Trading on economic news

How to trade on economic data

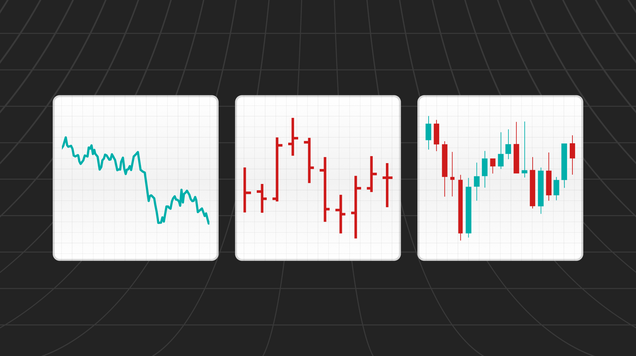

Basics of trading on economic data.

How economic data influences global market movements.

Economic calendar... its significance and how to use it in trading.

When trading in global markets, it is crucial to recognize that movements in currencies, stocks, or commodities result from economic changes occurring either globally or locally when trading a specific currency.

It is important in trading to monitor economic data, statements from central bank governors, as well as political and geopolitical events. Typically, such data and events reflect the strength of the economy, directly impacting its currency.

Some believe that trading on news involves high risks and may not be suitable for all traders. However, this type of trading can create numerous opportunities in global markets.

How to Trade on News and Economic Data.

- First Method: Direct Impact of Economic Data on Global Market Movements.

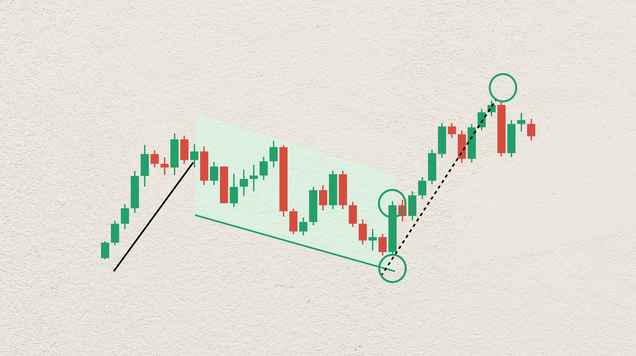

Through this approach, you can trade directly based on economic expectations, taking financial positions before the release of news. This strategy is particularly effective with important economic news that directly influences currency movements, such as inflation data, employment figures, and key sectors like manufacturing and services.

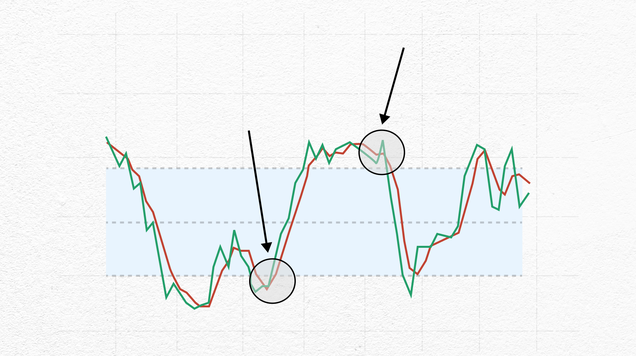

Currencies often move based on expectations rather than after the release of data. A common maxim followed by many investors is "buy on rumors and sell on facts." This means that currency movements are based on expectations, and investors take financial positions based on those expectations. Consequently, when the news is released, especially if it aligns with expectations, widespread profit-taking occurs among investors, leading to a rapid reversal of the trade ultimately.

- Second Method: Indirect Trading.

With this strategy, investors monitor economic data not for making instantaneous investment decisions but to identify central bank directions and currency trends in the upcoming period. It's important to note that this strategy relies on patience and careful consideration in trading, refraining from entering the market immediately after the news is released. Investors are advised to wait for market calmness after the spontaneous fluctuations that often accompany global markets immediately following news releases.

Using the Economic Calendar in Trading:

The economic calendar includes indicators and economic reports that illustrate the performance of different sectors within a country, helping us ultimately predict currency movements and general trends.

Economic indicators are regularly issued on different schedules, whether weekly, monthly, or quarterly. However, the importance of each indicator varies; some strongly and directly impact global markets, while others have a weaker effect.

Components of the Economic Calendar:

Date and Time: The economic calendar lists events by date and time, allowing traders to plan and make investment decisions.

Event: It includes economic data, monetary policy decisions, and major central bank meetings. All these events directly influence global market movements.

Country: Events are categorized based on the region or country where they occur. Different countries may have distinct events.

Importance: Events are classified as weak, moderate, or strong in terms of their impact on the local currency.

Previous and Expected Readings: The economic calendar includes previous readings of released data and market expectations for upcoming data.

The Importance of the Economic Calendar:

The economic calendar provides essential information for traders to make various investment decisions. It helps to stay ahead of events, enabling you to make informed decisions. By knowing the timing of events and important economic data, you can minimize risks as much as possible.

Upon the release of economic data, if the actual value diverges from expectations, it can lead to rapid market movements and strong fluctuations. By following the economic calendar, you can implement robust capital management and hedge against risks that may arise in the account.

Events Affecting Currencies and Commodities:

Economic Indicators: Through the economic calendar, you can track crucial economic data such as Gross Domestic Product (GDP), inflation rates, employment figures, and other economic data directly impacting currency movements.

Central Bank Decisions: Interest rate decisions and monetary policy statements are significant factors influencing currency and commodity movements. The impact of interest rate decisions is not only immediate but also shapes the general trend of products over the medium and long term.

Corporate Earnings Reports: It is important for stock investors to monitor quarterly financial performance reports as they reflect the company's status, helping determine the direction of stocks in the upcoming period.

Geopolitical Events: Geopolitical tensions directly affect stock and commodity movements, such as elections, trade tensions, and conflicts.