Why ETFs haven't sparked bullish momentum in Bitcoin prices, yet?

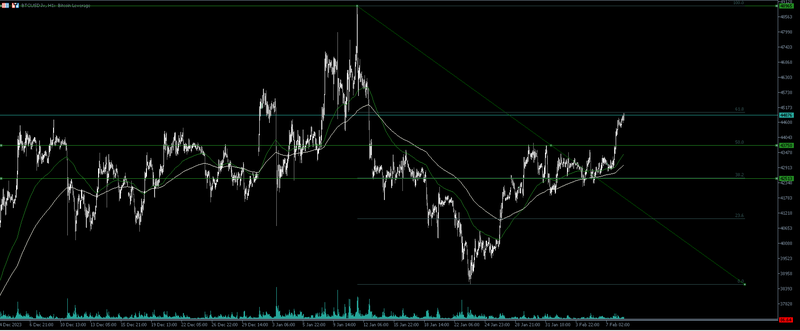

The recent approval of the first Bitcoin exchange-traded fund by US regulatory authorities was an important step in the world of digital currencies, which supporters of these assets eagerly awaited, expecting it to ignite a rising wave for Bitcoin. But the result was contrary to expectations. Bitcoin witnessed a rapid rise towards $47,000 - its highest level in nearly two years, but then declined significantly days after approval, losing 10 percent in less than two weeks, breaking lower than the support around $40,000.

One of the main factors is the phenomenon of “buying rumors and selling news”, typical in financial markets, where investors anticipate the impact of an event and place their positions based on those expectations, and as soon as the news comes out similar to expectations, investors close their positions in what is known as a “profit taking wave”. Especially since the news came with a bit of disappointment, as although the Securities and Exchange Commission granted approval, it made it clear that it did so with "reluctance", which indicates a cautious stance towards digital currencies.

We now see relative calm in the digital currency market, as some alternative currencies are recovering only part of their losses after selling pressures at the beginning of the year. While Bitcoin has managed to rebound from its recent lows near $39,000 to $44,900, we see positivity in Bitcoin's performance as it appears unaffected by the movements of other assets.

For example, the dollar index rose last week, but this did not significantly affect Bitcoin despite the selling pressure on dollar-priced assets such as oil commodities and even gold. Bitcoin's correlation with the dollar index and the stock market appears to have been completely disrupted recently, indicating that Bitcoin's trading fundamentals may be shaping up in a way that is independent of global factors.

Despite the positive nature of these movements, we believe that expected problems in the banking sector in the United States may give support to Bitcoin, just as we saw during previous banking crises. But these trends do not guarantee that we will see immediate adoption of trading funds linked to digital currencies by major institutions. These products will undergo scrutiny and evaluation before being recommended to customers, which may delay their widespread adoption and dampen bullish sentiment in the short term.

Although there is no immediate upward momentum following the approval of the exchange-traded funds, Bitcoin's cyclical nature suggests potential for a price increase within the year. Previous sessions witnessed prices reaching new peaks after around 230 days of corrections, which suggests the possibility of achieving new historical levels again in late 2024. Another thing that may support the strength of the upward momentum in the year is if we witness new crises in the banking sector in the US, where we witnessed in the past crises of the banking sector support for cryptocurrencies, led by Bitcoin, which strengthened its attractiveness as a safe asset against economic fluctuations.