Disappointing retail sales figures from the UK - but the picture going forward is looking brighter

Today's report shows the strength of consumer demand to remain lacklustre, although there are signs that spending may start to pick up over the course of the year.

A disappointing set of retail sales figures from the UK this morning, with volumes unchanged over the month to come in at 0.0%, below the 0.3% figure expected. And with February’s figure revised upwards marginally from 0.0% to 0.1%, the overall picture presented is one of weak consumer sentiment, with virtually all the growth seen over Q1 driven by the unexpected spending surge seen in January, which itself followed an equally large and unexpected fall in December. The core rate of growth showed a fall of -0.3%, largely offsetting February’s (upwardly revised) print of 0.3%. Overall, it is hard to escape the conclusion that the UK is yet to see any meaningful recovery in consumer confidence and spending, despite the fall that has been seen in CPI, with many retailers reporting that they are having to resort to on-going price cutting to attract shoppers into their stores and spend, a scenario that is unsustainable for any meaningful length of time.

But when compared to spending patterns seen over the past couple of years, the picture may not be so bleak. Despite the flat performance seen over February and March, over Q1 as a whole retail sales volumes grew by 1.9%, while the print for March itself represents a considerable improvement on both 2022 and 2023, when monthly volumes fell by -1.2% in both years. And this has meant that for the first time since April 2022, the 3-mth average of y/y sales growth has now returned to positive territory, while annual sales volumes this March have risen by 0.8%, compared to the -3.9% reading seen last year. Accordingly, the outlook for consumer spending is improving, but is recovering only slowly.

And continuing in this vein, there are reasons to suggest that the outlook for spending growth is looking increasingly bright. The heavy rainfall seen over much of the UK in February and the first half of March likely acted to keep a lot of shoppers away from the high street, a weather phenomenon that has hopefully now passed. But probably more importantly is the fact that household incomes are continuing to rise, as factors such as the impact of falling CPI, cuts made to taxation, uplifts to benefits payments and the near 10% rise in the national minimum wage that took effect this month, all boost real disposable incomes. And with the BoE widely expected to begin cutting interest rates this year, so further downwards pressure should be exerted on mortgage costs. While some of this extra income will be saved, some of it can be expected to feed into higher spending, boosting retail sales volumes and providing a boost to UK growth.

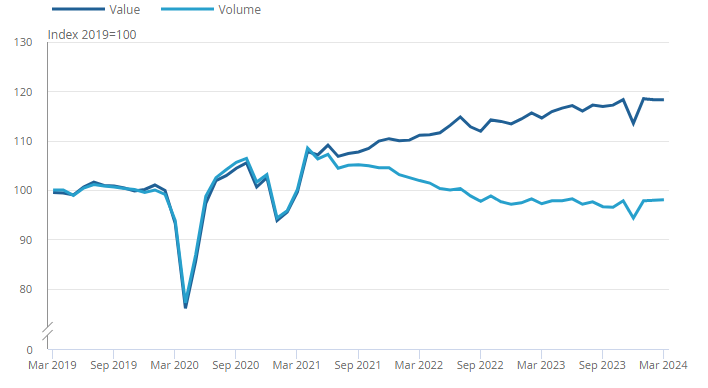

However, the chart below shows that the gap between the value and volume of retail sales is so far showing no signs of closing, pointing to no end in sight yet to the fall in the standards of living suffered by most UK households post-Covid.