Stop Loss Explained

A stop loss order is an essential risk management tool in CFD trading. Read our guide to learn how to limit trading losses and protect your capital.

A stop loss order is a popular tool in CFD trading used to limit losses and protect against unfavourable price movements

Set to a predefined price level, a stop loss order automatically closes an open position if the price reaches a certain point

The benefits of using stop loss order include automatic execution, flexibility and timesaving, while slippage and market gaps are some of the risks included

Stop loss orders should be used with other risk management strategies to avoid over-reliance and ensure a well-rounded approach to managing risk

What is a stop loss order?

In any form of trading or investing, knowing how to manage potential risks is important to protect your capital and to limit how much money can be lost.

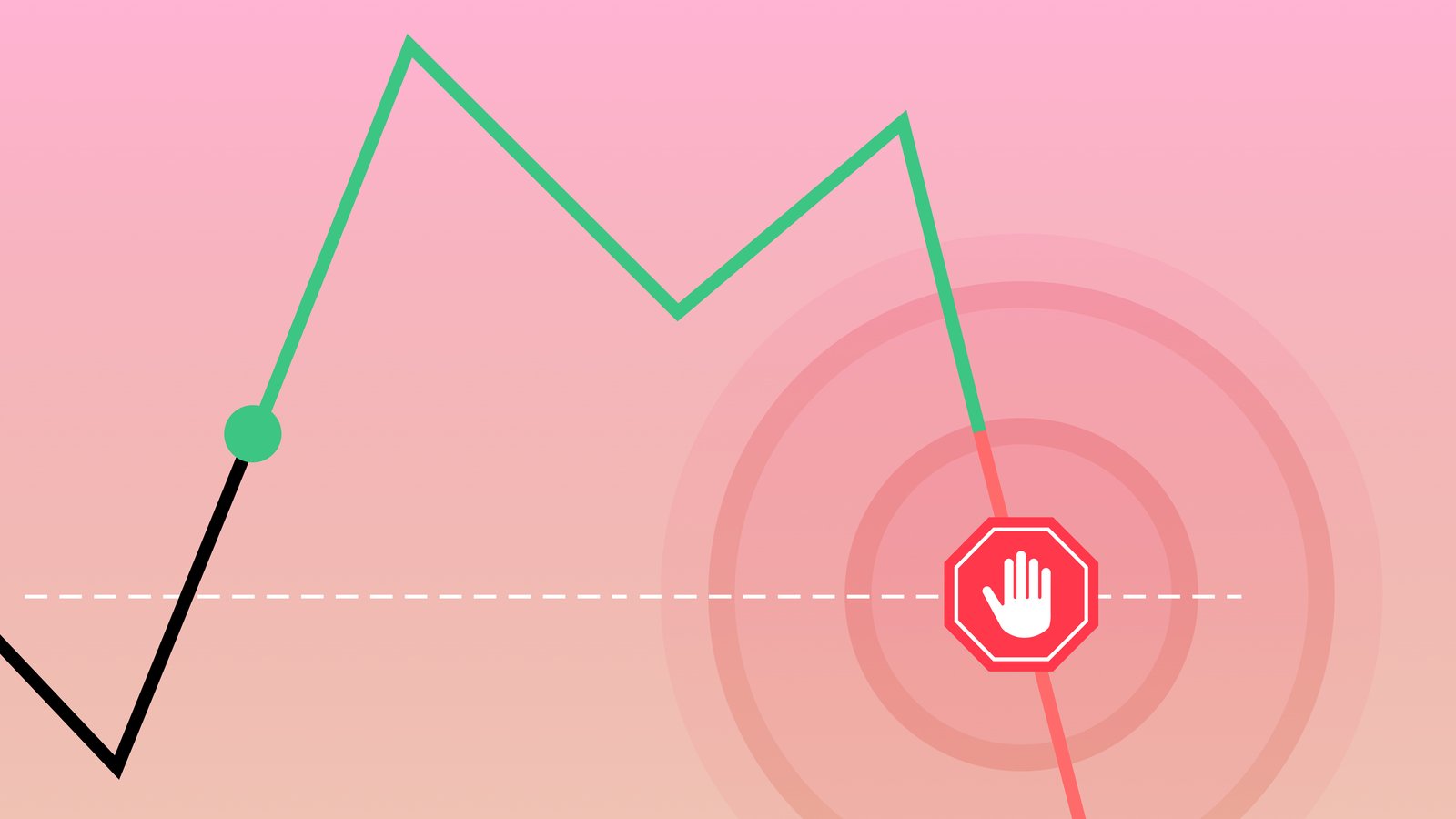

A stop loss order is an essential risk management tool that helps traders to limit potential losses and manage risks more effectively. Traders can add stop loss orders in their market watch window before they place a trading order by entering the lowest amount they’re willing to let an asset’s price fall to.

Its main purpose is to protect trader’s capital if the price of asset makes a sudden and unfavourable move. If the price moves to or beyond the chosen stop level, the stop loss order is triggered, and the trade is automatically closed at the best available market price.

For example, let's say you enter a long CFD trade on Company A stock priced at $50 per share, and you set a stop loss order with a stop level of $45. If the price of the asset drops to $45 or below before the closure of your trade, your stop loss order will be triggered and your trade will automatically close. In this scenario, the trader’s loss would be $5. Without the stop loss order, the trader could have lost a lot more if the price had continued to drop.

Using stop loss orders in CFD trading

A stop loss order is an instruction added to a trade that tells the broker to close the trade if the product being traded falls or rises to a certain price. That price is decided by the trader when they add a stop loss order. It’s usually called a ‘stop’ or ‘stop level’.

You can set a stop loss order with your broker at the time you place your trade, but there is also a possibility to add it later. Stop loss orders are available to all traders on the most popular trading platforms.

Most traders will set a stop level that reflects the maximum amount of risk they’re willing to take on which can be set with price levels or percentages.

To determine the right stop loss for your trade, technical analysis and support and resistance levels can be used. Many traders will typically place the stop loss right below the support level. This is because if the price breaks the support level, it can indicate that it will continue to move in that direction, which could result in bigger losses.

The advantages of price orders

Using stop loss orders offers several potential benefits for traders. Let’s see why you should also consider adding stop loss to your risk management toolkit.

Here are some advantages of including tools like stop loss orders in your trades:

Manage multiple trades with stop loss orders

Stop loss orders can be used to manage multiple trades at once. Traders can set different stop levels for different trades based on their risk appetite and trading strategy, allowing them to manage multiple positions more efficiently.

Lock in gains with take profit orders

Similar to a stop loss, traders can also use take profit orders with the aim of locking in profits on profitable trades. Once the price reaches a certain level of profit, a trader can set a take profit order at that level to lock in the gains, even if the trade continues to move in their favour. This helps to secure potential profits if the price changes direction.

Follow prices with trailing stop loss orders

Trailing stop-losses are like regular stop loss orders except they follow the price when it moves in a favourable direction. This helps lock in any potential profit, as the stop loss follows the direction of the market price as it moves in the trader’s favour, while limiting risk by capping the potential fall in price. For example, if a trader sets a trailing stop of $5 on a trade, and the price moves $5 in their favour, the stop level will automatically adjust to lock in the profit. This allows traders to capture profits as the price moves in their favour while still protecting against potential losses if the price reverses.

Potential for less loss

The main benefit of stop loss orders is the potential for losing less money. A stop loss order’s purpose is to help stop the trader losing more money than they want to risk.

Helps to build broader risk management skills

Another benefit of using stop loss orders is the formation of overall risk management. By setting stop loss orders, traders can build discipline to help prevent emotional decision-making when trading during volatility.

Convenience of automatic execution

Because stop loss orders are automatically executed, they provide a level of convenience for traders. You should monitor your trades, but a stop loss order can take some of the pressure off as you are required to spend less time watching market moves.

Flexibility

Stop loss orders offer flexibility because you can set different stop levels for different trades based on your risk tolerance and trading goals. You can also adjust stop levels in response to price or changes to your trading strategy.

Potential risks of stop loss orders

While stop loss orders can be an effective risk management tool, there are potential risks to keep in mind. Stop loss orders should be used with other risk management tools to build a successful risk management strategy.

Slippage

Slippage refers to a situation when there is a difference in the expected stop loss level and the actual executed price. During periods of high market volatility or low liquidity, the price may move from the expected stop level before the execution goes through, resulting in slippage. This can mean larger losses than expected or trigger the stop loss order at a less favourable price. However because of slippage, it’s impossible to fully guarantee the stop loss will fulfil its order at the chosen price.

Price gaps

Sudden gaps in prices can occur due to unexpected news events or market developments. This means that sometimes the price changes significantly when there is little or no trading, like when the markets are closed. Stop loss orders are not guaranteed to be executed at the exact stop level in case of market gaps, and the trade may be closed at a different price than expected, resulting in potential losses beyond the stop level.

Over-reliance on stop loss orders

It’s easy to start relying purely on stop loss orders but they shouldn’t be the only risk management tool you use. Instead, it should be seen as one tool in a toolbox for risk management. It’s important to have a risk management plan that includes other tools and strategies to manage risks effectively. Diversification and hedging are other commonly used risk management strategies.

How to practice using stop loss orders

Stop loss orders can protect traders from making impulsive and emotional decisions during market volatility, but they can also trigger early exits from trades, resulting in missed profit opportunities if the price reverses after hitting the stop level.

Traders need to consider their risk tolerance and trading strategy carefully and set stop levels accordingly to avoid having their trading position closed because of a lack of funds.

You can test stop loss order and other risk management tools conveniently with a risk-free demo account. With a demo account, you get access to real markets with virtual funds and can perfect your risk management plan before investing any money.