Australia economic recovery meets a cooling labour market

Australia’s economy is entering a growth phase where GDP is showing signs of recovery, yet some weaknesses are beginning to emerge. The Australian dollar remains under pressure, the labour market is cooling, and a stronger U.S. dollar is tightening financial conditions at a critical moment for the economy.

The unemployment rate climbed to 4.3% in October 2025.

Hiring is slowing across multiple sectors.

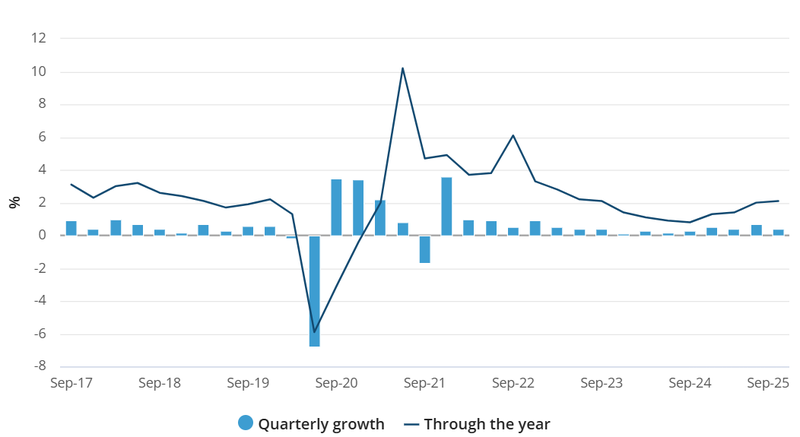

GDP growth reached 2.1%, the strongest since 2021.

Growth rebounds but labor market weakens

The unemployment rate rose to 4.3% in October 2025, marking its highest level in the post-pandemic cycle. While this does not signal a crisis, it clearly confirms that the labour market is no longer as tight as it was over the past two years. For households, the increase weakens income security. For policymakers, it signals that earlier monetary tightening is now feeding into real economic activity. At the same time, Australia’s economy posted 2.1% year-on-year growth, the strongest pace of expansion since 2021. While this rebound offers some relief after a period of concern, it has not been strong enough to restore confidence in the currency. Growth is improving, but it is not accelerating fast enough to materially alter the monetary policy outlook. The Australian dollar continues to struggle as the U.S. dollar regains momentum, supported by firm U.S. data, elevated yields, and strong global demand for dollar liquidity. For Australia, this dynamic adds further pressure, as a stronger greenback tightens financial conditions and weighs on commodity-linked currencies.

Growth improves, but confidence remains weak

The 2.1% GDP growth rate reflects resilience in consumption and a modest recovery in business activity. However, this growth has come against a backdrop of higher interest rates, and investors are now questioning whether this pace of expansion can be sustained into 2026 without an easing in financial conditions. AUD/USD has recently seen a rally as markets price in an economy that is growing but losing momentum beneath the surface. This creates a challenging environment for the Australian dollar, which typically performs best when growth is accelerating, and global risk appetite is strong.

Source: Australian Bureau of Statistics

A stronger U.S. a weaker AUS

Australia now sits at a crossroads. GDP growth has recovered to its strongest level in years, but unemployment is rising, consumer confidence is under pressure, and the U.S. dollar is strengthening once again. Together, these forces point to a challenging year ahead for the Australian dollar. The combination of softening labour data, tightening global financial conditions, and continued USD dominance suggests that currency markets will remain cautious towards Australia despite the recent improvement in growth. For investors, the picture is increasingly divided: improving output data on one side and weakening labour conditions and worsening external headwinds on the other. How these forces unfold over the coming quarters will determine whether the current phase proves to be a temporary slowdown or the beginning of renewed recession fears.