China’s economy at the start of 2026

China enters 2026 with a mixed economic picture. Recent data show a clear pickup in industrial activity toward the end of 2025, even as broader economic growth slows and structural pressures persist. Markets are now weighing whether policy support and exports can offset weak domestic demand and rising global uncertainty.

Industrial production grew 5.2% year-on-year in December.

GDP expanded 4.5% year-on-year in Q4 2025.

China accounts for roughly 45% of global silver demand.

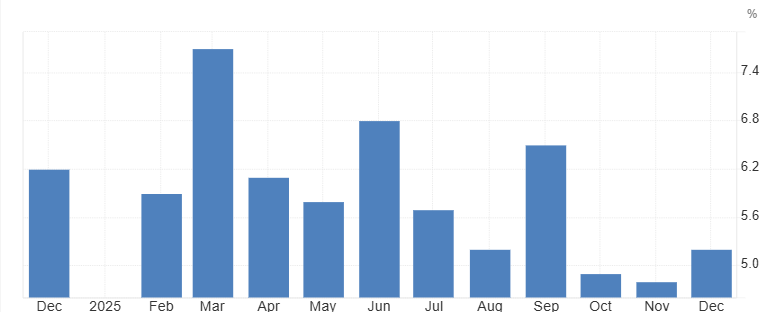

Industrial production is reaccelerating

China’s industrial production rose 5.2% year-on-year in December 2025, up from 4.8% in November and above expectations of 5.0%, marking the strongest growth since September. Manufacturing led the rebound, expanding 5.7%, supported by government efforts to boost domestic demand and stabilize key industries.

The breadth of the recovery matters. 33 of 41 manufacturing industries recorded growth, with particularly strong gains in computers and communications equipment (11.8%), railway and shipbuilding (9.2%), and automotive production (8.3%). These sectors are not only cyclical but structurally important, tied to electrification, transport upgrades, and digital infrastructure.

Looking ahead into Q1 and Q2 of 2026, industrial momentum is likely to remain relatively resilient even if headline GDP softens further. Continued fiscal support and infrastructure spending suggest manufacturing growth may hold in the 5–6% range, helping cushion the economy against weak consumption and property investment.

Source: National Bureau of Statistics of China

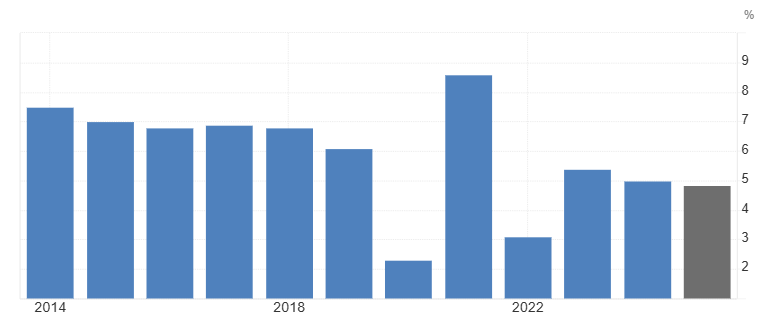

GDP growth is slowing

China’s economy expanded 4.5% year-on-year in Q4 2025, slowing from 4.8% in Q3 and marking the weakest pace in three years. Retail sales growth weakened further in December, reflecting ongoing pressure from the property slump and deflationary trends. However, the unemployment rate remained stable at 5.1%, and industrial output accelerated, highlighting a divergence between production and consumption.

For the full year, GDP grew 5%, meeting Beijing’s target and matching 2024’s pace. A record trade surplus was a key support, as exports to non-U.S. markets offset tariff pressure and softer domestic investment. Policymakers have reaffirmed a proactive fiscal stance, suggesting that growth in 2026 will be managed rather than allowed to slide sharply.

From a predictive standpoint, markets should expect sub-5% GDP growth in 2026, but not a hard landing. Instead, China appears to be leaning on industry, exports, and strategic manufacturing to anchor growth while gradually addressing structural weaknesses in property and consumption.

Source: National Bureau of Statistics of China

China’s silver supply

China’s industrial performance has direct implications for the global silver market. As the world’s largest consumer of industrial metals, China accounts for roughly 35-45% of formal global silver refining capacity., driven by electronics, solar panels, electrical equipment, and automotive manufacturing. The strong growth in sectors such as electronics, electrical machinery, and transport equipment points to sustained silver demand into 2026.

On the supply side, China is also a major silver producer, accounting for about 13–14% of global mine output, often as a byproduct of lead, zinc, and copper mining. December data showed non-ferrous metal smelting and rolling rising 4.8%, indicating steady upstream activity. However, mining growth overall has slowed compared with earlier in 2025, suggesting that supply expansion may lag demand growth.

This imbalance creates a forward-looking risk for silver markets. If China’s manufacturing strength persists while mine output grows only modestly, global silver balances could tighten further. Combined with already elevated inventories in U.S. warehouses and rising geopolitical uncertainty, this supports a scenario where silver prices remain structurally supported in 2026, even if broader economic growth slows.