China’s silver exports surge, easing fears of imminent curbs

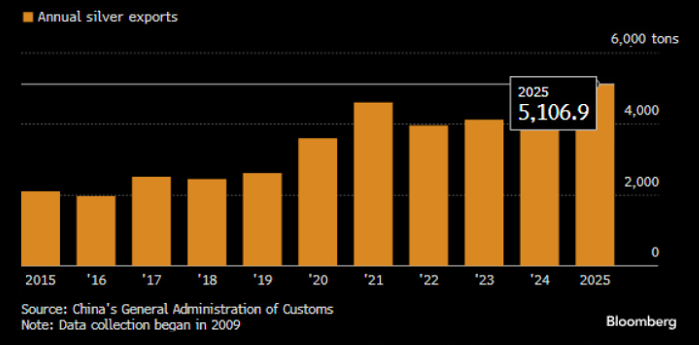

China shipped the largest volume of silver overseas in more than a decade last year, a data point that undercuts market anxiety about looming export restrictions and suggests the recent rally in the metal has been fueled more by perception than policy.

China exported about 5,100 tons of silver last year, the highest level in at least 16 years.

Exporters say shipments have not materially changed since Beijing extended its licensing regime in October.

Investor demand in India has intensified further, amplifying price momentum driven by policy misinterpretation.

Concerns over future curbs persist, but there is no evidence of near-term tightening.

Record exports challenge tightening narrative

Customs data show that China shipped roughly 5,100 tons of silver abroad last year, the strongest annual export performance since at least 2009. The figures arrive amid heightened speculation that Beijing may curb shipments of the white metal, a fear that has helped propel silver prices to record highs alongside gold.

Source: Bloomberg

Those concerns were sparked in October, when Ministry of Commerce issued a document extending the country’s existing silver export licensing regime through 2027. While some investors interpreted the move as a prelude to tighter controls, exporters and analysts say the policy change was largely procedural.

Export rules unchanged, flows intact

China has managed silver exports under a licensing system since 2019, replacing an older quota-based framework. Under the current regime, licenses carry no explicit volume caps and remain valid for two years, provided refiners meet minimum production thresholds.

Major exporters say shipments have continued largely uninterrupted since October, noting that most silver flows occur under processing trade arrangements that benefit from tax exemptions. Any serious attempt to restrict exports would require dismantling these tax structures — a step that would represent a far more significant policy shift than the document issued last year.

Market frenzy driven by misinterpretation

Despite the steady flow of exports, rumors around Chinese policy have fed a wave of speculative buying. The impact has been especially pronounced in India, where fund managers, bullion dealers and local media widely framed the extension of China’s licensing rules as evidence of looming shortages.

That narrative collided with seasonal buying ahead of Diwali and supply constraints in Western markets, draining liquidity in London and pushing silver prices to levels last seen decades ago. The speculation even spilled onto social media, drawing commentary from Elon Musk, further amplifying investor attention.

Retail demand in India is now stronger than it was in October, with investors favoring smaller bars and coins — a classic hallmark of fear-driven accumulation.

Longer-term risks still linger

China’s track record of imposing export controls on strategically sensitive materials — from rare earths to antimony — means the possibility of future action cannot be dismissed. Analysts caution, however, that silver does not currently appear to be on the same policy trajectory.

There is no indication of tightening export controls on silver at this stage, but given China’s broader approach to resource management, the risk cannot be ruled out entirely over the longer term.

For now, the data tell a simpler story: silver is leaving China at a record pace, and the fears of an imminent supply choke look premature. Whether prices can sustain their rally will depend less on Beijing’s licensing paperwork — and more on whether investor enthusiasm can outrun physical reality.

Looking at silver’s supply-and-demand balance, demand appears exceptionally strong right now, reinforcing the narrative of accelerating upside momentum in prices. At the same time, rising reliance on assets not denominated in the US dollar—amid the protectionist tilt associated with US President Donald Trump—along with the interplay between real and nominal yields, is adding to silver’s support. So far, no new catalysts have emerged that would meaningfully challenge silver’s strength at this stage.