All Eyes on 158: Japan’s new spending spree shakes FX markets

Japan’s parliament has approved a massive 21.3 trillion-yen (about $135 billion) stimulus package, marking one of the country’s most ambitious spending drives since COVID-19. The package aims to support industries under competitive pressure and lay the groundwork for Japan’s next phase of economic recovery.

The yen had been sitting near a 10-month low.

Bank of Japan Governor Kazuo Ueda warned that persistent yen weakness could feed into higher import costs.

The market may once again test Tokyo’s tolerance for rapid depreciation.

Japan’s parliament approves spending package

The package allocates 17.7 trillion yen toward general spending and 2.7 trillion yen in temporary tax cuts, with the remainder directed toward subsidies and targeted programs. Lawmakers expect to finalize the supplementary budget later this month.

Takaichi framed the measures as essential for strengthening key strategic sectors among them artificial intelligence while providing financial relief to households still grappling with high living costs. The government hopes that this mix of industrial investment and consumer support will give the economy enough momentum to offset weakening global demand.

Long-Term Japanese government bond yields rise

Financial markets responded cautiously. The yen had been hovering near a 10-month low, while long-term Japanese government bond yields continued to firm.

The reaction highlights a familiar tension, aggressive fiscal expansion may stimulate growth, but it also deepens concerns about Japan’s already heavy public-debt burden.

Speaking before parliament, Bank of Japan Governor Kazuo Ueda warned that persistent yen weakness could feed into higher import costs and broader inflationary pressures a sign that the central bank is monitoring FX developments closely. Finance Minister Satsuki Katayama also suggested that the government would not rule out intervention if currency volatility became excessive or if speculative flows began to dominate market behaviour.

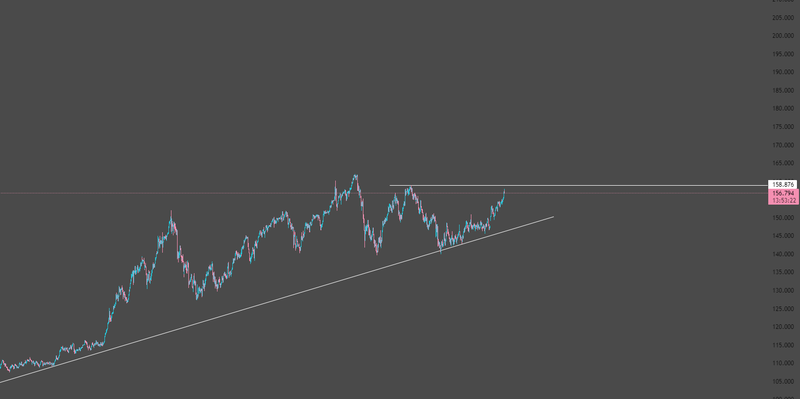

Source: Trading View

USD/JPY: all eyes on the 158.70 psychological level

With the yen still under pressure, traders are closely watching the key psychological zone around 158 against the U.S dollar. This level is significant not only because of past market reactions, but also because Japanese authorities previously intervened near this zone to stabilize the currency.

If USD/JPY approaches or decisively breaks above 158, markets may once again test Tokyo’s tolerance for rapid depreciation.

What happens next will depend on the interplay between fiscal expansion, inflation dynamics, and the Bank of Japan’s policy stance. A coordinated message from policymakers could help anchor expectations, but if yields push higher and the yen continues to weaken, speculation about fresh intervention will likely intensify.

For now, investors are watching to see whether the stimulus package provides enough confidence to support domestic demand without reigniting concerns about Japan’s long-term fiscal sustainability. In the coming weeks, particularly during the budget’s finalization and any shifts in BOJ communication, markets will determine whether the yen stabilizes or whether another run at the critical 158 level unfolds.