Why mutual funds matter when building a balanced portfolio

Mutual funds make diversification simple: you buy one fund, and in return you own a professionally managed basket of securities that spreads risk across many names, sectors, and even countries.

Mutual funds pool investors’ money into a professionally managed basket of securities, delivering instant diversification and end-of-day NAV pricing.

Broad, low-cost index funds provide reliable market exposure, while active funds may add value in less-efficient niches at the cost of higher fees.

Blending equity, bond, and international funds spreads risk across asset classes, sectors, and regions, which tends to smooth returns over full cycles.

Long-run outcomes hinge on expenses, taxes, and holdings overlap as much as returns; controlling these frictions preserves compounding.

Mutual funds definition—What are mutual funds, really?

If you’re after a plain-English mutual funds definition, think of a mutual fund as a shared investment account. Thousands of investors pool their money, and a manager invests that pool according to the fund’s stated objective. Your slice of that pool is measured by shares priced once per day at NAV (net asset value). That’s the essential mutual fund meaning—pooled money, a clear strategy, and professional stewardship.

How mutual funds work from the inside

When you contribute cash, it joins the fund’s assets and is allocated into securities that match the mandate. In an equity fund, that may be a broad mix of large-cap and mid-cap companies; in a bond fund, a ladder of government and corporate debt with different maturities and credit qualities. The manager (or, in the case of index funds, a rules-based process) handles research, trading, rebalancing, and corporate actions so you don’t have to. Fees are taken via the expense ratio, which is quietly deducted from assets over the year. Lower ongoing costs leave more of the return compounding in your favor.

Why mutual funds are powerful for diversification

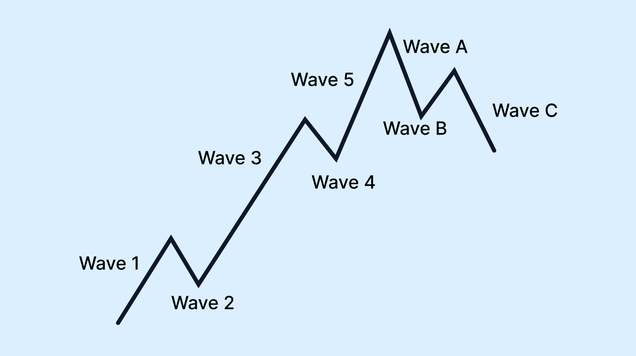

Diversification works because not all assets move in lockstep. A well-constructed mutual fund holds dozens or hundreds of positions, reducing the damage any single holding can inflict on your portfolio. Add more than one fund—say a broad U.S. equity index fund, a high-quality core bond fund, and an international equity fund—and you’ve diversified across asset classes, interest-rate exposure, sectors, and geographies. The result is a return path that tends to be smoother than owning a handful of individual stocks.

Types of mutual funds and when they fit

Most investors start with equity funds for growth and bond funds for stability and income. Equity funds branch into styles such as value, growth, small-cap, and international or emerging markets; each offers a different flavor of risk and return. Bond funds range from short-term government portfolios that cushion volatility to multisector funds that hunt for income across corporate and sovereign markets. Balanced or allocation funds do the mixing for you inside a single vehicle, keeping a preset stock-bond split. Index funds deliver market exposure at very low cost by tracking benchmarks like the S&P 500, and they function well as core building blocks. More specialized choices—sector funds, thematic strategies, or target-date funds that gradually shift toward bonds as your retirement year approaches—play supporting roles when you want a tilt or a fully automated glide path.

Building a diversified portfolio with mutual fund investment

A sensible approach begins with your goal and time horizon. If you are decades from retirement, a stock-heavy mix can make sense because you have time to ride out bear markets. Closer to a short-term goal, bond exposure helps stabilize outcomes. Many investors anchor their portfolio with two or three low-cost index funds that cover U.S. stocks, international stocks, and investment-grade bonds, then add a satellite fund or two if they want to emphasize small caps, value, or real-estate income. Rebalancing once or twice a year—selling a bit of what outperformed and buying what lagged—keeps risk aligned with your plan without trying to time the market.

Active vs. index: how to choose

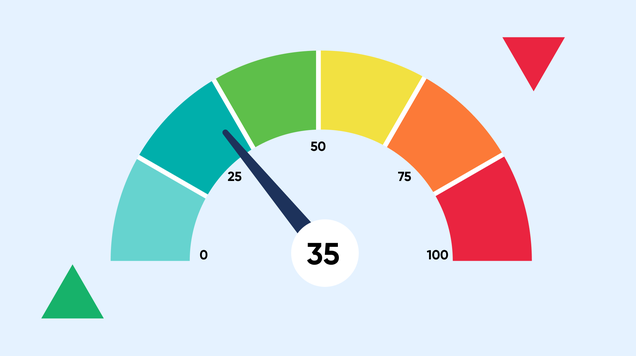

Index funds win on simplicity, transparency, and cost. They’re excellent for the “core” of a portfolio because fees are among the strongest predictors of long-term outcomes. Active funds can still add value in less efficient corners of the market, such as certain bond sectors or small-cap international stocks, but success depends on a manager’s repeatable process and cost discipline. When evaluating an active fund, focus on long-term consistency against an appropriate benchmark rather than chasing last year’s performance.

Costs, taxes, and other quiet performance drivers

Fees compound in reverse. A seemingly small difference—say 0.20% vs. 0.80%—adds up over decades. Loads (sales charges) are increasingly avoidable; favor no-load funds when possible. Taxes matter too. Funds that trade frequently may realize gains and distribute them, creating taxable income in brokerage accounts. If you invest in a taxable account, tax-efficient index funds or municipal bond funds can reduce the drag. In retirement or other tax-advantaged accounts, the emphasis shifts back to total return because distributions are sheltered.

Risk still exists—diversified doesn’t mean immune

Even broadly diversified mutual funds fall during market stress, and bond funds can lose value when interest rates jump or credit spreads widen. The point of diversification is not to eliminate drawdowns but to make them more tolerable and recoverable. A cash buffer for near-term needs, a measured allocation to high-quality bonds, and a written rebalancing rule are practical defenses against selling at the worst possible moment.

Mutual funds vs. ETFs—when one makes more sense

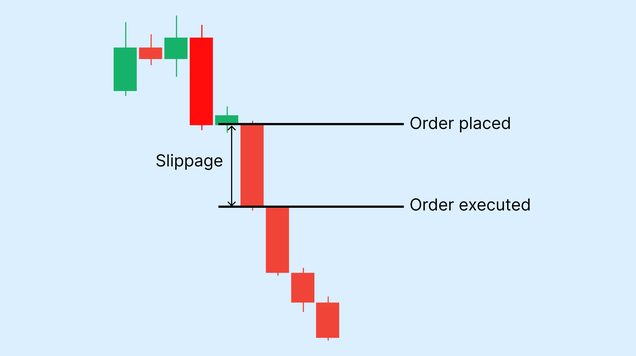

Both vehicles give you diversified baskets. ETFs trade intraday and often carry slightly lower expense ratios and better tax efficiency in taxable accounts. Mutual funds transact at end-of-day NAV and excel for automated saving plans, fractional investing, and goal-based programs like target-date series. Many investors blend the two: mutual funds for automatic contributions and set-and-forget retirement plans, ETFs for brokerage accounts where intraday flexibility and tax efficiency matter.

Due diligence made simple

Before buying, read the summary prospectus. Confirm that the fund’s objective and benchmark match your need, that the expense ratio is competitive, and that the holdings lineup won’t duplicate other funds you already own. Glance at long-term drawdowns and volatility to make sure the ride fits your temperament. For active funds, look for manager tenure and a stable process; for index funds, confirm that the benchmark is broad and sensible rather than overly narrow.

Common missteps and how to avoid them

New investors often assemble too many overlapping funds that all own the same top ten stocks, giving the illusion of diversification without the benefit. Others chase last year’s star performer only to learn that leadership rotates. The antidote is a concise plan: two or three core funds, optional satellites for modest tilts, and a rebalancing calendar you actually follow. Keep fees low, be patient with market cycles, and let your contributions and compounding do most of the heavy lifting.

FAQs

What are mutual funds, in one sentence?

They’re pooled investment vehicles that let you buy a diversified portfolio managed to a stated strategy, with your ownership measured by end-of-day NAV.

How do mutual funds work day to day?

You place an order, it executes at the fund’s closing NAV, and the manager invests your money alongside everyone else’s according to the mandate—no intraday trading required.

Which types of mutual funds should a beginner consider first?

A total-market equity index fund paired with a core bond fund covers a surprising amount of ground; add an international equity fund if you want global diversification.

Are mutual funds good for long-term investing?

Yes. Their built-in diversification, automatic reinvestment, and low-cost index options make them well suited to long horizons where consistency matters more than day-to-day movement.