Strategic decision-making: How to time your trades to maximise profits

Learn how to use smart timing and nuanced strategies to buy and sell stocks in the financial markets for peak profitability.

Strategic timing is key for maximising capital gains when buying and selling products on financial markets

Understanding market trends is a crucial skill for traders to spot the ideal times to buy or sell stocks

Traders should focus on adopting a disciplined approach and making informed decisions based on market analysis, instead of chasing the perfect timing

Your investment strategies should always align with your personal financial goals and long-term success requires a disciplined, informed investment approach

Stock market trading and timing trades

In the stock market, where billions of dollars swirl through the veins of global finance daily, the art of strategic decision-making emerges as a cornerstone for investors aiming to maximise their capital gains.

At the heart of successful stock market trading lies the ability to adeptly navigate the timing of purchases and sales, a skill that differentiates experienced traders from their novice counterparts.

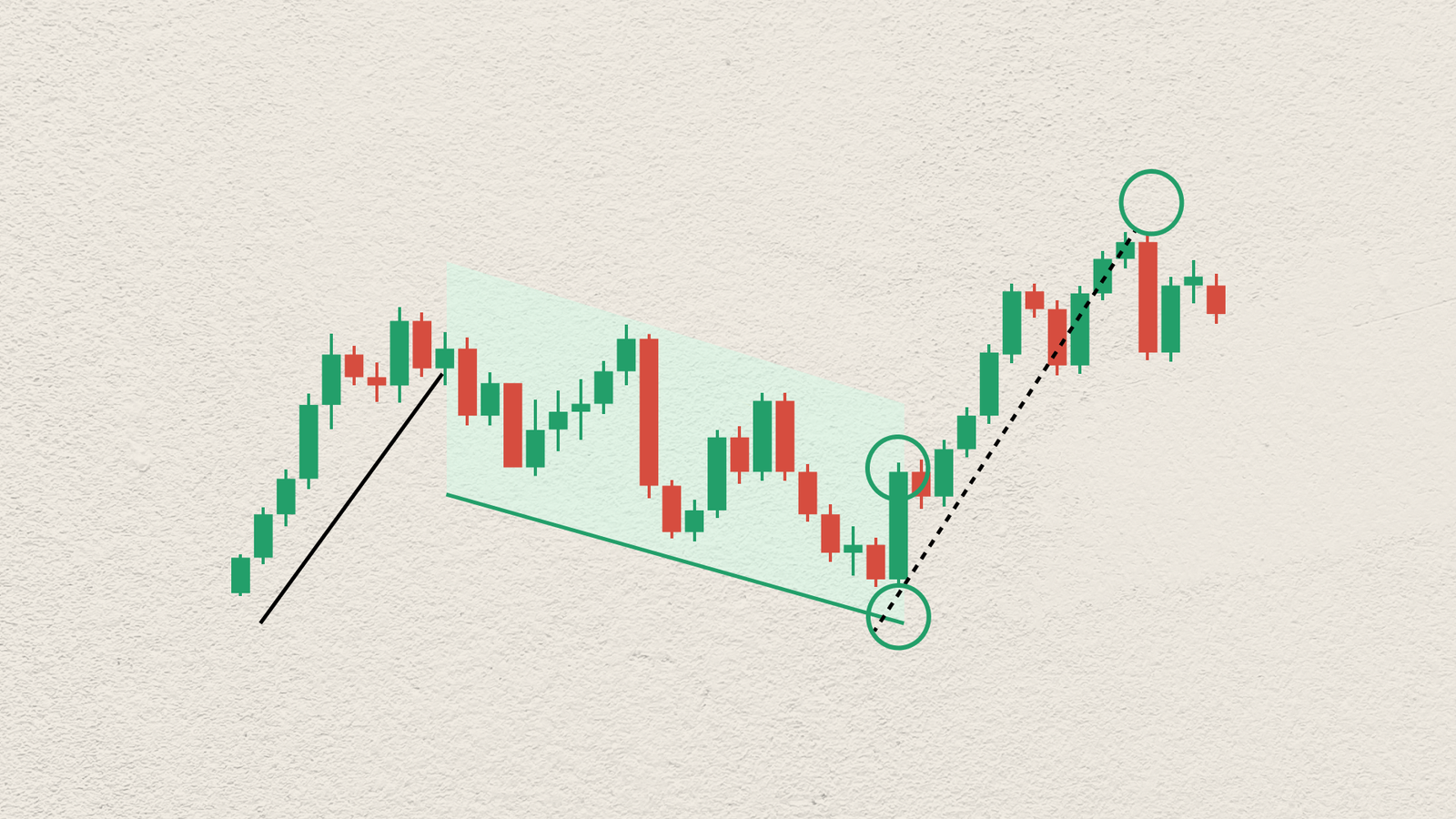

The principle of "buy low, sell high" may sound deceptively simple, yet the complex reality of financial markets makes timing your trades correctly both a science and an art. This delicate balance depends not only on luck, but on a deep understanding of market dynamics, expertise gained through experience, and nuanced investing that goes beyond mere speculation.

For experienced traders, timing is synonymous with spotting opportunities and achieving profits. However, for new traders, getting the market timing right can seem like a herculean task, fraught with uncertainty and risk.

Therefore, it’s crucial to demystify the strategies and approaches that can guide investors and traders towards making informed decisions that align with their financial goals and risk tolerance.

Importance of understanding market trends

One of the first principles in the investor's playbook is keeping a vigilant eye on market trends. These trends serve as a compass, providing insights into potential entry and exit points. For example, a bull market, characterised by rising stock prices, might signal a favourable buying opportunity, while a bear market, marked by declining prices, could suggest that it's time to sell. However, the unpredictable nature of financial markets means that trends can sometimes defy expectations, turning what seems like a clear signal into a false dawn.

An example of the importance of understanding market trends can be drawn from the dot-com bubble of the late 1990s. Investors who recognised the unsustainable overvaluation of tech stocks and exited their positions before the bubble burst in 2000 managed to preserve their capital, and in some cases, secure substantial gains. Conversely, those who misread the trend or entered the market too late suffered significant losses.

Finding the perfect timing is a fool's mission

The quest for perfect timing in stock market transactions is like chasing shadows. No investor, regardless of their knowledge or access to information, can predict market movements with unerring accuracy. The pursuit of perfection often leads to paralysis by analysis or, worse, uninformed decisions driven by fear of missing out, culminating in missed opportunities or direct financial losses.

Instead of striving for the impossible, investors should focus on adopting a disciplined approach, making informed decisions based on comprehensive market analysis, and aligning their investment strategy with their long-term financial goals.

The concept of dollar-cost averaging exemplifies this approach. By systematically investing a fixed sum at regular intervals, investors can mitigate the impact of volatility, potentially lowering the average cost per share over time, and smoothing out the highs and lows of market movements.

Role of investment goals and stop-loss orders in strategic decision-making

Your timing strategies should always be based on your own financial objectives. For those with long-term goals, short-term market fluctuations become less significant, allowing for a more patient, growth-oriented approach. Conversely, short-term investors must be nimble, leveraging market insights and trends to time their transactions more acutely.

Using free trading tools is a crucial part of a disciplined strategy as they help you to manage risk and reduce the influence of emotions in your decision-making. Incorporating stop loss orders into your strategy offers a pragmatic mechanism to protect your open positions against market downturns. By setting a predetermined selling price, investors and traders can limit their losses, ensuring that a swift downturn doesn't cause too much damage to their portfolio.

Maximising capital gains in the stock market involves a balanced composition of understanding market trends, acknowledging the limitations of perfect timing, aligning strategies with investment goals, and utilising tools like dollar-cost averaging and stop loss orders. While profits can never be guaranteed and trading assets in stock market involves risks, a disciplined and informed approach can help you to limit losses and maximise the potential for profits.