Fed doubts grow over December rate cut as policymakers split over next move

Growing divisions inside the Federal Reserve are clouding expectations for a December rate cut, as policymakers signal resilience in economic activity and warn that inflation progress may not justify another move lower. Markets, once convinced a cut was guaranteed, are now sharply reassessing the odds.

Growing skepticism inside the fed over cutting rates again in December

Kashkari says he did not support the previous cut and remains undecided for next month

Several officials argue rates should stay on hold to balance inflation risks and labor-market weakness

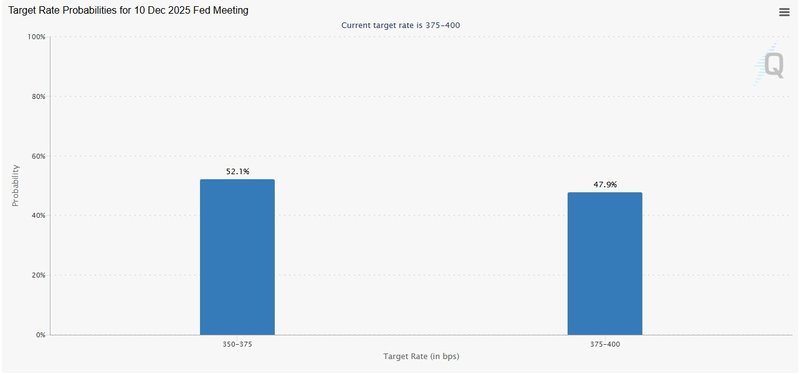

Market-implied odds of a December cut have fallen from nearly 100% to roughly 50%

A divided committee heads toward December

Tension is building inside the Federal Reserve ahead of its final policy meeting of the year, as more officials openly question whether another rate cut is justified. The debate intensified after Minneapolis Fed President Neel Kashkari said he did not support the October reduction and sees “underlying resilience” in activity that argues for caution. Although he doesn’t vote this year, he participates in the internal deliberations that shape the direction of the Federal Open Market Committee.

Kashkari described the economic backdrop as firmer than he expected heading into the autumn. Even now, he says conditions have not shifted meaningfully since the last cut, leaving him able to argue for either holding or trimming rates depending on which data arrive before the December 9–10 meeting. His undecided stance underscores just how fluid the landscape has become.

Momentum shifts away from a quick follow-up cut

Kashkari’s hesitation is not isolated. In recent days, a string of policymakers from across the central bank have signaled varying degrees of doubt over the need for a further reduction next month. The pushback comes even as some colleagues remain focused on signs of cooling in the labor market and slower hiring.

Investors have quickly taken note. Market pricing that once assigned nearly a 100% probability to a December cut now sits closer to 50%, reflecting a reassessment of the Fed’s appetite to move quickly after its first two cuts of the year.

Source: CME group

Underlying the shift is a mixed dataset. On one hand, there are pockets of stress among lower-income borrowers and firms tied to sub-prime consumers — signals that job-market softness is becoming more concentrated. On the other, corporate earnings have held up, and business sentiment about 2026 remains generally optimistic. The divergence creates an uneasy balance as policymakers weigh how much further to adjust borrowing costs.

Hawkish voices grow louder

Several regional Fed presidents who typically lean toward caution on easing have hardened their stance. Officials at key banks — including Boston, Chicago, Cleveland, Kansas City and Dallas — have all argued recently that inflation remains too high to justify aggressive rate cuts. With headline inflation still around 3%, they contend that stronger growth could easily stall progress toward the 2% target.

Others, however, continue to see room for lowering rates. Some members of the Board of Governors argue recent inflation readings have been better than anticipated, supporting the case for another cut. Still, the internal balance appears to be shifting toward patience rather than urgency.

What complicates the picture further is the lack of government data. The October jobs report is incomplete, and the October inflation report is unlikely to be released at all because the shutdown halted the surveys needed to compile them. Policymakers will therefore enter the December meeting with an unusually thin set of official indicators — a blind spot that makes it harder to build consensus.

An uncertain path to the final meeting of the year

The divide inside the Fed has rarely been this visible so close to a policy decision. With no clear direction in the economic figures and mixed signals from households and businesses, the range of possible outcomes for December remains unusually wide. The reopening of government agencies will restore data flows, but there is no guarantee that enough information will be available in time to settle the debate.

For markets, the next few weeks will determine whether the Fed delivers one more cut before year-end or opts for a pause that could reshape expectations for early 2026.