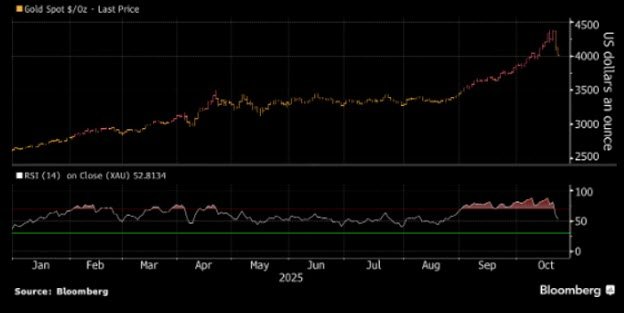

Gold extends losses near $4,100 as traders brace for renewed volatility

Gold continued to retreat on Wednesday, extending losses after its sharpest single-day selloff in more than a decade. The metal traded around $4,100 an ounce, slipping further after Tuesday’s 6% collapse, while silver steadied near $48.55, unchanged from its opening level. The correction has paused a two-month rally that pushed gold and silver to historic peaks, driven by fears of currency debasement and expectations of major Federal Reserve rate cuts. With volatility surging and investors repos

Gold trades near $4,100, extending Tuesday’s heavy losses.

Silver holds flat at $48.55 after steep declines earlier this week.

Options volatility remains elevated as traders hedge risk.

Markets await fresh cues from the Fed and U.S.–China trade signals.

Gold’s rally cools after parabolic surge

Gold’s meteoric rise has cooled sharply, with the metal now consolidating near $4,100 following a dramatic selloff that erased more than $250 in value since Monday. Tuesday’s 6.3% plunge — the steepest intraday drop in over twelve years — marked the end of a rapid advance fueled by safe-haven flows, central-bank accumulation, and the so-called “debasement trade.”

Source: Bloomberg

Traders say the recent slide was triggered by profit-taking and algorithmic stop orders after weeks of overbought technical readings. Despite the setback, gold remains up nearly 60% year-to-date, reflecting persistent concerns over global debt, fiscal deficits, and expectations that the Federal Reserve will soon pivot toward deeper rate cuts.

Volatility spikes as traders hedge for more swings

While spot prices have steadied slightly from Tuesday’s lows, volatility remains elevated. One-month implied volatility for gold options hovers near the highest level since early 2022, signaling that traders are bracing for further turbulence.

Many funds are now re-hedging positions after the selloff, using options to guard against a break below the key $4,000 support. The surge in derivatives activity follows months of record ETF inflows and aggressive physical demand from central banks — dynamics that amplified both the rally and the correction.

Source: Bloomberg

Policy signals and trade headlines drive uncertainty

Macroeconomic uncertainty continues to shape sentiment. U.S. President Donald Trump suggested that renewed talks with China could lead to a “good deal,” but markets remain skeptical given recent tariff threats and export restrictions. Meanwhile, the ongoing U.S. government shutdown has limited access to key data such as the Commodity Futures Trading Commission’s weekly positioning report, leaving traders blind to speculative flows.

This lack of transparency has magnified price reactions, with investors reacting swiftly to even minor shifts in sentiment or liquidity.

Structural drivers remain in play

Despite the correction, the broader structural story for gold and silver remains largely unchanged. Central banks are still diversifying away from the dollar, and institutional investors continue to view precious metals as protection against currency debasement and policy uncertainty.

Market participants note that as long as real yields remain low and the Fed remains inclined toward easing, gold’s longer-term uptrend is likely intact. The current phase is viewed as consolidation within a broader bull market rather than the beginning of a sustained downturn.

Silver holds steady as london liquidity tightens

Silver traded at $48.55 per ounce, unchanged from its opening level after recovering from Tuesday’s steep drop. The white metal remains highly volatile following a liquidity crunch in the London market earlier this month that pushed benchmark prices far above New York futures.

While industrial demand and ETF inflows continue to support prices, analysts warn that any renewed dollar strength or further unwinding of speculative positions could trigger another sharp leg lower.

Fragile calm before next catalyst

By Wednesday afternoon, gold hovered near $4,100, showing mild additional losses, while silver remained flat around $48.55. Platinum and palladium traded mixed, and the Bloomberg Dollar Spot Index held steady.

Traders expect short-term volatility to persist until clearer signals emerge from the Federal Reserve’s late-October meeting. A decisive move below $4,000 could open the door to a deeper correction toward $3,850, while any dovish shift from the Fed could reignite buying momentum before year-end.

For now, the gold market’s message is one of fragile calm — stability on the surface, but tension just beneath it.

A decisive move below $4,000 could open the door to a deeper correction toward $3,850