Gold breaks $4400 for first time as rate-cut bets and Venezuela tensions fuel haven demand

Gold breaks $4400 for first time as rate-cut bets and Venezuela tensions fuel haven demand

Gold jumped more than 1.5% to a new record above the prior $4,381 peak set in October.

Markets are leaning toward two Fed cuts in 2026, a tailwind for non-yielding metals.

Venezuela frictions and an attack on a Russian “shadow fleet” tanker lifted safe-haven bids.

Silver, platinum and palladium also rallied sharply as positioning and supply dynamics tightened.

Gold breaks out again as the Fed narrative returns to the driver’s seat

Gold climbed to a new record, gaining more than 1.5% and pushing beyond the previous peak near $4,381 an ounce set in October.

Source: Bloomberg

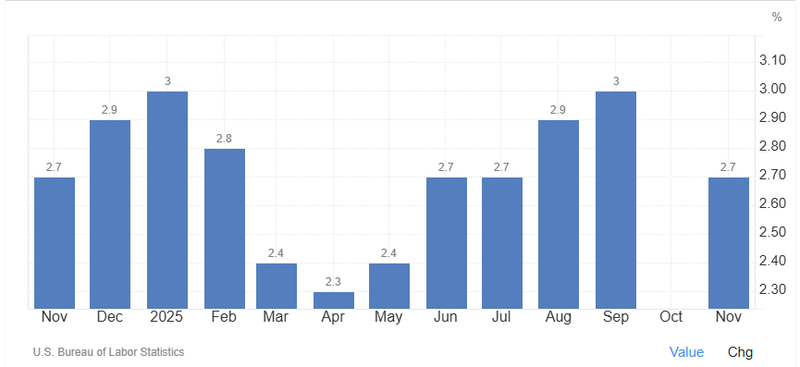

The latest leg higher is being powered by renewed conviction that US interest rates will move lower again — a setup that typically supports gold because it offers no yield. Traders have increasingly priced in two Federal Reserve cuts in 2026, helped by softer recent US data and louder political pressure for easier policy. As the inflation drops to 2.7% in November. While the unemployment rate rises to 4.6%.

Source: TradningEconmoics

Geopolitics adds a second tailwind to the rally

Safe-haven demand has also been reinforced by an intensifying geopolitical backdrop. The US has stepped up pressure on Venezuela through an intensified oil blockade, while Ukraine carried out its first attack on an oil tanker tied to Russia’s shadow fleet in the Mediterranean. The mix has supported both gold and silver, as investors look for hedges against disruption risk and policy uncertainty.

A “debasement trade” is back in fashion — and ETF flows are confirming it

Beyond rates and headlines, investor behavior has played a central role. Demand has been supported by the so-called debasement trade — a shift away from sovereign bonds and the currencies they’re priced in, driven by concerns that rising debt burdens erode real value over time. Gold-backed ETFs have logged inflows for five straight weeks, and industry data show ETF holdings increased in every month of the year except one, reinforcing the idea that the bid is broadening beyond short-term traders.

Silver, platinum and palladium surge as positioning tightens

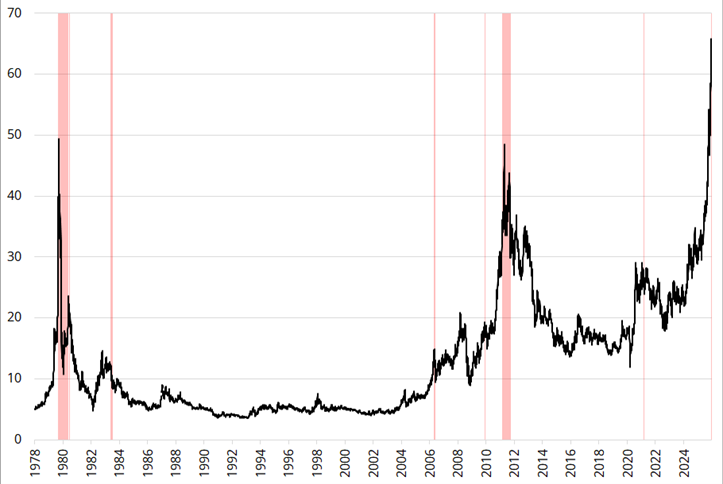

The rally has not been limited to gold. Silver jumped as much as 3.4%, pushing toward $70 an ounce, while palladium surged about 5% and platinum extended gains for an eighth straight session, trading above $2,000 for the first time since 2008.

Source: Bloomberg

Silver’s advance has been supported by speculative inflows and lingering supply dislocations across major trading hubs following an earlier short squeeze, with trading activity in Shanghai showing spikes reminiscent of prior stress episodes. Platinum’s move has also been linked to tightening conditions in London, with some market participants shifting metal into the US as a hedge against tariff risk, while flows to China remained firm as contract activity broadens.

A warning sign under the surface: silver’s “parabolic” behavior

Even as momentum remains powerful, it is noted that silver’s move has the feel of an impulsive, position-driven surge — the kind that can resemble a short-squeeze dynamic more than a fundamentals-led repricing. Historically, periods where silver posts outsized annual gains have often been followed by more muted forward returns, a reminder that extreme momentum can raise the bar for what comes next. But regarding to supply and demand, silver could write new story of the bullish perspective.

Source: TradingView

Where prices were last seen

Spot gold rose about 1.5% to roughly $4,414 in Asia session trade. Silver advanced to around $68.95, while platinum and palladium added roughly 4% each. A softer dollar provided additional breathing room for metals, with the Bloomberg Dollar Spot Index slightly lower on the day.