BOJ holds rates as firmer inflation outlook adds a hawkish tilt

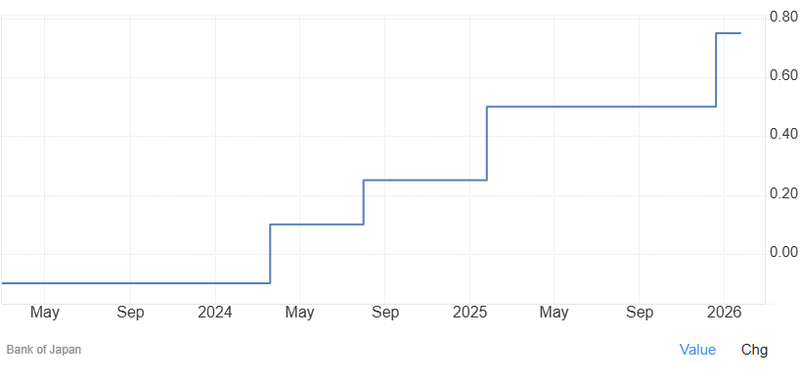

The Bank of Japan kept its policy rate unchanged at 0.75% but delivered a more assertive inflation message, reinforcing expectations that the next rate hike could arrive sooner than markets had assumed.

The BOJ left rates at 0.75%, the highest level in three decades, as expected.

Inflation forecasts were revised higher in four of six projections.

One board member voted for a back-to-back rate hike, signaling rising internal pressure.

The yen stabilized, but markets remain cautious on the timing of the next move.

Inflation upgrades give policy hold a hawkish edge

The Bank of Japan held its benchmark rate steady on Friday, opting to assess the impact of last month’s increase while navigating political uncertainty ahead of a snap election. While the decision itself was widely anticipated, the tone of the accompanying outlook carried a notably firmer stance.

Source: TradningEconomics

In its quarterly projections, the central bank upgraded inflation expectations across most horizons, underscoring confidence that price pressures are becoming more durable. Officials reiterated that borrowing costs will rise further if the outlook materializes, keeping the normalization path intact.

Dissent highlights growing confidence in price momentum

Adding weight to the hawkish signal, board member Hajime Takata dissented, voting in favor of another immediate rate increase. While the rest of the nine-member board supported holding policy steady, the lone call for a back-to-back hike highlighted concern that inflation dynamics may be strengthening faster than previously assumed.

The dissent combined with higher forecasts reduced the likelihood that the BOJ will wait until summer to act again.

Yen steadies, but conviction remains limited

The decision helped keep the yen from sliding further, trading near 158.5 per dollar after the announcement. The currency had touched an 18-month low earlier this month, pressured by political headlines and concerns that Japan’s yield advantage remains insufficient to attract capital.

Market pricing still leans toward a June or July move, though some strategists now see scope for an earlier hike if inflation data and wage trends remain firm.

Politics complicate the policy path

The BOJ’s calculus is complicated by domestic politics. Prime Minister Sanae Takaichi recently unsettled markets by pledging to suspend sales taxes on food as part of her election platform, raising questions about fiscal expansion at a time when inflation is already elevated.

Officials will need to balance the inflationary impact of yen weakness and fiscal stimulus against the risk of tightening too aggressively into an uncertain political environment.

April hike enters the conversation

Governor Kazuo Ueda has avoided explicit guidance on timing, but analysts noted subtle shifts in communication. The BOJ softened language around downside risks and trimmed references to external headwinds such as US tariffs, suggesting greater confidence in the domestic outlook.

April — rather than mid-year — is emerging as a plausible window for the next move, provided inflation remains above target and financial conditions stay orderly.

For now, the BOJ has chosen patience. But with inflation projections moving higher and internal dissent growing louder, the era of ultra-cautious normalization in Japan looks increasingly fragile.