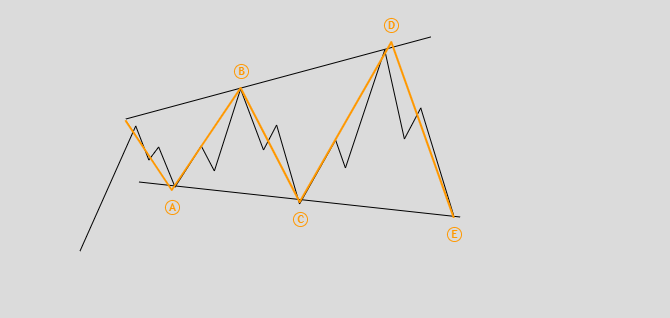

Reverse symmetrical

Falling bottom, rising top, expanding triangle is labeled with letters (A-B-C-D-E) rather than numbers. An expanding triangle is defined by 5 sub-waves (3-3-3-3-3), meaning each leg of the triangle is itself a corrective three-wave move, and the upper boundary (resistance) is a rising trendline, while the lower boundary (support) is a falling trendline. It is almost always a "penultimate" move in Wave 4 or Wave B, right before the final move of a larger trend (before Wave 5 or Wave C). The difference is instead of price coiling and getting tighter (contracting), the price swings become larger as the pattern progresses. Each wave is typically longer than the previous one (E > D > C > B > A).

Source: Trading View

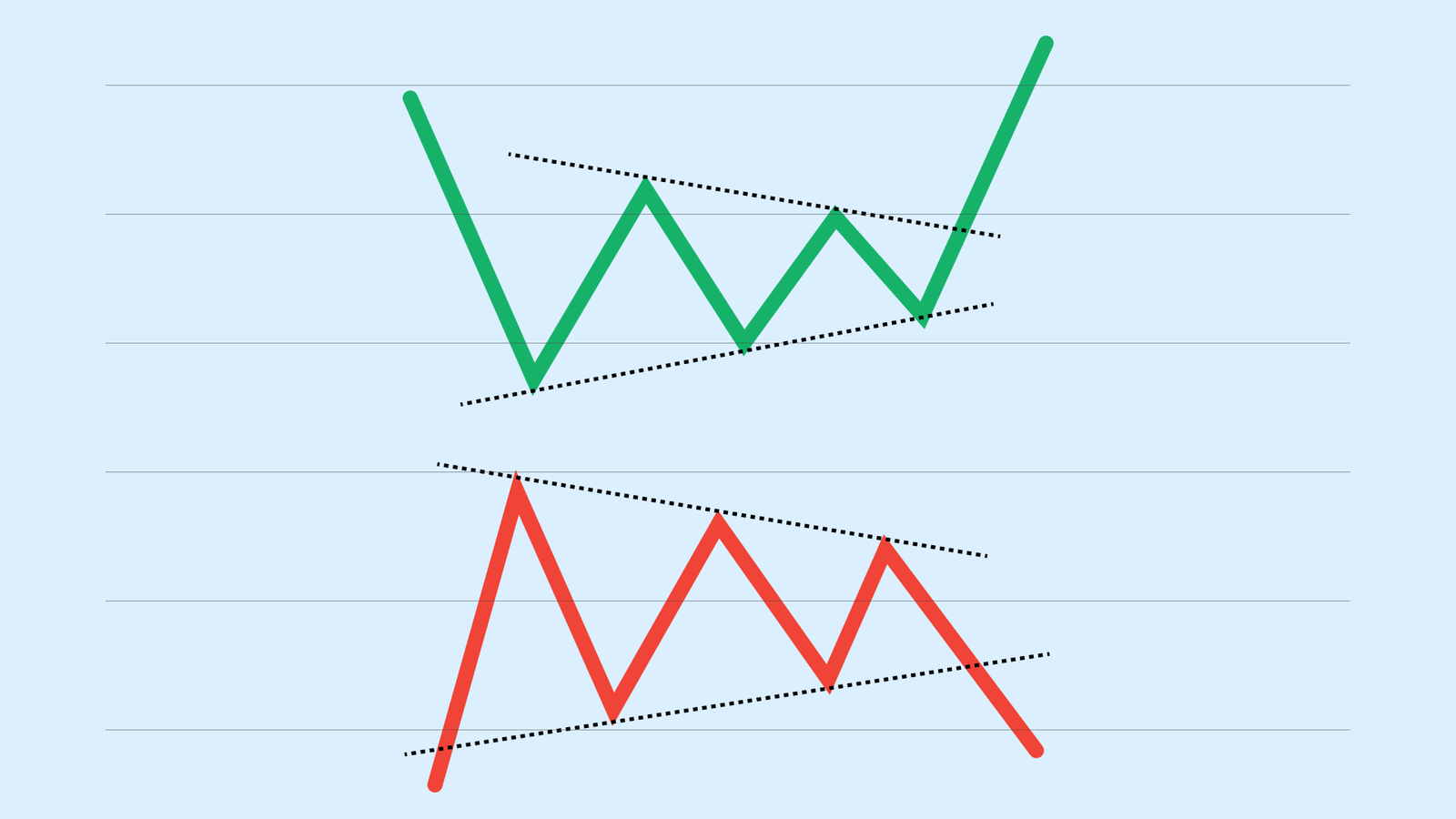

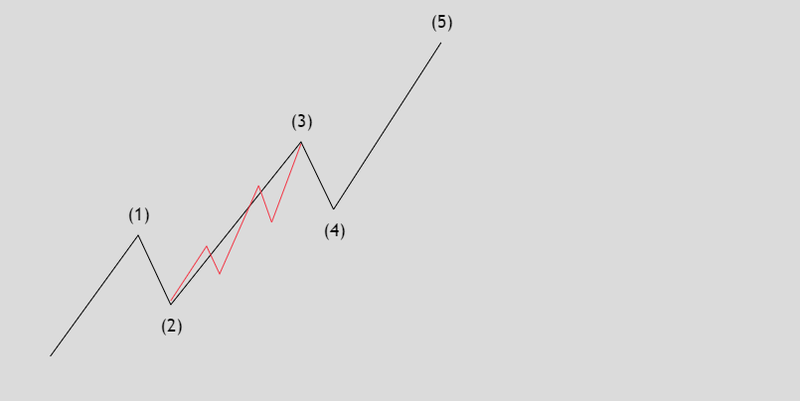

Extended waves

In Elliott Wave theory, an extension refers to an elongated motive wave within an impulse. Instead of a normal 5-wave pattern, one of the sub waves (usually Wave 1, 3, or 5) becomes significantly longer. tensions reflect strong market momentum. They indicate that one part of the trend is more powerful than others, which often aligns with dramatic sentiment shifts. Wave 3 is most frequently the extended wave, typically the longest and most powerful in trending markets. If Wave 3 extends, Waves 1 and 5 are usually shorter and more compact. Extensions can also occur in Wave 1 or Wave 5, though less often.

Source: Trading View

Only one of the three motive waves (1, 3, or 5) is typically extended. If Wave 1 or 5 is extended, then Wave 3 or another impulse will adjust to maintain Elliott’s structural rules. Extensions affect how traders project targets. They signal higher trend strength than usual. They help estimate future price targets, e.g., using ratios like 1.618, 2.618 of prior waves. Extensions often define the dominant leg in a trend, useful for positioning.

FQAs

What does a triangle pattern indicate in trading?

A triangle pattern indicates indecision and decreasing volatility, often preceding a strong breakout known as a “thrust.” The breakout usually occurs in the direction of the larger trend that existed before the triangle formed.

What is an extended wave in Elliott Wave Theory?

An extended wave is a motive wave that is longer and more complex than usual, subdividing into five smaller waves instead of the normal structure. Extensions typically occur in Wave 1, Wave 3, or Wave 5 of an impulse.

Can more than one wave be extended in Elliott Wave Theory?

Typically, only one motive wave (Wave 1, 3, or 5) extends within an impulse. While rare exceptions exist, Elliott Wave guidelines suggest that multiple extensions in the same impulse are uncommon.

What is the difference between a triangle and an extended wave?

A triangle is a corrective, sideways pattern that pauses the trend, while an extended wave is a strong directional move that accelerates the trend. Triangles reduce volatility; extensions increase it.