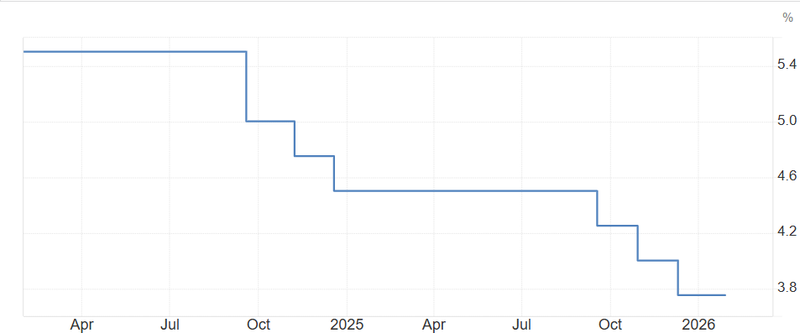

Fed pauses rate cuts

The Fed left the federal funds rate unchanged at the 3.5%–3.75% target range in its January 2026 meeting, in line with expectations, after three consecutive rate cuts last year that pushed borrowing costs to their lowest level since 2022.

Holding rate at 3.50%-3.75% in January was widely expected.

Biggest surprise was the removal of language referring to a “shift in the balance of risks.”

Core PCE inflation excluding tariff-affected goods is running just above 2%.

The next move is no longer a question of when the Fed acts, but what breaks the equilibrium first.

Economy in a comfortable zone allows for an extended policy hold

The Federal Reserve’s decision to leave the interest rate unchanged at 3.5%–3.75% in its January 2026 meeting was widely anticipated, but the accompanying statement and Chair Powell’s remarks subtly reshaped the policy narrative. The message was not one of renewed tightening or imminent easing, but of confidence in the current stance and patience in the face of politically driven inflation noise.

The most telling change in the statement was qualitative rather than numerical. The Fed upgraded its assessment of economic momentum, describing activity as expanding at a “solid” pace, replacing earlier language that characterized growth as “moderate.” At the same time, policymakers acknowledged that job gains have remained low, while the unemployment rate has “shown some signs of stabilization.” This combination points to an economy that is no longer overheating but also not rolling over a sweet spot that supports a prolonged policy hold.

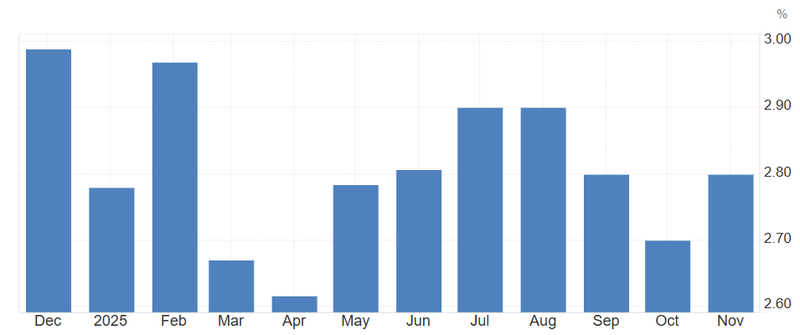

Source: Federal reserve

Shift in the balance of risk

Perhaps the biggest surprise was the removal of language referring to a “shift in the balance of risks.” That phrase had previously signaled sensitivity to downside growth risks and left the door open to further ease. Its omission suggests the Committee no longer sees risks as tilting decisively in either direction.

This shift is reinforced by Powell’s repeated emphasis that last year’s rate cuts have left policy “appropriate” to support both growth and inflation objectives. In effect, the Fed is signaling that it has already delivered sufficient accommodation and now prefers to wait for clearer evidence before adjusting policy again.

Dissent from Governor Waller, who favored another 25bp cut, highlights that the easing debate is not fully settled. Importantly, Waller’s vote carries added weight in the current political context, as he is widely viewed as being on President Trump’s short list for the next Federal Reserve chair. That backdrop adds a subtle political dimension to the dissent, reinforcing the perception that the core of the Committee remains firmly anchored around a cautious, data-dependent hold even as external pressure for easier policy continues to build.

Tariffs drive inflation persistence

A key theme of Powell’s press conference was the source of inflation. He was explicit that much of the recent overshoot is coming from tariffs, not domestic demand pressure. Core PCE inflation excluding tariff-affected goods is running just above 2%, while total core PCE in December likely rose around 3%.

This distinction matters for policy. Tariff-driven price increases are viewed as largely one-time level effects, not a signal of an overheating economy. That framing allows the Fed to tolerate inflation staying “somewhat elevated” without feeling compelled to tighten as long as inflation expectations remain anchored and labor markets stay balanced.

Powell’s comments also suggest the Fed is willing to look through near-term inflation bumps, especially if they are tied to trade policy rather than wage or demand acceleration.

Source: U.S. Bureau of Economic Analysis

Policy inertia becomes the base case

Looking ahead, the Fed is likely to remain on hold for an extended period unless one of two conditions emerges, clear labor market deterioration, which would revive the case for additional easing, broad-based inflation reacceleration, especially outside tariff-affected sectors.

Absent either, policy inertia becomes the base case. Markets may continue to price gradually easing later in the year, but the bar for action has risen. The Fed is comfortable letting growth run, inflation cools slowly, and political distortions wash through the data.

This meeting was not about changing direction, it was about closing the door on urgency. The Fed believes policy is working, inflation is better understood, and the economy is entering 2026 on firm footing. For investors, that means fewer surprises from monetary policy and greater sensitivity to fiscal, trade, and geopolitical shocks.

The next move is no longer a question of when the Fed acts, but what breaks the equilibrium first.